Consider the United States and the countries it trades with

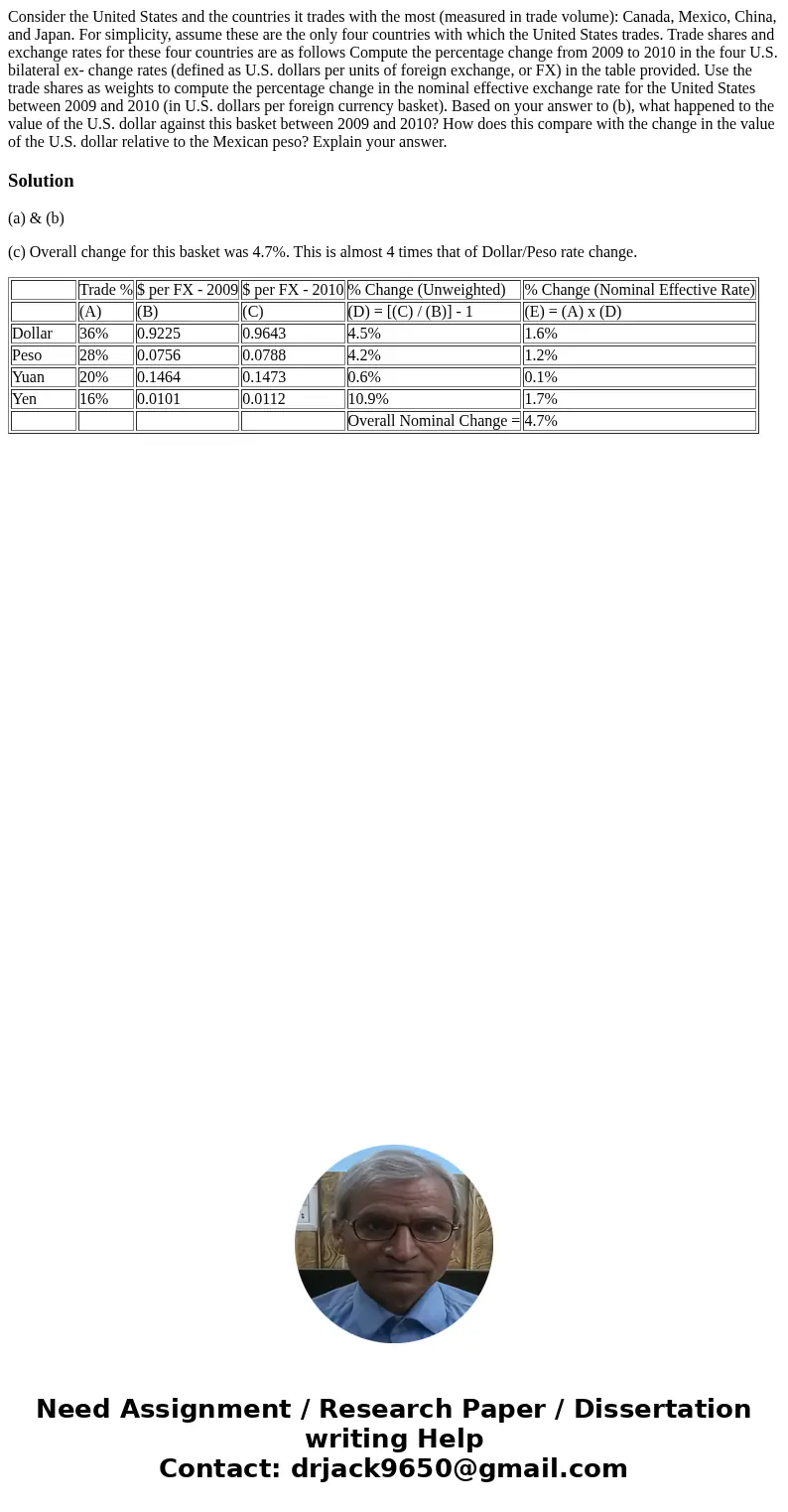

Consider the United States and the countries it trades with the most (measured in trade volume): Canada, Mexico, China, and Japan. For simplicity, assume these are the only four countries with which the United States trades. Trade shares and exchange rates for these four countries are as follows Compute the percentage change from 2009 to 2010 in the four U.S. bilateral ex- change rates (defined as U.S. dollars per units of foreign exchange, or FX) in the table provided. Use the trade shares as weights to compute the percentage change in the nominal effective exchange rate for the United States between 2009 and 2010 (in U.S. dollars per foreign currency basket). Based on your answer to (b), what happened to the value of the U.S. dollar against this basket between 2009 and 2010? How does this compare with the change in the value of the U.S. dollar relative to the Mexican peso? Explain your answer.

Solution

(a) & (b)

(c) Overall change for this basket was 4.7%. This is almost 4 times that of Dollar/Peso rate change.

| Trade % | $ per FX - 2009 | $ per FX - 2010 | % Change (Unweighted) | % Change (Nominal Effective Rate) | |

| (A) | (B) | (C) | (D) = [(C) / (B)] - 1 | (E) = (A) x (D) | |

| Dollar | 36% | 0.9225 | 0.9643 | 4.5% | 1.6% |

| Peso | 28% | 0.0756 | 0.0788 | 4.2% | 1.2% |

| Yuan | 20% | 0.1464 | 0.1473 | 0.6% | 0.1% |

| Yen | 16% | 0.0101 | 0.0112 | 10.9% | 1.7% |

| Overall Nominal Change = | 4.7% |

Homework Sourse

Homework Sourse