Problem 13 The following information is KRS Incs balance she

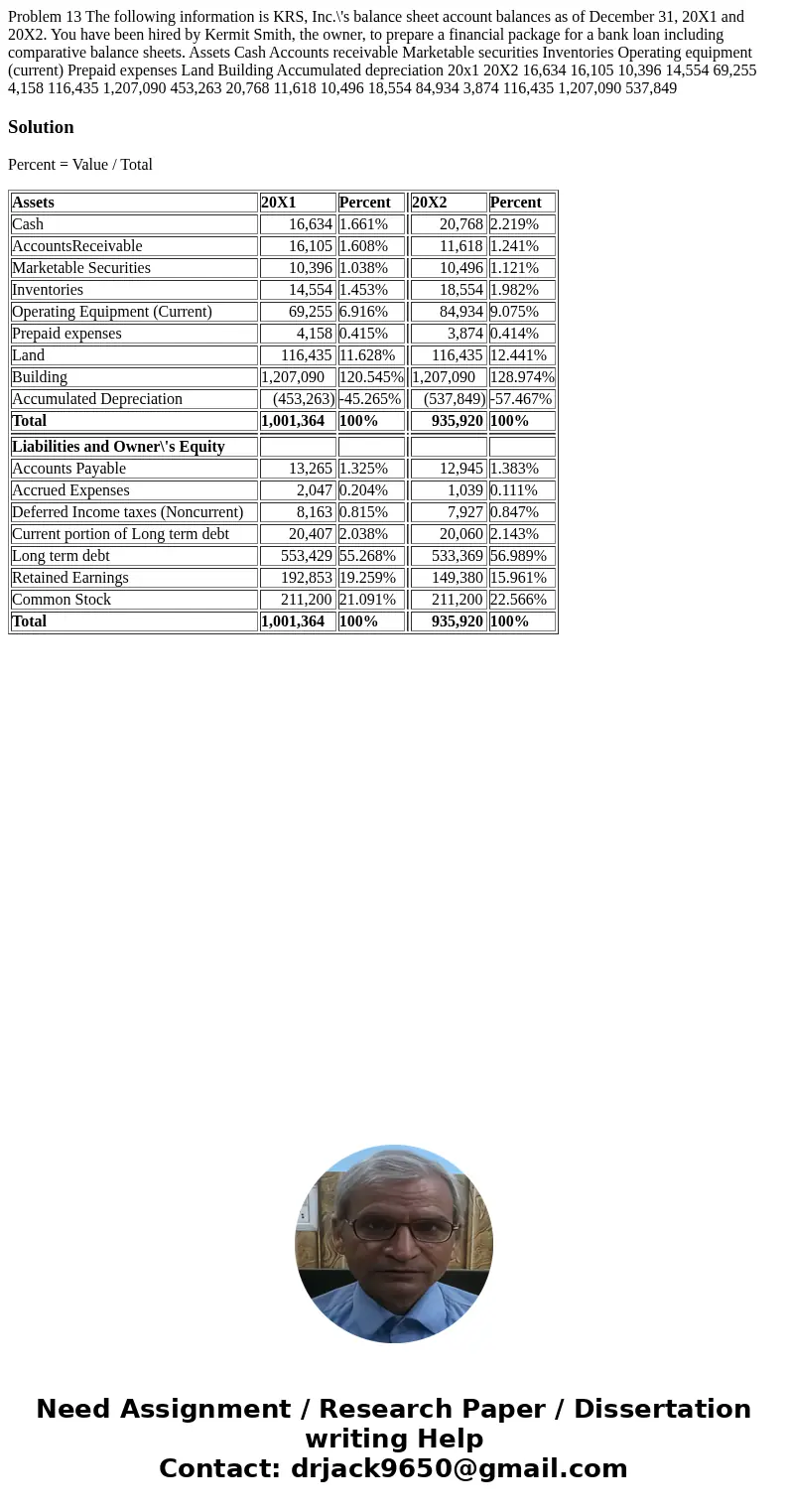

Problem 13 The following information is KRS, Inc.\'s balance sheet account balances as of December 31, 20X1 and 20X2. You have been hired by Kermit Smith, the owner, to prepare a financial package for a bank loan including comparative balance sheets. Assets Cash Accounts receivable Marketable securities Inventories Operating equipment (current) Prepaid expenses Land Building Accumulated depreciation 20x1 20X2 16,634 16,105 10,396 14,554 69,255 4,158 116,435 1,207,090 453,263 20,768 11,618 10,496 18,554 84,934 3,874 116,435 1,207,090 537,849

Solution

Percent = Value / Total

| Assets | 20X1 | Percent | 20X2 | Percent | |

| Cash | 16,634 | 1.661% | 20,768 | 2.219% | |

| AccountsReceivable | 16,105 | 1.608% | 11,618 | 1.241% | |

| Marketable Securities | 10,396 | 1.038% | 10,496 | 1.121% | |

| Inventories | 14,554 | 1.453% | 18,554 | 1.982% | |

| Operating Equipment (Current) | 69,255 | 6.916% | 84,934 | 9.075% | |

| Prepaid expenses | 4,158 | 0.415% | 3,874 | 0.414% | |

| Land | 116,435 | 11.628% | 116,435 | 12.441% | |

| Building | 1,207,090 | 120.545% | 1,207,090 | 128.974% | |

| Accumulated Depreciation | (453,263) | -45.265% | (537,849) | -57.467% | |

| Total | 1,001,364 | 100% | 935,920 | 100% | |

| Liabilities and Owner\'s Equity | |||||

| Accounts Payable | 13,265 | 1.325% | 12,945 | 1.383% | |

| Accrued Expenses | 2,047 | 0.204% | 1,039 | 0.111% | |

| Deferred Income taxes (Noncurrent) | 8,163 | 0.815% | 7,927 | 0.847% | |

| Current portion of Long term debt | 20,407 | 2.038% | 20,060 | 2.143% | |

| Long term debt | 553,429 | 55.268% | 533,369 | 56.989% | |

| Retained Earnings | 192,853 | 19.259% | 149,380 | 15.961% | |

| Common Stock | 211,200 | 21.091% | 211,200 | 22.566% | |

| Total | 1,001,364 | 100% | 935,920 | 100% |

Homework Sourse

Homework Sourse