has prepared the following comparative balance sheet for 11

has prepared the following comparative balance sheet for 11, 2012 2012 2011 $198,000 $102,000 Receivable 78,000 106,000 100,000 12,000 840,000- (300,000) - 120,000 18,000 700,000 (250,000) 116.000 Plant assets Accumulated depreciation Goodwill Total Assets Account Payable $102,000 40,000 $112,000 Accrued Liabilities 28,000 Ponds Payable Preferred stocks Common stocks Retrained earnings 300,000 400,000 $884,000 430,000 400,000 Total Liabilities & equity $1.058,000 1- The Accumulated Depreciation account has been credited only for the depreciation expense for the period. Goodwill was tested for impairment during the year 2. The Retained Earnings account has been charged for dividends of $ 92,000 and credited for the net income for the year. The income statement for 2012, is as follows: Sales Cost of sales Gross profit Operating expenses Net income $1,320,000 726,000 594,000 460,000 nstructions: se the information above to prepare statement of cash flows according to the rect method for Dillard\'s Corporation, for the year ended December 31, 2012. how Computations)

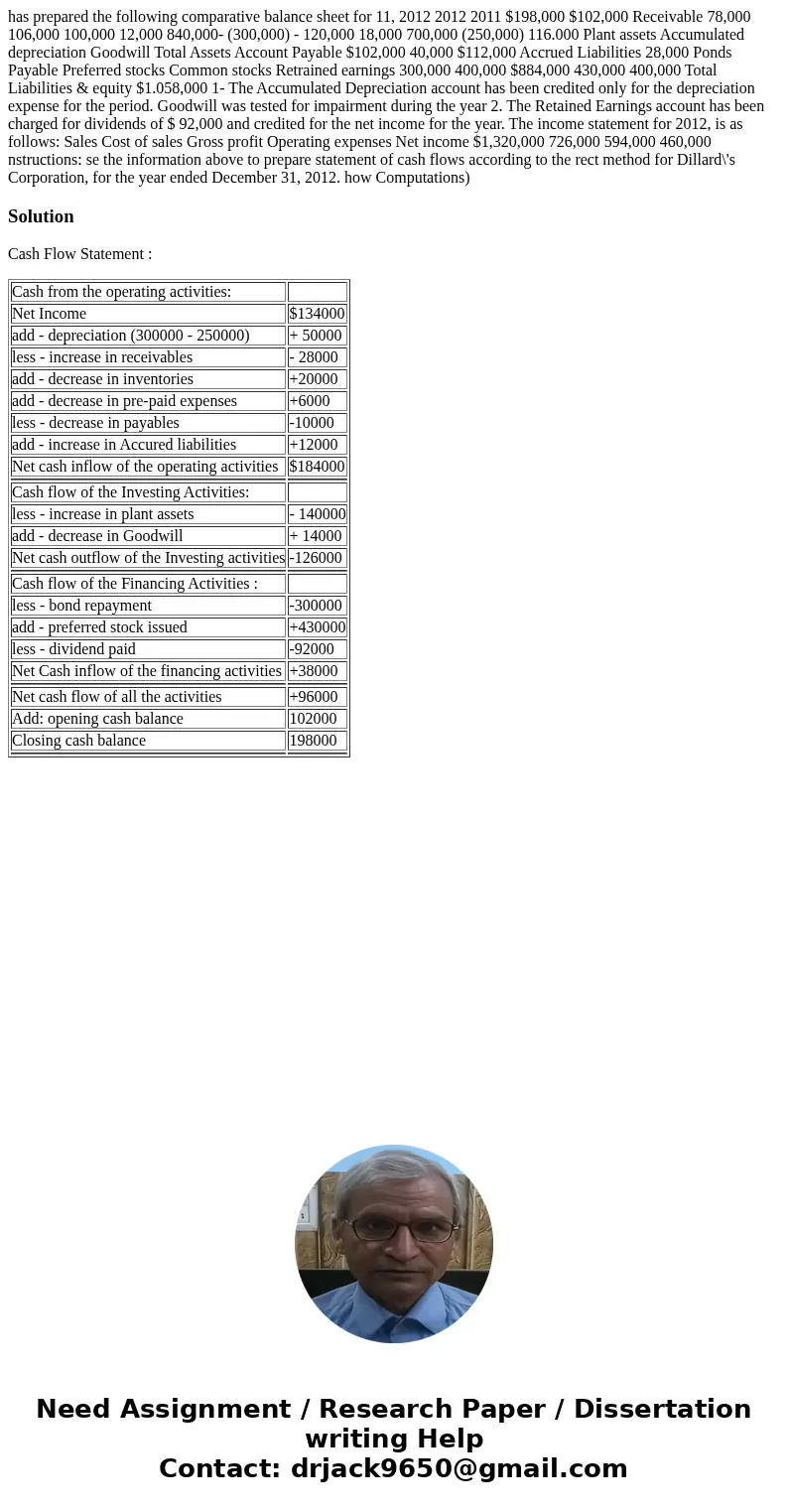

Solution

Cash Flow Statement :

| Cash from the operating activities: | |

| Net Income | $134000 |

| add - depreciation (300000 - 250000) | + 50000 |

| less - increase in receivables | - 28000 |

| add - decrease in inventories | +20000 |

| add - decrease in pre-paid expenses | +6000 |

| less - decrease in payables | -10000 |

| add - increase in Accured liabilities | +12000 |

| Net cash inflow of the operating activities | $184000 |

| Cash flow of the Investing Activities: | |

| less - increase in plant assets | - 140000 |

| add - decrease in Goodwill | + 14000 |

| Net cash outflow of the Investing activities | -126000 |

| Cash flow of the Financing Activities : | |

| less - bond repayment | -300000 |

| add - preferred stock issued | +430000 |

| less - dividend paid | -92000 |

| Net Cash inflow of the financing activities | +38000 |

| Net cash flow of all the activities | +96000 |

| Add: opening cash balance | 102000 |

| Closing cash balance | 198000 |

Homework Sourse

Homework Sourse