All parts A B C You are 60 years old Currently you have 1000

All parts

A)

B)

C)

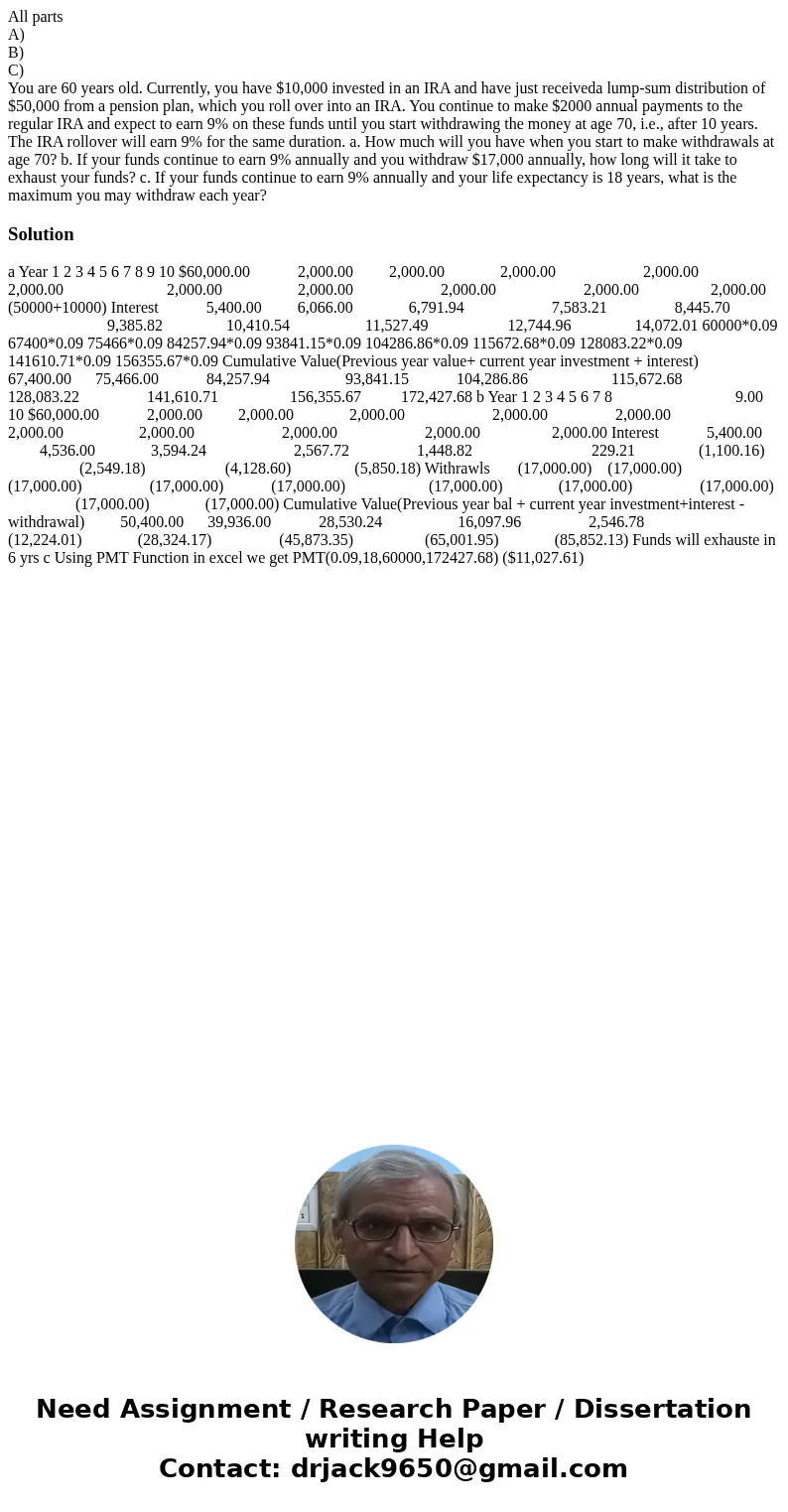

You are 60 years old. Currently, you have $10,000 invested in an IRA and have just receiveda lump-sum distribution of $50,000 from a pension plan, which you roll over into an IRA. You continue to make $2000 annual payments to the regular IRA and expect to earn 9% on these funds until you start withdrawing the money at age 70, i.e., after 10 years. The IRA rollover will earn 9% for the same duration. a. How much will you have when you start to make withdrawals at age 70? b. If your funds continue to earn 9% annually and you withdraw $17,000 annually, how long will it take to exhaust your funds? c. If your funds continue to earn 9% annually and your life expectancy is 18 years, what is the maximum you may withdraw each year? Solution

a Year 1 2 3 4 5 6 7 8 9 10 $60,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 (50000+10000) Interest 5,400.00 6,066.00 6,791.94 7,583.21 8,445.70 9,385.82 10,410.54 11,527.49 12,744.96 14,072.01 60000*0.09 67400*0.09 75466*0.09 84257.94*0.09 93841.15*0.09 104286.86*0.09 115672.68*0.09 128083.22*0.09 141610.71*0.09 156355.67*0.09 Cumulative Value(Previous year value+ current year investment + interest) 67,400.00 75,466.00 84,257.94 93,841.15 104,286.86 115,672.68 128,083.22 141,610.71 156,355.67 172,427.68 b Year 1 2 3 4 5 6 7 8 9.00 10 $60,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 2,000.00 Interest 5,400.00 4,536.00 3,594.24 2,567.72 1,448.82 229.21 (1,100.16) (2,549.18) (4,128.60) (5,850.18) Withrawls (17,000.00) (17,000.00) (17,000.00) (17,000.00) (17,000.00) (17,000.00) (17,000.00) (17,000.00) (17,000.00) (17,000.00) Cumulative Value(Previous year bal + current year investment+interest - withdrawal) 50,400.00 39,936.00 28,530.24 16,097.96 2,546.78 (12,224.01) (28,324.17) (45,873.35) (65,001.95) (85,852.13) Funds will exhauste in 6 yrs c Using PMT Function in excel we get PMT(0.09,18,60000,172427.68) ($11,027.61)

Homework Sourse

Homework Sourse