Total 30 marks 7 Rose Ltd manufactures plastic containers fo

Solution

SOLUTIONA:-

SOLUTIONB:-

PRE DETERMINED OVERHEAD RATE by using labor hours:-

CUTTING=512759/9000=56.97

shaping=363041/12000=30.25

SOLUTION D:- PRE DETERMINED OVERHEAD RATE:- the predetermined overheads is calculated by dividing the total estimated overheads costs to the estimated total activity base.

ADVANTAGES:-

1.pre determined overhead rate is a tool to ascertain the estimated future costs in advance and make planning for the future projects.

2. actual overheads can be compared to the pre determined overhead rate to determine the causes of deviations if any and taking the necessary corrective actions .

3.in a business where job order costing is followed , the firm can deternine in advance costs to be allocated to a particular job work .

SOLUTION E:-

under activity costing method the firm first determine the activities that it performs and than allocates overheads expenses to its products.:-

LIMITATIONS:-

1. difficult to install, costly to maintain , data related to the different activities of a business is need to be entered into the system

2.under this system data need to be collected from the multiple departments , lets say it the organisation has large number of departments than it is risky to have collected information reliable all the times.

ADVANTAGES:-

1.decision making of the managers is greatly enhanced because they have more reliable costs of a product therefore they can fix more accurately selling prices of a product .

2.it serves as a great tool for cost reduction because we can compare the existing resources with those required in the ABC method.

EXAMPLES:-

manufacturing organisations use activity based costing method when they have broad product lines. or overheads costs makes a significant proportion to the overall costs of a business

2.in a construction industry , costs can be assigned to different projects enabling the constructio3.3.n firm to be cost competitive by each project.

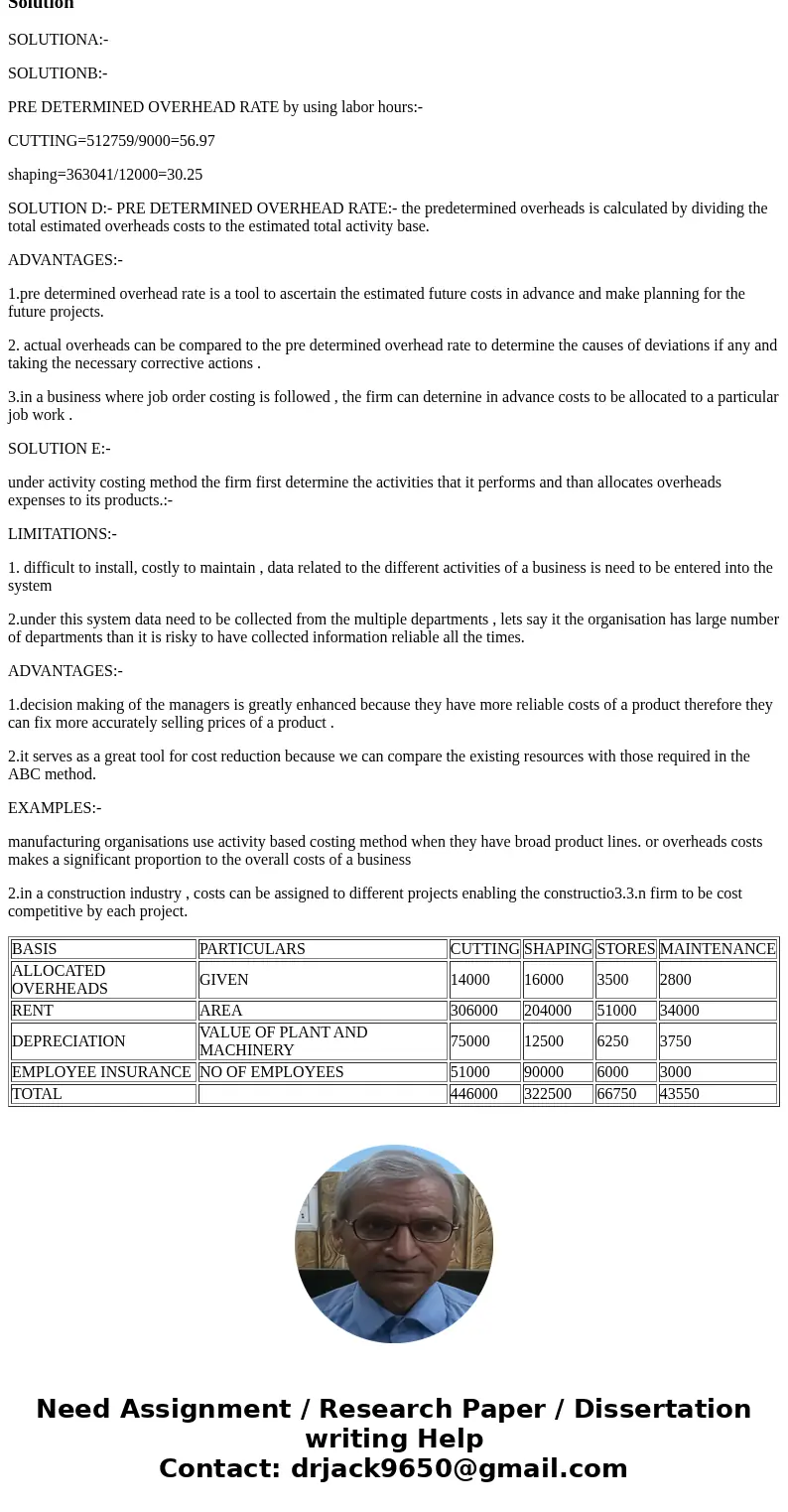

| BASIS | PARTICULARS | CUTTING | SHAPING | STORES | MAINTENANCE |

| ALLOCATED OVERHEADS | GIVEN | 14000 | 16000 | 3500 | 2800 |

| RENT | AREA | 306000 | 204000 | 51000 | 34000 |

| DEPRECIATION | VALUE OF PLANT AND MACHINERY | 75000 | 12500 | 6250 | 3750 |

| EMPLOYEE INSURANCE | NO OF EMPLOYEES | 51000 | 90000 | 6000 | 3000 |

| TOTAL | 446000 | 322500 | 66750 | 43550 |

Homework Sourse

Homework Sourse