Complete the worksheet for the preparation of accrual basis

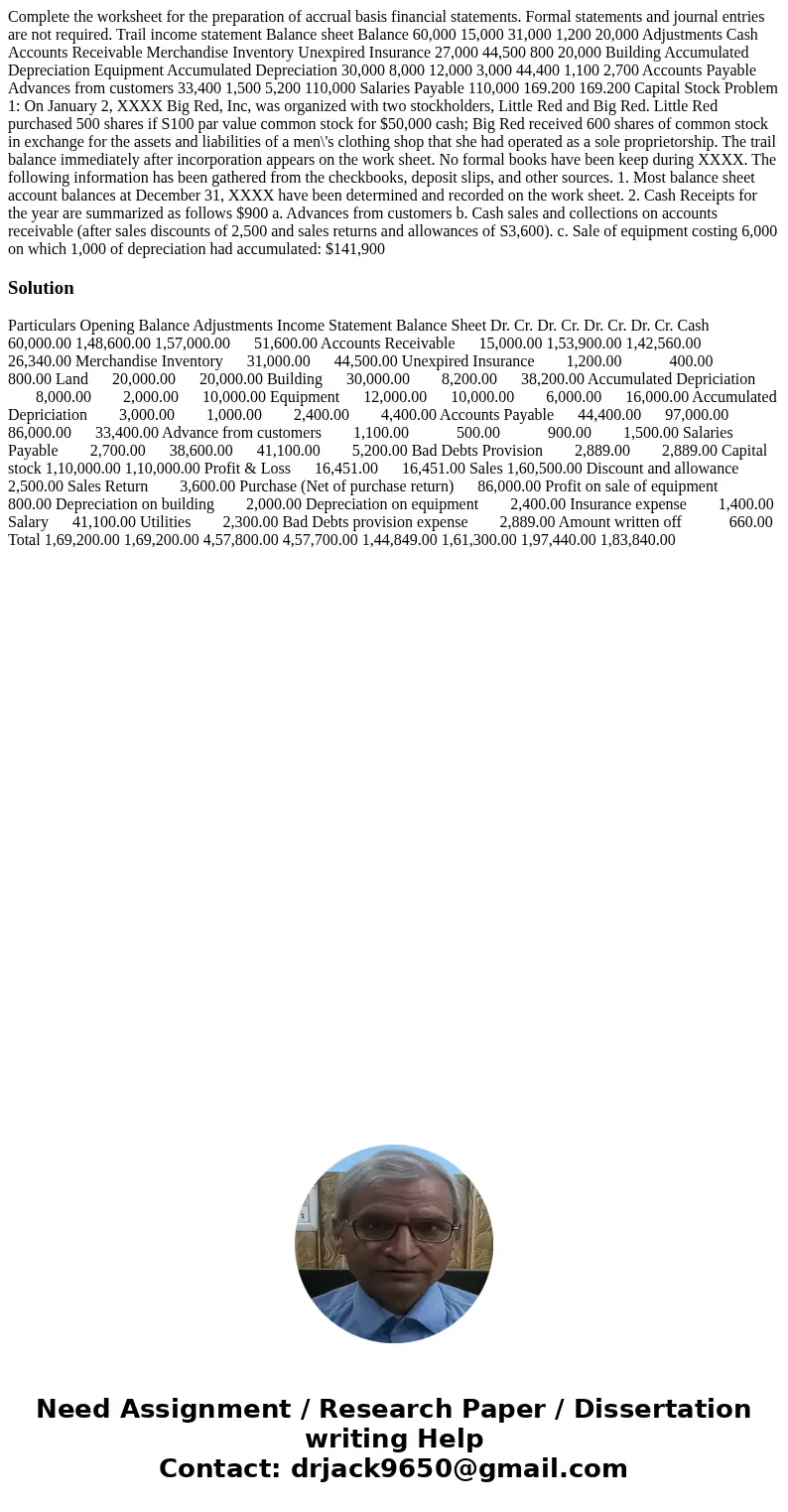

Complete the worksheet for the preparation of accrual basis financial statements. Formal statements and journal entries are not required. Trail income statement Balance sheet Balance 60,000 15,000 31,000 1,200 20,000 Adjustments Cash Accounts Receivable Merchandise Inventory Unexpired Insurance 27,000 44,500 800 20,000 Building Accumulated Depreciation Equipment Accumulated Depreciation 30,000 8,000 12,000 3,000 44,400 1,100 2,700 Accounts Payable Advances from customers 33,400 1,500 5,200 110,000 Salaries Payable 110,000 169.200 169.200 Capital Stock Problem 1: On January 2, XXXX Big Red, Inc, was organized with two stockholders, Little Red and Big Red. Little Red purchased 500 shares if S100 par value common stock for $50,000 cash; Big Red received 600 shares of common stock in exchange for the assets and liabilities of a men\'s clothing shop that she had operated as a sole proprietorship. The trail balance immediately after incorporation appears on the work sheet. No formal books have been keep during XXXX. The following information has been gathered from the checkbooks, deposit slips, and other sources. 1. Most balance sheet account balances at December 31, XXXX have been determined and recorded on the work sheet. 2. Cash Receipts for the year are summarized as follows $900 a. Advances from customers b. Cash sales and collections on accounts receivable (after sales discounts of 2,500 and sales returns and allowances of S3,600). c. Sale of equipment costing 6,000 on which 1,000 of depreciation had accumulated: $141,900

Solution

Particulars Opening Balance Adjustments Income Statement Balance Sheet Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Cash 60,000.00 1,48,600.00 1,57,000.00 51,600.00 Accounts Receivable 15,000.00 1,53,900.00 1,42,560.00 26,340.00 Merchandise Inventory 31,000.00 44,500.00 Unexpired Insurance 1,200.00 400.00 800.00 Land 20,000.00 20,000.00 Building 30,000.00 8,200.00 38,200.00 Accumulated Depriciation 8,000.00 2,000.00 10,000.00 Equipment 12,000.00 10,000.00 6,000.00 16,000.00 Accumulated Depriciation 3,000.00 1,000.00 2,400.00 4,400.00 Accounts Payable 44,400.00 97,000.00 86,000.00 33,400.00 Advance from customers 1,100.00 500.00 900.00 1,500.00 Salaries Payable 2,700.00 38,600.00 41,100.00 5,200.00 Bad Debts Provision 2,889.00 2,889.00 Capital stock 1,10,000.00 1,10,000.00 Profit & Loss 16,451.00 16,451.00 Sales 1,60,500.00 Discount and allowance 2,500.00 Sales Return 3,600.00 Purchase (Net of purchase return) 86,000.00 Profit on sale of equipment 800.00 Depreciation on building 2,000.00 Depreciation on equipment 2,400.00 Insurance expense 1,400.00 Salary 41,100.00 Utilities 2,300.00 Bad Debts provision expense 2,889.00 Amount written off 660.00 Total 1,69,200.00 1,69,200.00 4,57,800.00 4,57,700.00 1,44,849.00 1,61,300.00 1,97,440.00 1,83,840.00

Homework Sourse

Homework Sourse