NPV with rankingsBotany Bay Inc a maker of casual clothing i

NPV?, with rankings???Botany? Bay, Inc., a maker of casual? clothing, is considering four projects shown in the following? table. Because of past financial? difficulties, the company has a high cost of capital at 14.1 %. a.??Calculate the NPV of each? project, using a cost of capital of 14.1 %. b.??Rank acceptable projects by NPV. c.??Calculate the IRR of each project and use it to determine the highest cost of capital at which all of the projects would be acceptable. nitial investment ?(CF 0?)Initial investment A-$50,000 B-$100,300 C-$79,200 D-$179,500 Year Cash inflows Year 1 $20,400 $36,100 $19,100 $100,300 Year 2 $20,400 $51,900 $39,100 $80,400 Year 3 $20,400 $50,900 $59,700 $60,000

Solution

a.

Project A

Project B

Project C

Project D

NPV

$ (2,718.06)

$ 5,470.11

$ 7,763.11

$ 10,554.05

Computation of NPV of Projects:

Year

Cash

Flow (A)

Cash

Flow (B)

Cash Flow (C)

Cash

Flow (D)

PV Factor Calculation

PV Factor @14.1 % (F)

PV

(= A x F)

PV

(= B x F)

PV

(= C x F)

PV

(= D x F)

0

$ (50,000)

$ (100,300)

$ (79,200)

$ (179,500)

1/(1.141)^0

1

$ (50,000)

$ (100,300)

$ (79,200)

$

(179,500)

1

$ 20,400

$ 36,100

$ 19,100

$ 100,300

1/(1.141)^1

0.876424189

$ 17,879.05

$ 31,638.91

$ 16,739.70

$

87,905.35

2

$ 20,400

$ 51,900

$ 39,100

$ 80,400

1/(1.141)^2

0.76811936

$ 15,669.63

$ 39,865.39

$ 30,033.47

$

61,756.80

3

$ 20,400

$ 50,900

$ 59,700

$ 60,000

1/(1.141)^3

0.673198387

$ 13,733.25

$ 34,265.80

$ 40,189.94

$

40,391.90

NPV

$ (2,718.06)

$ 5,470.11

$ 7,763.11

$

10,554.05

b.

Rank of projects based on NPV:

Project A

Project B

Project C

Project D

Rank

IV

III

II

I

c.

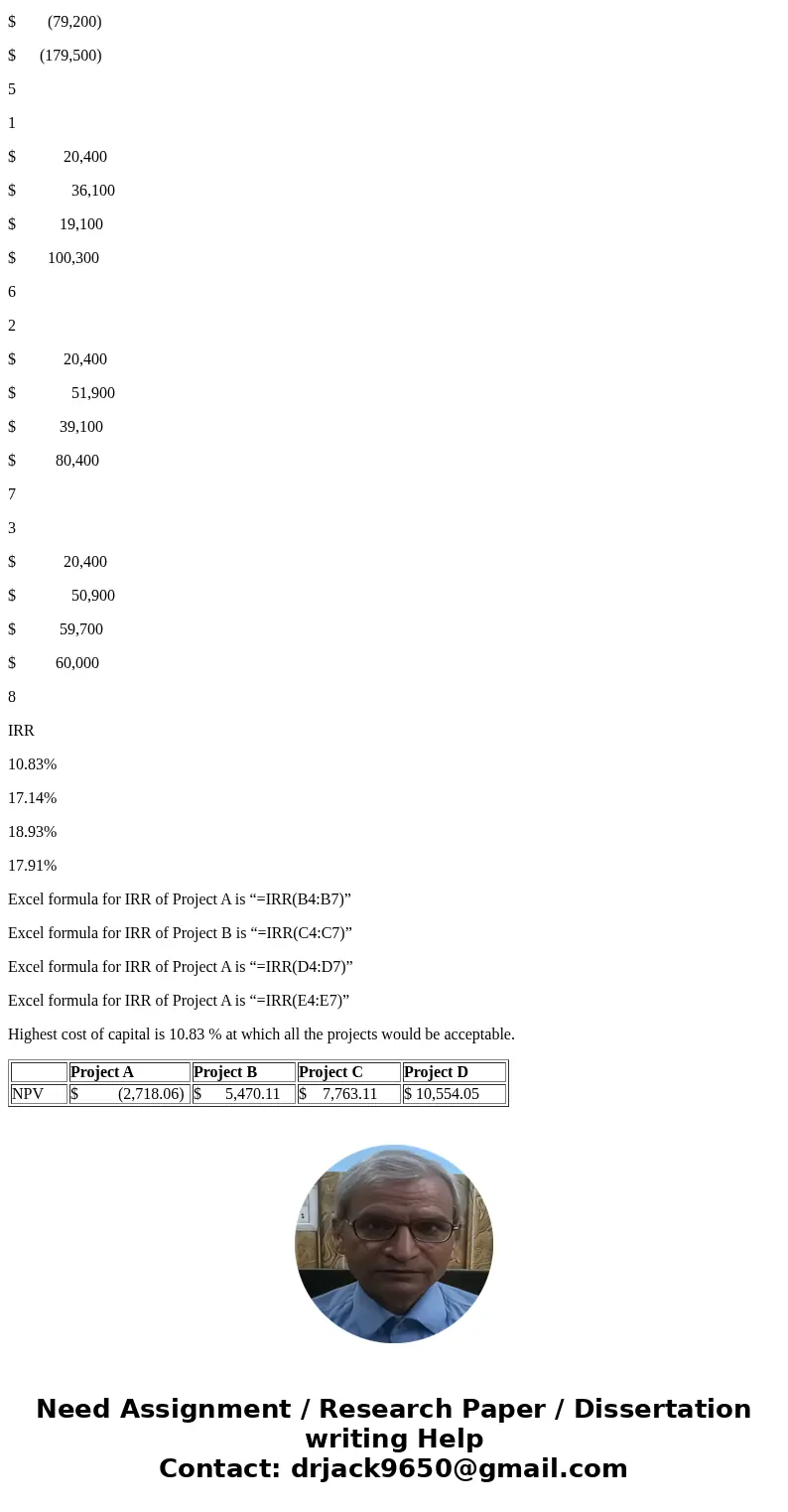

Computation of IRR of Projects:

1

A

B

C

D

E

2

Year

Project A

Project B

Project C

Project D

3

Cash Flow

Cash Flow

Cash Flow

Cash Flow

4

0

$ (50,000)

$ (100,300)

$ (79,200)

$ (179,500)

5

1

$ 20,400

$ 36,100

$ 19,100

$ 100,300

6

2

$ 20,400

$ 51,900

$ 39,100

$ 80,400

7

3

$ 20,400

$ 50,900

$ 59,700

$ 60,000

8

IRR

10.83%

17.14%

18.93%

17.91%

Excel formula for IRR of Project A is “=IRR(B4:B7)”

Excel formula for IRR of Project B is “=IRR(C4:C7)”

Excel formula for IRR of Project A is “=IRR(D4:D7)”

Excel formula for IRR of Project A is “=IRR(E4:E7)”

Highest cost of capital is 10.83 % at which all the projects would be acceptable.

| Project A | Project B | Project C | Project D | |

| NPV | $ (2,718.06) | $ 5,470.11 | $ 7,763.11 | $ 10,554.05 |

Homework Sourse

Homework Sourse