Super Bikes SB Inc is a company which manufactures bicycles

Super Bikes (SB) Inc. is a company which manufactures bicycles and distributes to retailers across Canada. Its line of business is generally considered quite stable and low risk. SB Inc. would like to invest in a new division to manufacture skateboards.

Currently, SB Inc. has a cost of debt (before tax) of 5% and its stock has a beta of 0.6. The firm’s debt-equity ratio is 0.7. The firm has identified another company (Free Wheels Inc) whose main business is similar to this project. Free Wheels Inc. has a cost of debt (before tax) of 8%, a beta of 2.5, tax rate of 35% and a debt-equity ratio of 0.4.

SB Inc.has an effective tax rate of 35%. The expected return on the market is 10% and the risk free rate of interest is 4%.

What is the appropriate cost of capital to apply to SB Inc.’s proposed expansion into the skateboard manufacturing business?

PLEASE SHOW ALL WORK AND CALCULATIONS

Solution

Super bike

cost of debt

5%

after tax cost of debt

5*(1-.35)

3.25

cost of equity

risk free rate+(market return-risk free rate)*beta

4+(10-4)*.6

7.6

source

weight

cost

weight*cost

debt

0.411765

3.2500

1.338235

common stock

0.588235

7.600

4.470588

total

1.7

WACC

sum of weight*cost

5.81

Free wheels

cost of debt

8%

after tax cost of debt

8*(1-.35)

5.2

cost of equity

risk free rate+(market return-risk free rate)*beta

4+(10-4)*2.5

19

source

weight

cost

weight*cost

debt

0.285714

5.2000

1.485714

common stock

0.714286

19.000

13.57143

total

1.4

WACC

sum of weight*cost

15.06

Appropriate discount rate is 15.06% as its expansion cost of capital while super bike WACC is 5.81 which is much lower to WACC of expansion so it will increase the riskiness of the super bike so WACC of expansion should be used for discount of cash flow

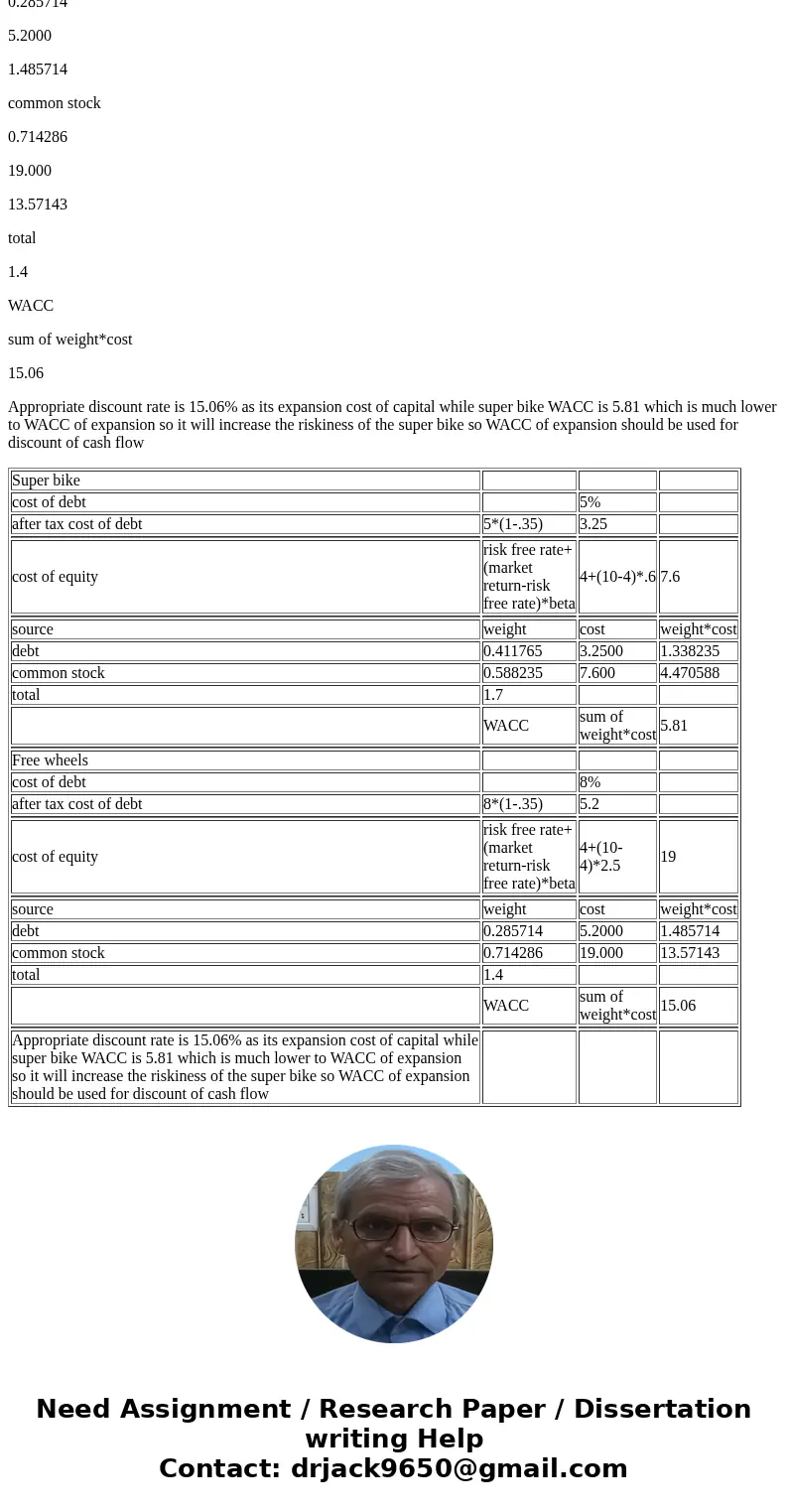

| Super bike | |||

| cost of debt | 5% | ||

| after tax cost of debt | 5*(1-.35) | 3.25 | |

| cost of equity | risk free rate+(market return-risk free rate)*beta | 4+(10-4)*.6 | 7.6 |

| source | weight | cost | weight*cost |

| debt | 0.411765 | 3.2500 | 1.338235 |

| common stock | 0.588235 | 7.600 | 4.470588 |

| total | 1.7 | ||

| WACC | sum of weight*cost | 5.81 | |

| Free wheels | |||

| cost of debt | 8% | ||

| after tax cost of debt | 8*(1-.35) | 5.2 | |

| cost of equity | risk free rate+(market return-risk free rate)*beta | 4+(10-4)*2.5 | 19 |

| source | weight | cost | weight*cost |

| debt | 0.285714 | 5.2000 | 1.485714 |

| common stock | 0.714286 | 19.000 | 13.57143 |

| total | 1.4 | ||

| WACC | sum of weight*cost | 15.06 | |

| Appropriate discount rate is 15.06% as its expansion cost of capital while super bike WACC is 5.81 which is much lower to WACC of expansion so it will increase the riskiness of the super bike so WACC of expansion should be used for discount of cash flow |

Homework Sourse

Homework Sourse