Question 3 AS 36 Impairment of Assets requires that all asse

Solution

A) Impairment of Asset as per IAS 36

If an asset\'s carrying amount exceeds the amount that could be received through use or selling the asset i.e net realisable value, then the asset is impaired and value is brought to its net realisable value. The standard requires a company to make provision for the impairment loss.

Procedure of impairment review

2. Indicators that trigger the imapirement of assets are -

adverse changes in the way that the asset is used.

economic performance of an asset is worse than expected.

2. External Indicators

Note - These are examples of external and internal indicator that may trigger the impairment.

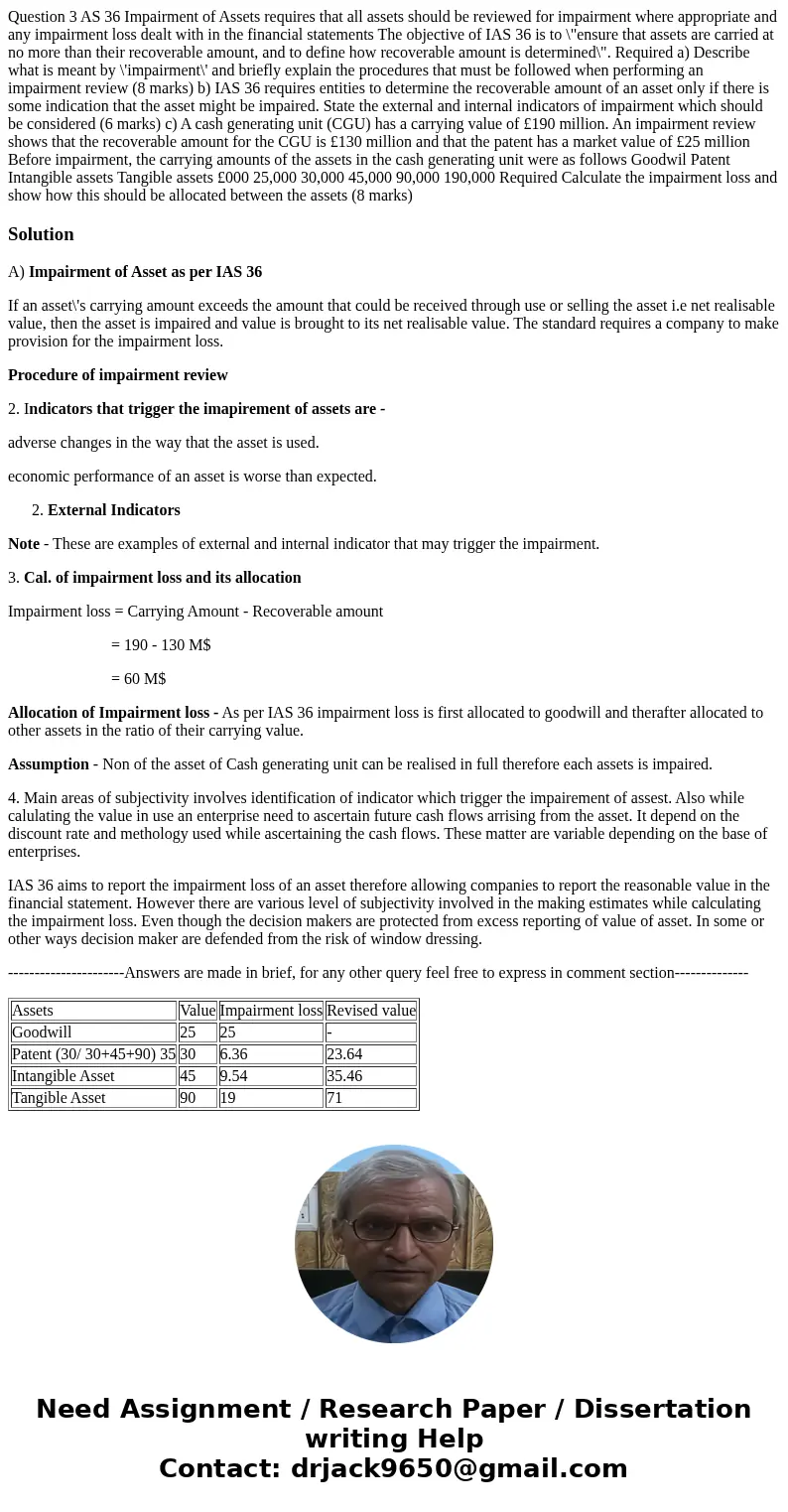

3. Cal. of impairment loss and its allocation

Impairment loss = Carrying Amount - Recoverable amount

= 190 - 130 M$

= 60 M$

Allocation of Impairment loss - As per IAS 36 impairment loss is first allocated to goodwill and therafter allocated to other assets in the ratio of their carrying value.

Assumption - Non of the asset of Cash generating unit can be realised in full therefore each assets is impaired.

4. Main areas of subjectivity involves identification of indicator which trigger the impairement of assest. Also while calulating the value in use an enterprise need to ascertain future cash flows arrising from the asset. It depend on the discount rate and methology used while ascertaining the cash flows. These matter are variable depending on the base of enterprises.

IAS 36 aims to report the impairment loss of an asset therefore allowing companies to report the reasonable value in the financial statement. However there are various level of subjectivity involved in the making estimates while calculating the impairment loss. Even though the decision makers are protected from excess reporting of value of asset. In some or other ways decision maker are defended from the risk of window dressing.

----------------------Answers are made in brief, for any other query feel free to express in comment section--------------

| Assets | Value | Impairment loss | Revised value |

| Goodwill | 25 | 25 | - |

| Patent (30/ 30+45+90) 35 | 30 | 6.36 | 23.64 |

| Intangible Asset | 45 | 9.54 | 35.46 |

| Tangible Asset | 90 | 19 | 71 |

Homework Sourse

Homework Sourse