What is the expected return and standard deviation of a port

What is the expected return and standard deviation of a portfolio which is comprised of $4,500 invested in stock S and $3,000 in stock T? Assume the correlation coefficient between the two securities = -.80.

State of Economy

Probability of State

of Economy

Return if State Occurs

Stock S

Return if State Occurs

Stock T

Boom

10%

12%

4%

Normal

65%

9%

6%

Recession

25%

2%

9%

| State of Economy | Probability of State of Economy | Return if State Occurs Stock S | Return if State Occurs Stock T |

| Boom | 10% | 12% | 4% |

| Normal | 65% | 9% | 6% |

| Recession | 25% | 2% | 9% |

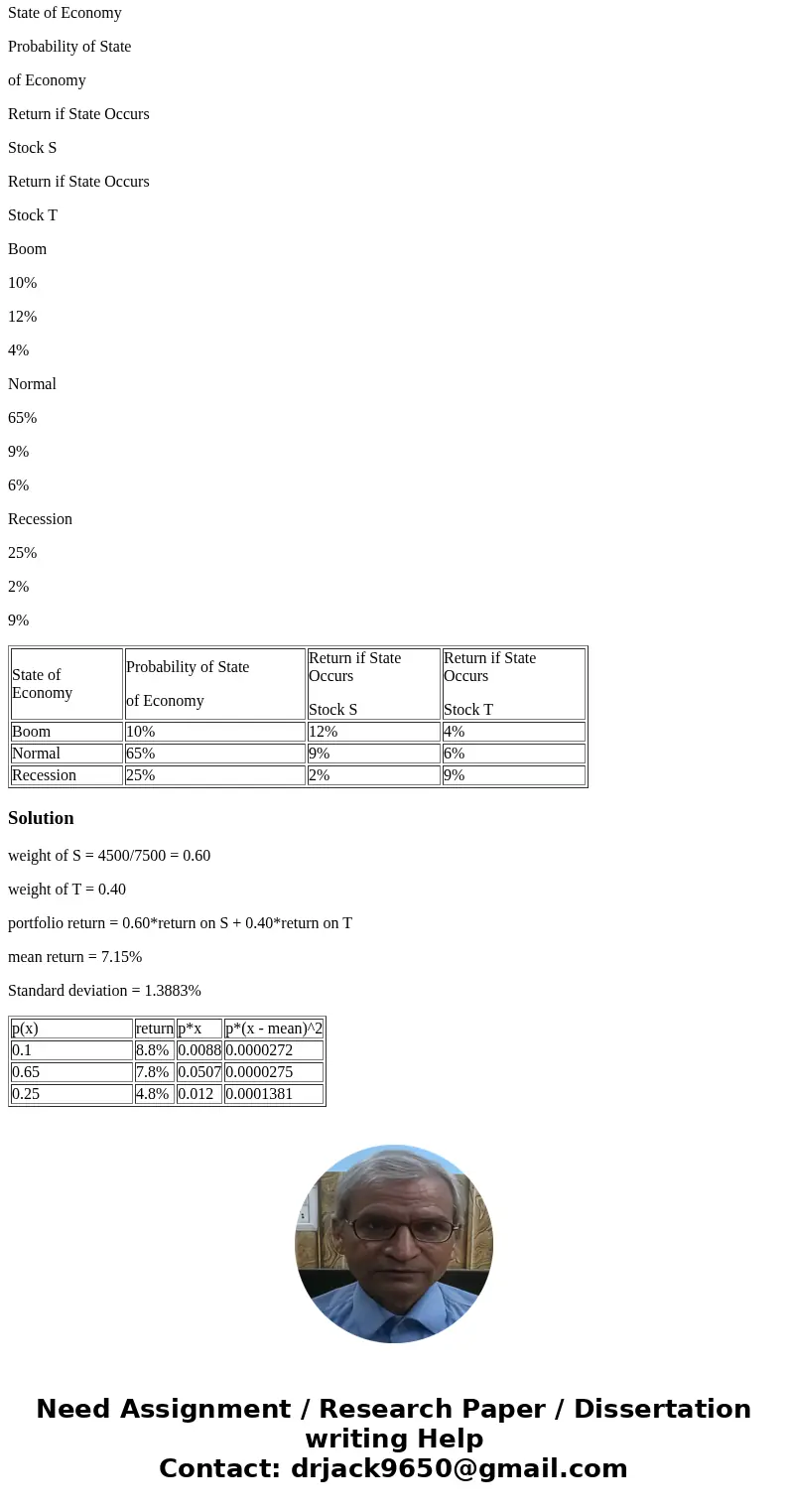

Solution

weight of S = 4500/7500 = 0.60

weight of T = 0.40

portfolio return = 0.60*return on S + 0.40*return on T

mean return = 7.15%

Standard deviation = 1.3883%

| p(x) | return | p*x | p*(x - mean)^2 |

| 0.1 | 8.8% | 0.0088 | 0.0000272 |

| 0.65 | 7.8% | 0.0507 | 0.0000275 |

| 0.25 | 4.8% | 0.012 | 0.0001381 |

Homework Sourse

Homework Sourse