In terms of paying less in interest which is more economical

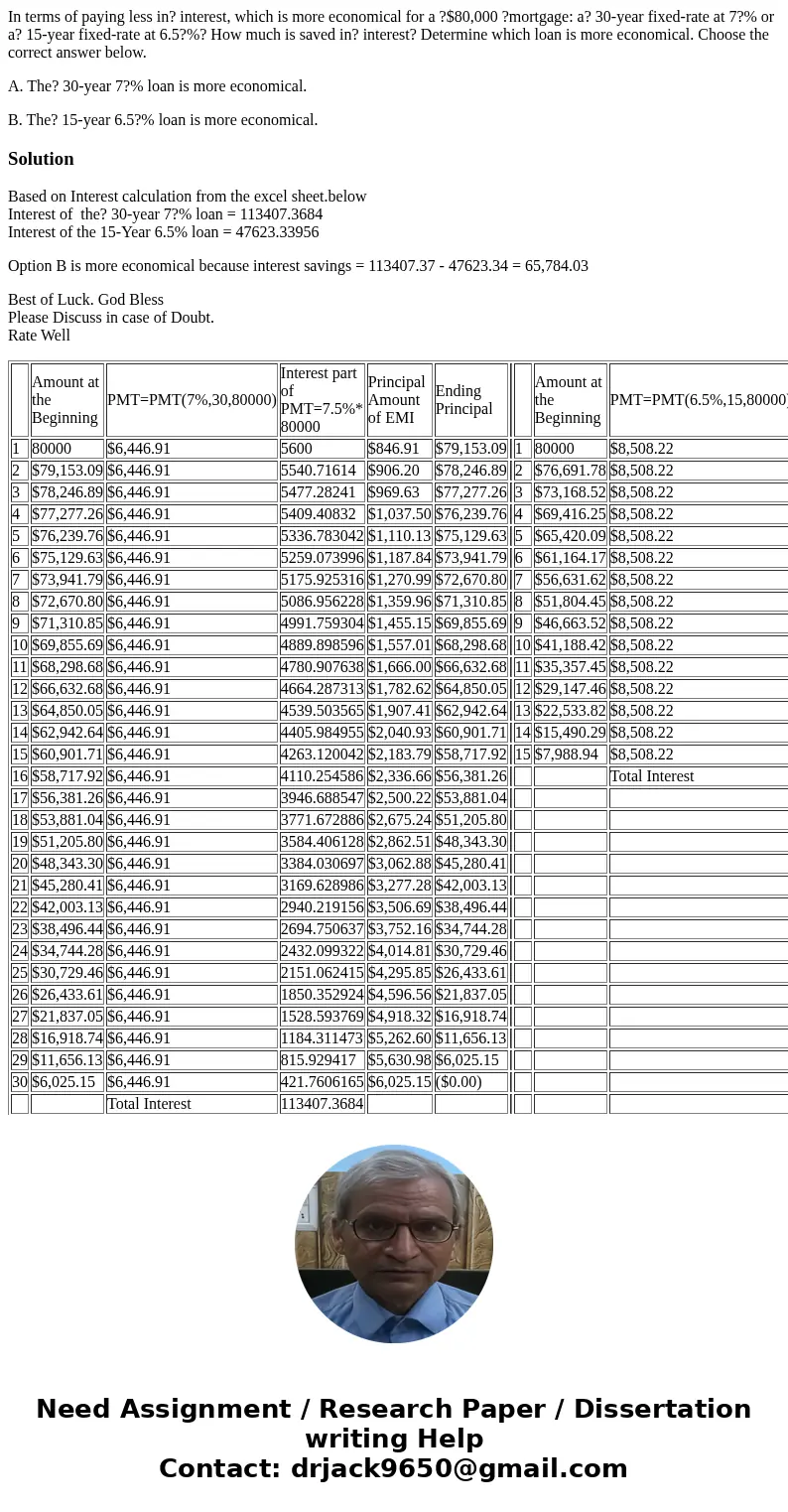

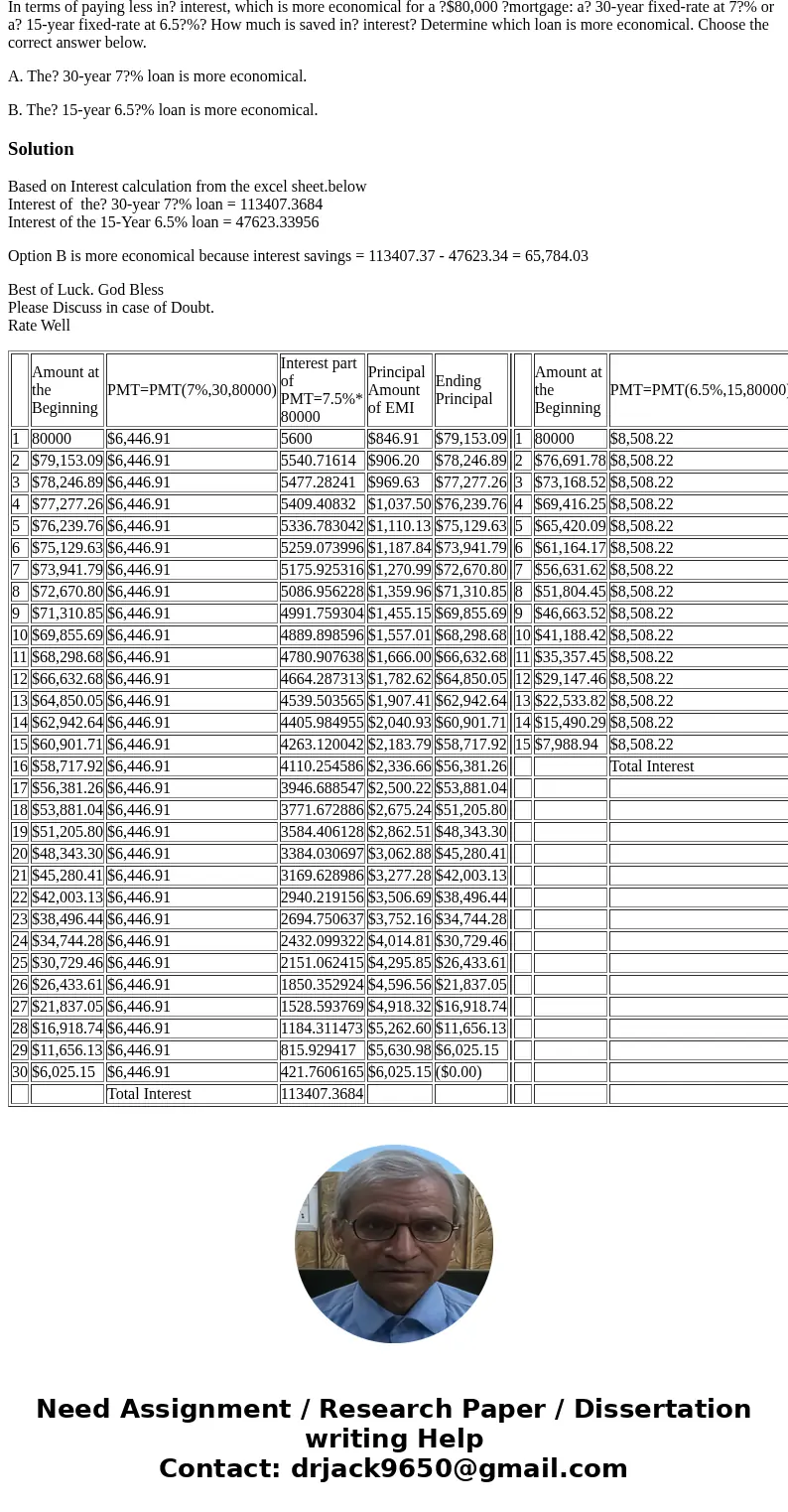

In terms of paying less in? interest, which is more economical for a ?$80,000 ?mortgage: a? 30-year fixed-rate at 7?% or a? 15-year fixed-rate at 6.5?%? How much is saved in? interest? Determine which loan is more economical. Choose the correct answer below.

A. The? 30-year 7?% loan is more economical.

B. The? 15-year 6.5?% loan is more economical.

Solution

Based on Interest calculation from the excel sheet.below

Interest of the? 30-year 7?% loan = 113407.3684

Interest of the 15-Year 6.5% loan = 47623.33956

Option B is more economical because interest savings = 113407.37 - 47623.34 = 65,784.03

Best of Luck. God Bless

Please Discuss in case of Doubt.

Rate Well

| Amount at the Beginning | PMT=PMT(7%,30,80000) | Interest part of PMT=7.5%* 80000 | Principal Amount of EMI | Ending Principal | Amount at the Beginning | PMT=PMT(6.5%,15,80000) | Interest part of PMT= 6.5%* 80000 | Principal Amount of EMI | Ending Principal | |||

| 1 | 80000 | $6,446.91 | 5600 | $846.91 | $79,153.09 | 1 | 80000 | $8,508.22 | 5200 | $3,308.22 | $76,691.78 | |

| 2 | $79,153.09 | $6,446.91 | 5540.71614 | $906.20 | $78,246.89 | 2 | $76,691.78 | $8,508.22 | 4984.965529 | $3,523.26 | $73,168.52 | |

| 3 | $78,246.89 | $6,446.91 | 5477.28241 | $969.63 | $77,277.26 | 3 | $73,168.52 | $8,508.22 | 4755.953817 | $3,752.27 | $69,416.25 | |

| 4 | $77,277.26 | $6,446.91 | 5409.40832 | $1,037.50 | $76,239.76 | 4 | $69,416.25 | $8,508.22 | 4512.056343 | $3,996.17 | $65,420.09 | |

| 5 | $76,239.76 | $6,446.91 | 5336.783042 | $1,110.13 | $75,129.63 | 5 | $65,420.09 | $8,508.22 | 4252.305534 | $4,255.92 | $61,164.17 | |

| 6 | $75,129.63 | $6,446.91 | 5259.073996 | $1,187.84 | $73,941.79 | 6 | $61,164.17 | $8,508.22 | 3975.670922 | $4,532.55 | $56,631.62 | |

| 7 | $73,941.79 | $6,446.91 | 5175.925316 | $1,270.99 | $72,670.80 | 7 | $56,631.62 | $8,508.22 | 3681.055061 | $4,827.17 | $51,804.45 | |

| 8 | $72,670.80 | $6,446.91 | 5086.956228 | $1,359.96 | $71,310.85 | 8 | $51,804.45 | $8,508.22 | 3367.289168 | $5,140.93 | $46,663.52 | |

| 9 | $71,310.85 | $6,446.91 | 4991.759304 | $1,455.15 | $69,855.69 | 9 | $46,663.52 | $8,508.22 | 3033.128493 | $5,475.09 | $41,188.42 | |

| 10 | $69,855.69 | $6,446.91 | 4889.898596 | $1,557.01 | $68,298.68 | 10 | $41,188.42 | $8,508.22 | 2677.247374 | $5,830.98 | $35,357.45 | |

| 11 | $68,298.68 | $6,446.91 | 4780.907638 | $1,666.00 | $66,632.68 | 11 | $35,357.45 | $8,508.22 | 2298.233981 | $6,209.99 | $29,147.46 | |

| 12 | $66,632.68 | $6,446.91 | 4664.287313 | $1,782.62 | $64,850.05 | 12 | $29,147.46 | $8,508.22 | 1894.584719 | $6,613.64 | $22,533.82 | |

| 13 | $64,850.05 | $6,446.91 | 4539.503565 | $1,907.41 | $62,942.64 | 13 | $22,533.82 | $8,508.22 | 1464.698254 | $7,043.52 | $15,490.29 | |

| 14 | $62,942.64 | $6,446.91 | 4405.984955 | $2,040.93 | $60,901.71 | 14 | $15,490.29 | $8,508.22 | 1006.869169 | $7,501.35 | $7,988.94 | |

| 15 | $60,901.71 | $6,446.91 | 4263.120042 | $2,183.79 | $58,717.92 | 15 | $7,988.94 | $8,508.22 | 519.2811938 | $7,988.94 | $0.00 | |

| 16 | $58,717.92 | $6,446.91 | 4110.254586 | $2,336.66 | $56,381.26 | Total Interest | 47623.33956 | |||||

| 17 | $56,381.26 | $6,446.91 | 3946.688547 | $2,500.22 | $53,881.04 | |||||||

| 18 | $53,881.04 | $6,446.91 | 3771.672886 | $2,675.24 | $51,205.80 | |||||||

| 19 | $51,205.80 | $6,446.91 | 3584.406128 | $2,862.51 | $48,343.30 | |||||||

| 20 | $48,343.30 | $6,446.91 | 3384.030697 | $3,062.88 | $45,280.41 | |||||||

| 21 | $45,280.41 | $6,446.91 | 3169.628986 | $3,277.28 | $42,003.13 | |||||||

| 22 | $42,003.13 | $6,446.91 | 2940.219156 | $3,506.69 | $38,496.44 | |||||||

| 23 | $38,496.44 | $6,446.91 | 2694.750637 | $3,752.16 | $34,744.28 | |||||||

| 24 | $34,744.28 | $6,446.91 | 2432.099322 | $4,014.81 | $30,729.46 | |||||||

| 25 | $30,729.46 | $6,446.91 | 2151.062415 | $4,295.85 | $26,433.61 | |||||||

| 26 | $26,433.61 | $6,446.91 | 1850.352924 | $4,596.56 | $21,837.05 | |||||||

| 27 | $21,837.05 | $6,446.91 | 1528.593769 | $4,918.32 | $16,918.74 | |||||||

| 28 | $16,918.74 | $6,446.91 | 1184.311473 | $5,262.60 | $11,656.13 | |||||||

| 29 | $11,656.13 | $6,446.91 | 815.929417 | $5,630.98 | $6,025.15 | |||||||

| 30 | $6,025.15 | $6,446.91 | 421.7606165 | $6,025.15 | ($0.00) | |||||||

| Total Interest | 113407.3684 |

Homework Sourse

Homework Sourse