IIL 20 JR Tire Store reported the following July purchases a

IIL. (20) JR Tire Store reported the following July purchases and sales data for a line of tires it deals. The company uses a perpetual inventory system. 1) Prepare the company\'s inventory record on LIFO basis. 2) Identify cost of goods sold for the month and the profit of the month. 3) Journalize the transactions on July 13 and 16. Date Item July1 Beginning Inventory 10 Quantity (Units) Unit Price 2 Purchase 13 Sales 16 Purchase 24 Sales $78 79 95 80 100

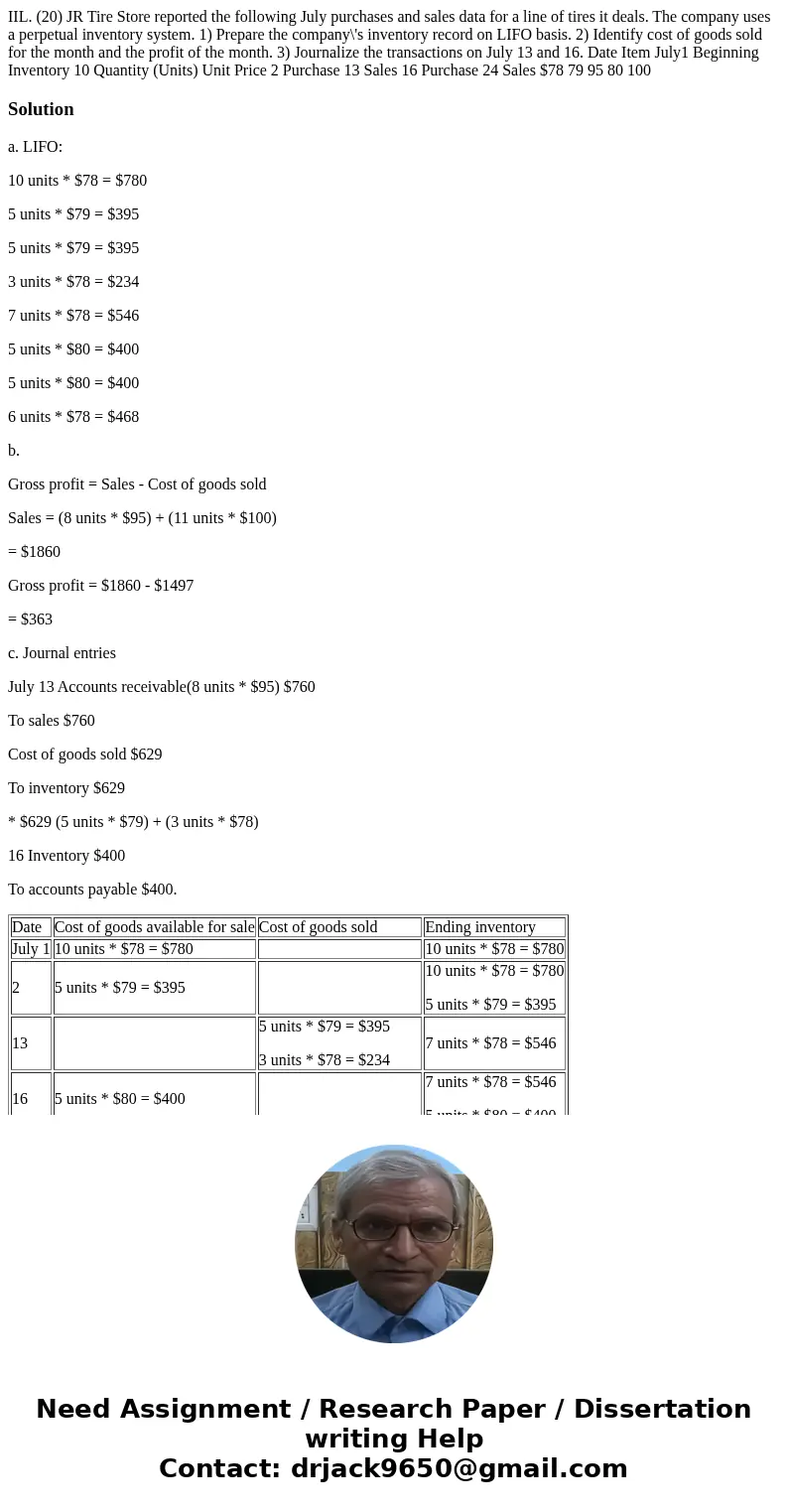

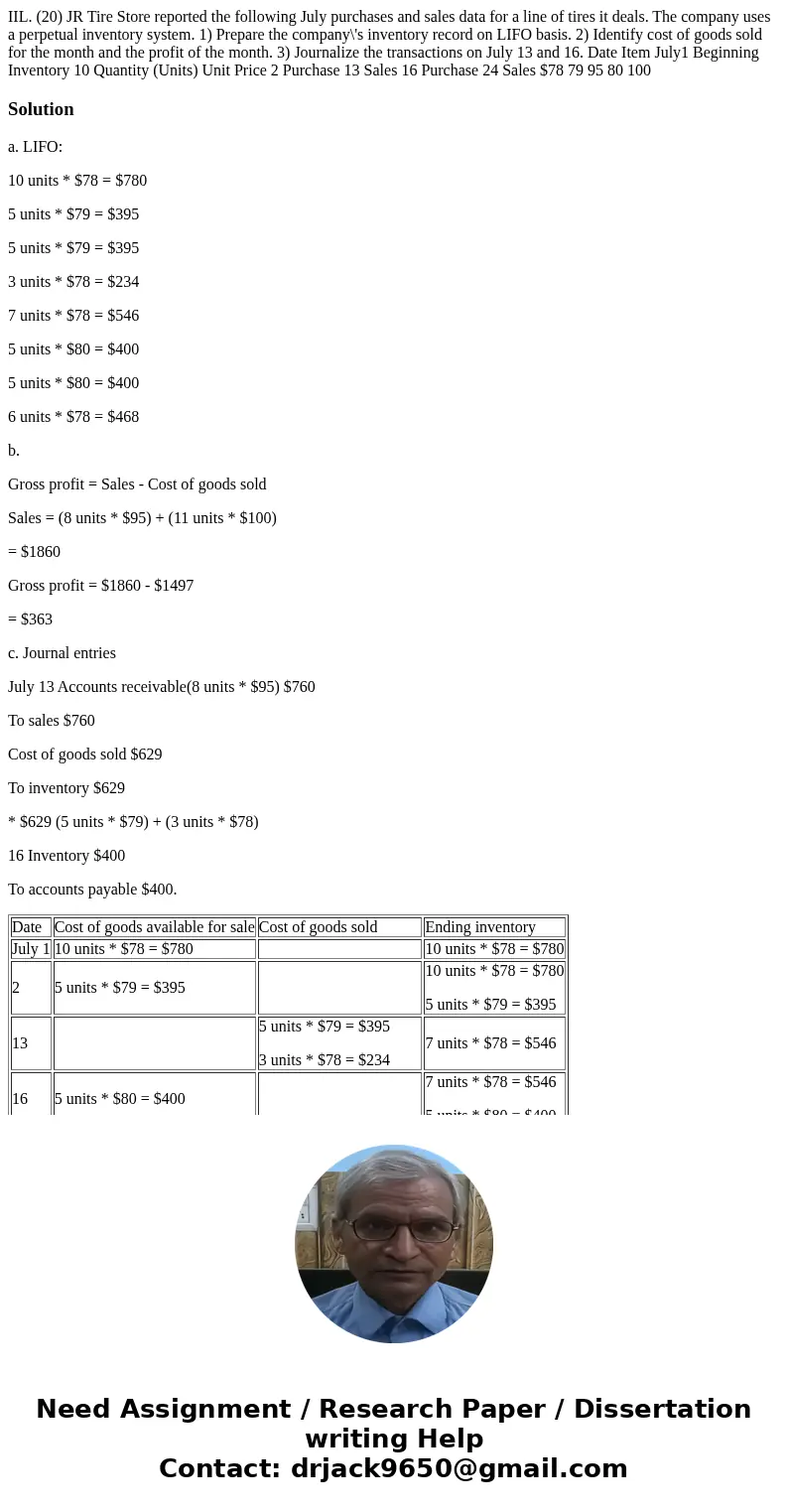

Solution

a. LIFO:

10 units * $78 = $780

5 units * $79 = $395

5 units * $79 = $395

3 units * $78 = $234

7 units * $78 = $546

5 units * $80 = $400

5 units * $80 = $400

6 units * $78 = $468

b.

Gross profit = Sales - Cost of goods sold

Sales = (8 units * $95) + (11 units * $100)

= $1860

Gross profit = $1860 - $1497

= $363

c. Journal entries

July 13 Accounts receivable(8 units * $95) $760

To sales $760

Cost of goods sold $629

To inventory $629

* $629 (5 units * $79) + (3 units * $78)

16 Inventory $400

To accounts payable $400.

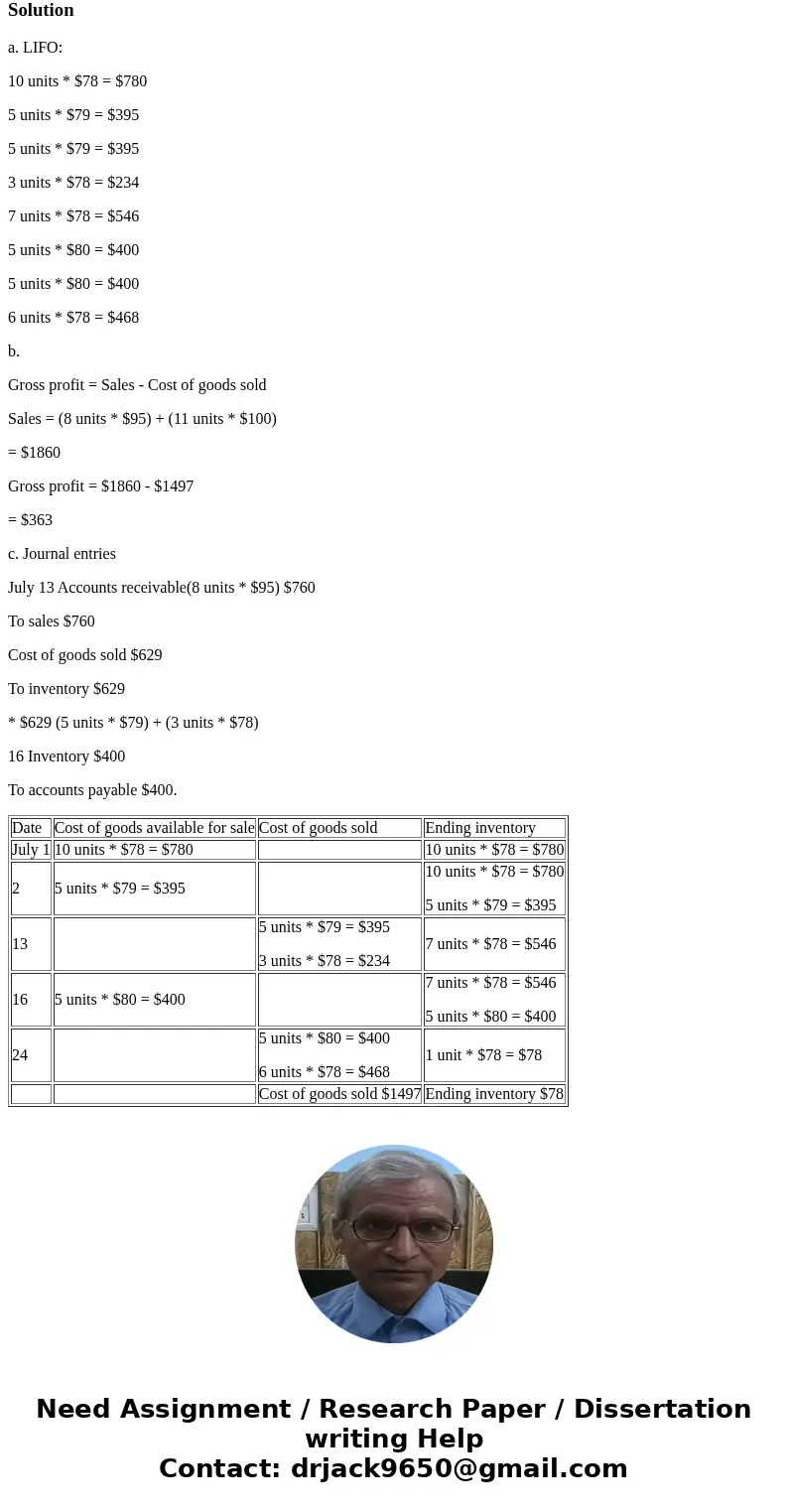

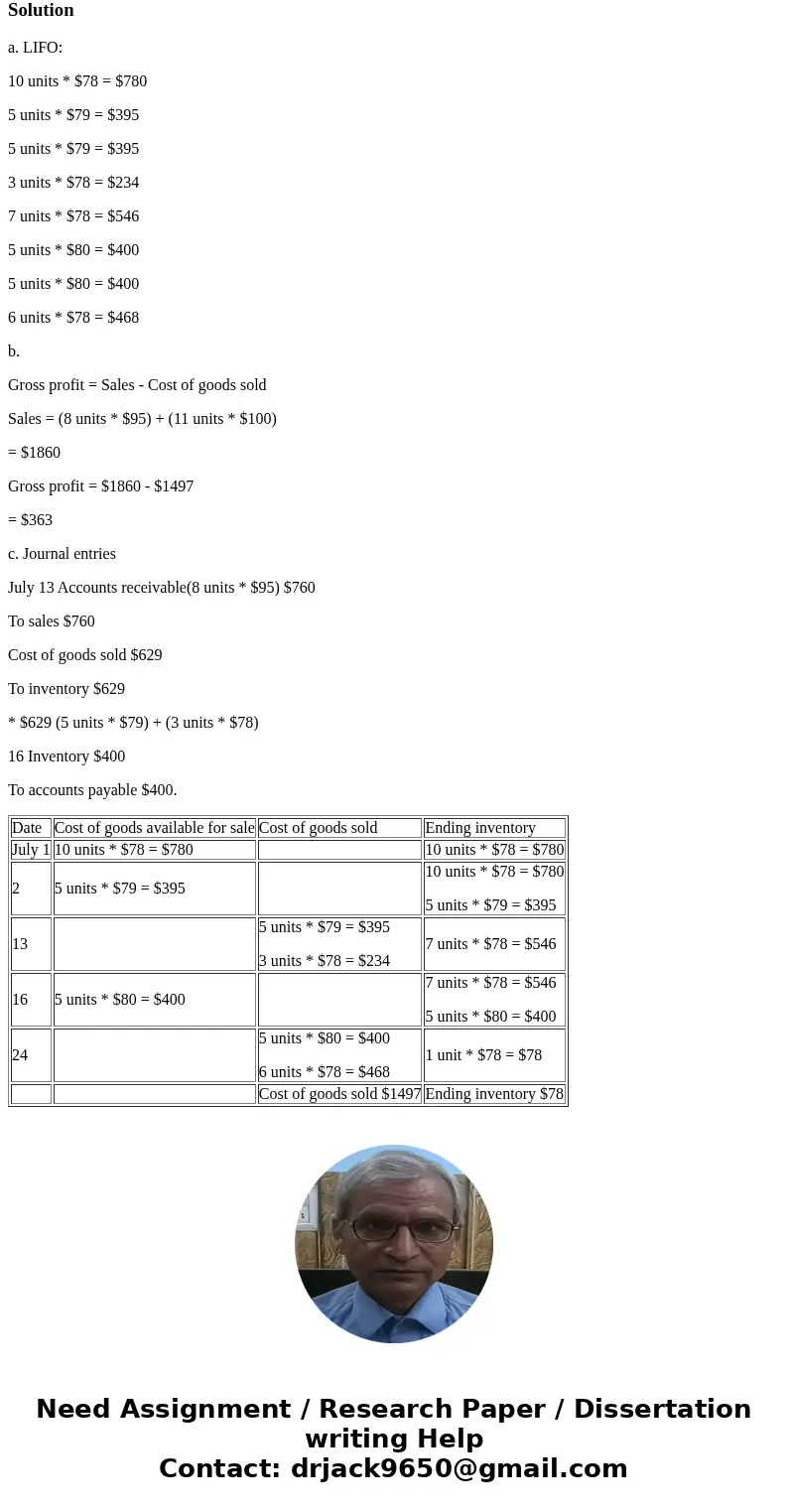

| Date | Cost of goods available for sale | Cost of goods sold | Ending inventory |

| July 1 | 10 units * $78 = $780 | 10 units * $78 = $780 | |

| 2 | 5 units * $79 = $395 | 10 units * $78 = $780 5 units * $79 = $395 | |

| 13 | 5 units * $79 = $395 3 units * $78 = $234 | 7 units * $78 = $546 | |

| 16 | 5 units * $80 = $400 | 7 units * $78 = $546 5 units * $80 = $400 | |

| 24 | 5 units * $80 = $400 6 units * $78 = $468 | 1 unit * $78 = $78 | |

| Cost of goods sold $1497 | Ending inventory $78 |

Homework Sourse

Homework Sourse