A corporations pretax net income of 1000000 is taxable based

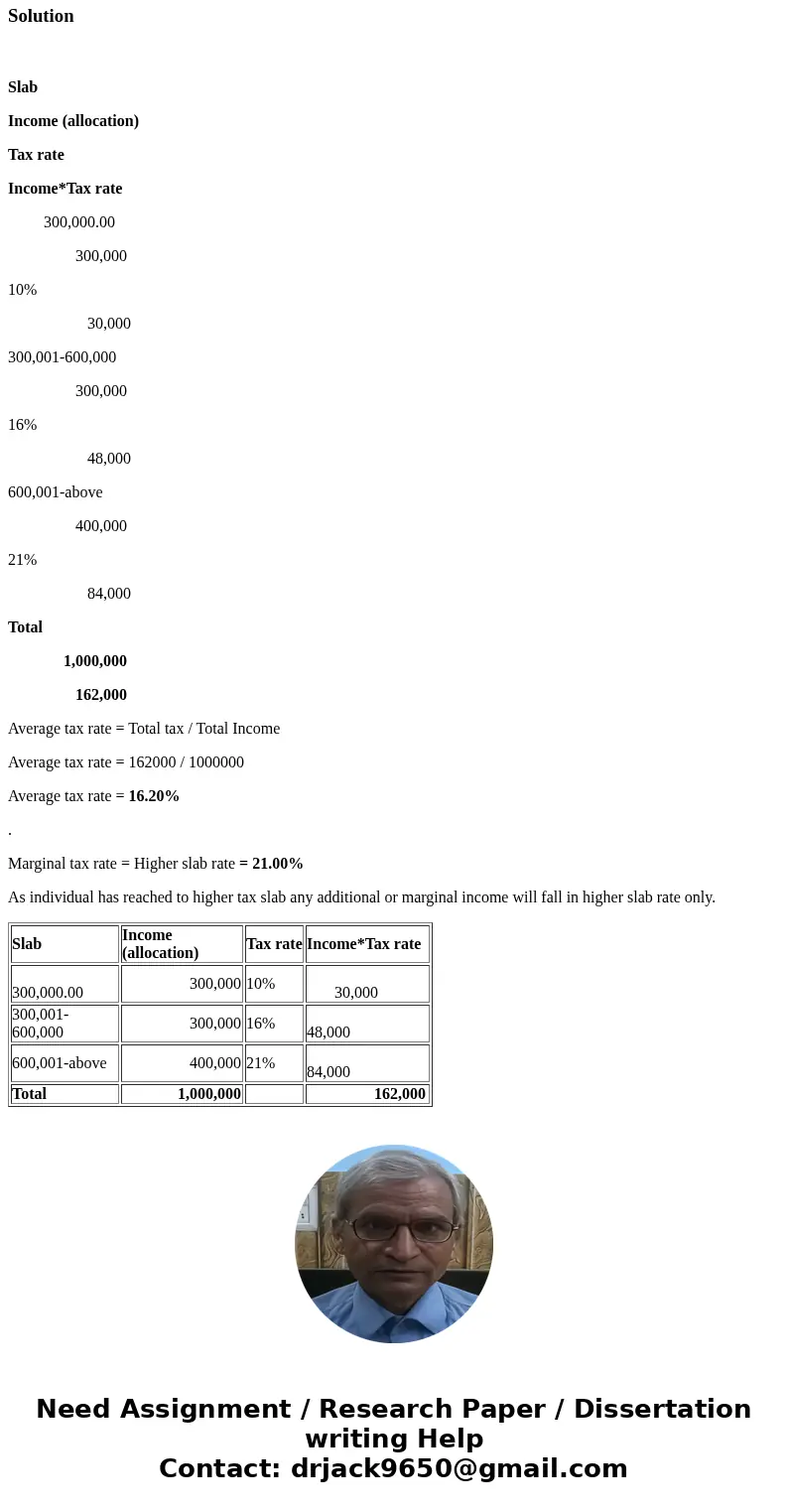

A corporation’s pretax net income of $1,000,000 is taxable based on 10% of the first $300,000, 16% of the next $300,000, and 21% of the balance:

What is the corporation’s average tax rate?

What is the corporation’s marginal tax rate?

Solution

Slab

Income (allocation)

Tax rate

Income*Tax rate

300,000.00

300,000

10%

30,000

300,001-600,000

300,000

16%

48,000

600,001-above

400,000

21%

84,000

Total

1,000,000

162,000

Average tax rate = Total tax / Total Income

Average tax rate = 162000 / 1000000

Average tax rate = 16.20%

.

Marginal tax rate = Higher slab rate = 21.00%

As individual has reached to higher tax slab any additional or marginal income will fall in higher slab rate only.

| Slab | Income (allocation) | Tax rate | Income*Tax rate |

| 300,000.00 | 300,000 | 10% | 30,000 |

| 300,001-600,000 | 300,000 | 16% | 48,000 |

| 600,001-above | 400,000 | 21% | 84,000 |

| Total | 1,000,000 | 162,000 |

Homework Sourse

Homework Sourse