Woodwick Company issues 10 fiveyear bonds on December 31 201

Solution

Answer

Date

Accounts Title

Dr

Cr

Working

12/31/2014

Cash

97911

[Carrying value on 12/31/2014]

Bonds Payable

90000

[Par Value]

Premium on Bonds payable

7911

[Unamortised Premium]

6/30/2015

Interest Expense

3709

[Balancing figure]

Premium on Bonds Payable

791

Amortised premium [7911 – 7120]

Cash

4500

[90000 x 10% x 6/12]

12/31/2015

Interest Expense

3709

[Balancing figure]

Premium on Bonds Payable

791

Amortised premium [7911 – 7120]

Cash

4500

[90000 x 10% x 6/12]

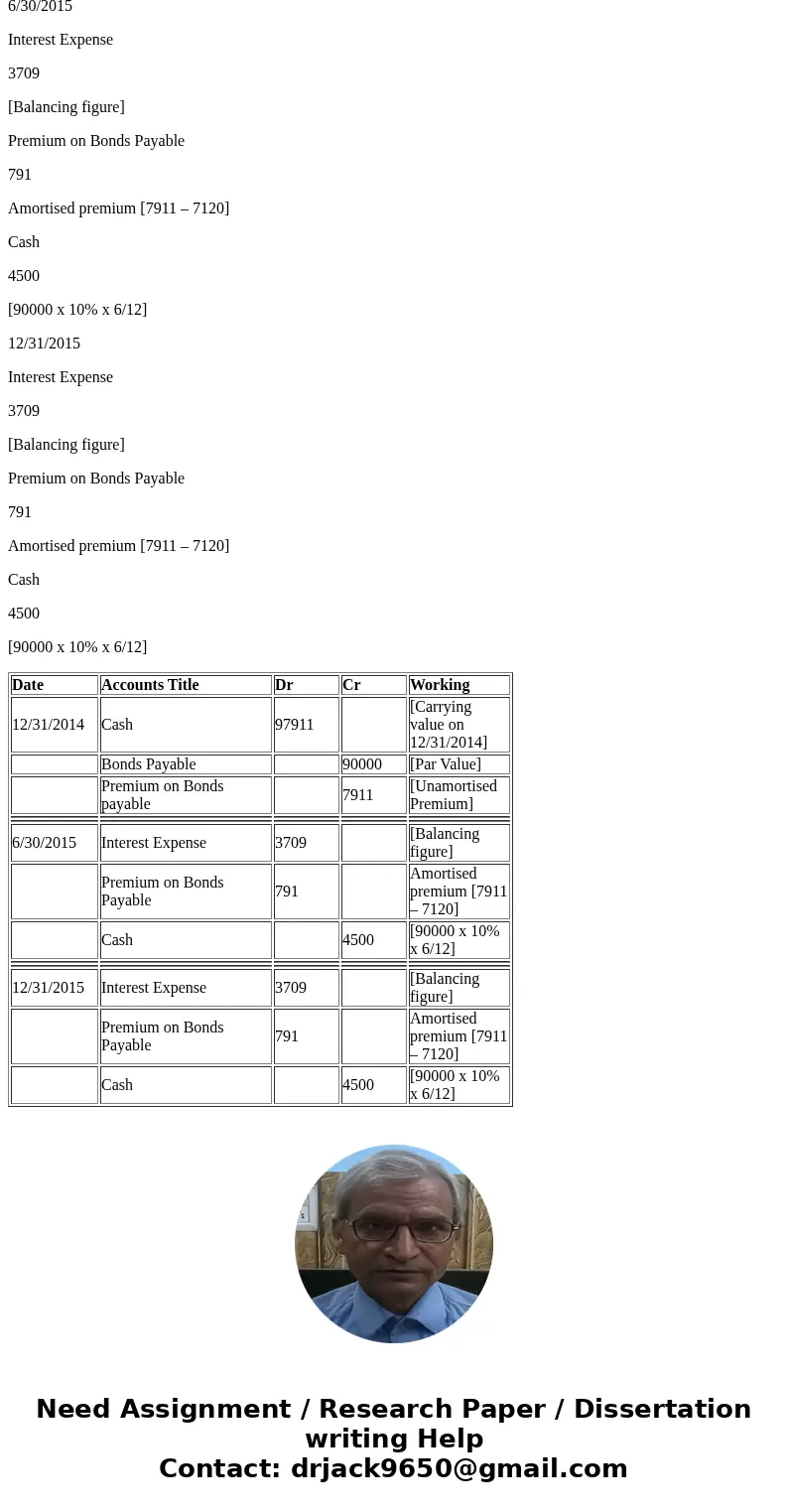

| Date | Accounts Title | Dr | Cr | Working |

| 12/31/2014 | Cash | 97911 | [Carrying value on 12/31/2014] | |

| Bonds Payable | 90000 | [Par Value] | ||

| Premium on Bonds payable | 7911 | [Unamortised Premium] | ||

| 6/30/2015 | Interest Expense | 3709 | [Balancing figure] | |

| Premium on Bonds Payable | 791 | Amortised premium [7911 – 7120] | ||

| Cash | 4500 | [90000 x 10% x 6/12] | ||

| 12/31/2015 | Interest Expense | 3709 | [Balancing figure] | |

| Premium on Bonds Payable | 791 | Amortised premium [7911 – 7120] | ||

| Cash | 4500 | [90000 x 10% x 6/12] |

Homework Sourse

Homework Sourse