E31 Inferring Statement of Earnings Values LO32 Supply the m

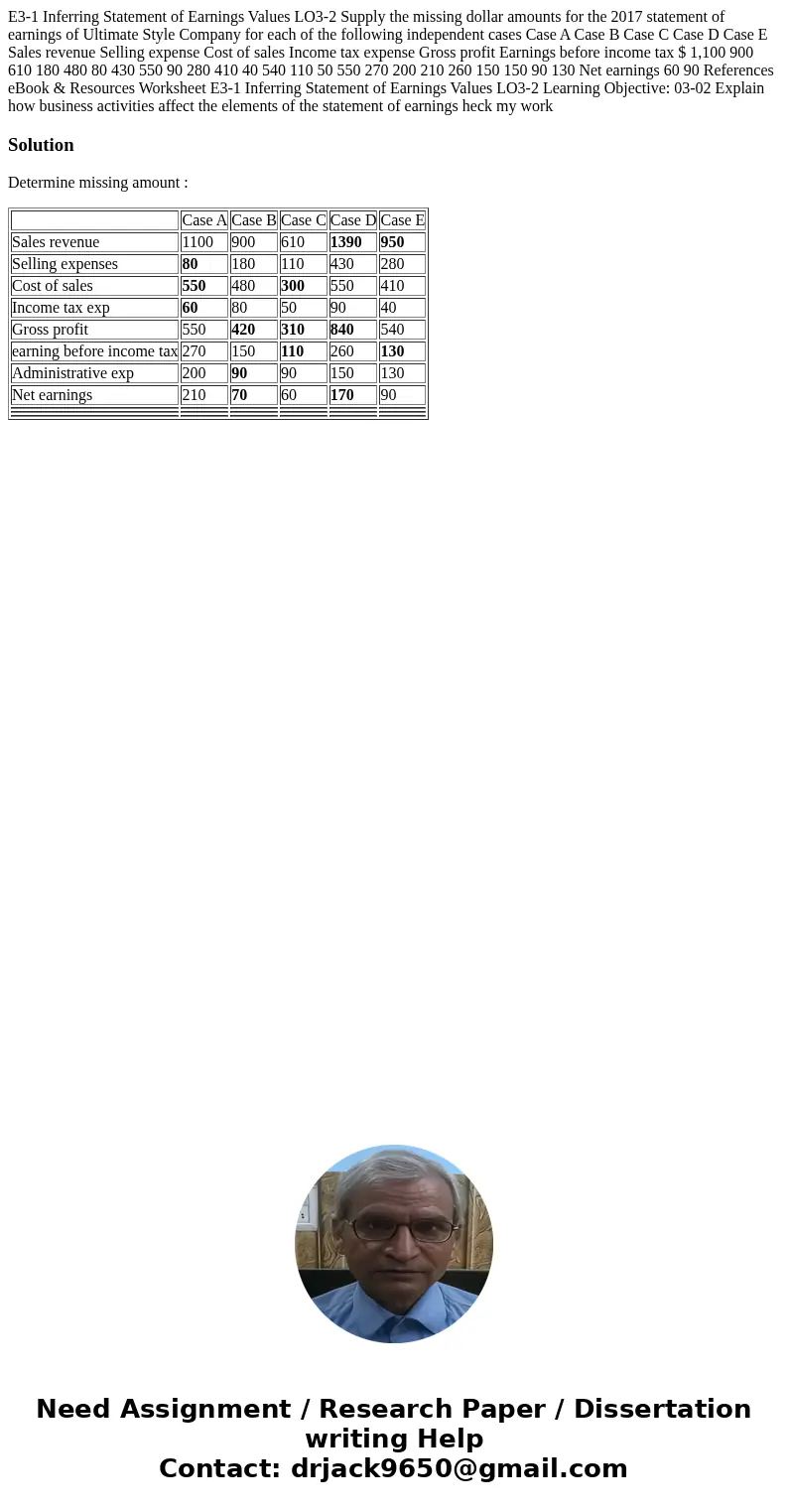

E3-1 Inferring Statement of Earnings Values LO3-2 Supply the missing dollar amounts for the 2017 statement of earnings of Ultimate Style Company for each of the following independent cases Case A Case B Case C Case D Case E Sales revenue Selling expense Cost of sales Income tax expense Gross profit Earnings before income tax $ 1,100 900 610 180 480 80 430 550 90 280 410 40 540 110 50 550 270 200 210 260 150 150 90 130 Net earnings 60 90 References eBook & Resources Worksheet E3-1 Inferring Statement of Earnings Values LO3-2 Learning Objective: 03-02 Explain how business activities affect the elements of the statement of earnings heck my work

Solution

Determine missing amount :

| Case A | Case B | Case C | Case D | Case E | |

| Sales revenue | 1100 | 900 | 610 | 1390 | 950 |

| Selling expenses | 80 | 180 | 110 | 430 | 280 |

| Cost of sales | 550 | 480 | 300 | 550 | 410 |

| Income tax exp | 60 | 80 | 50 | 90 | 40 |

| Gross profit | 550 | 420 | 310 | 840 | 540 |

| earning before income tax | 270 | 150 | 110 | 260 | 130 |

| Administrative exp | 200 | 90 | 90 | 150 | 130 |

| Net earnings | 210 | 70 | 60 | 170 | 90 |

Homework Sourse

Homework Sourse