FarCry Industries a maker of telecommunications equipment ha

FarCry Industries, a maker of telecommunications equipment, has 2 million shares of common stock outstanding, 1 million shares of preferred stock outstanding, and 10,000 bonds. Suppose the common shares are selling for $26 per share, the preferred shares are selling for $14.00 per share, and the bonds are selling for 97 percent of par.

What would be the weight used for equity in the computation of FarCry’s WACC? (Round your answer to 2 decimal places.)

| FarCry Industries, a maker of telecommunications equipment, has 2 million shares of common stock outstanding, 1 million shares of preferred stock outstanding, and 10,000 bonds. Suppose the common shares are selling for $26 per share, the preferred shares are selling for $14.00 per share, and the bonds are selling for 97 percent of par. |

Solution

Weight for equity for WACC = Value of equity / Total Capital

= 52,000,000 / 75,700,000

Weight for equity for WACC = 68.69%

.

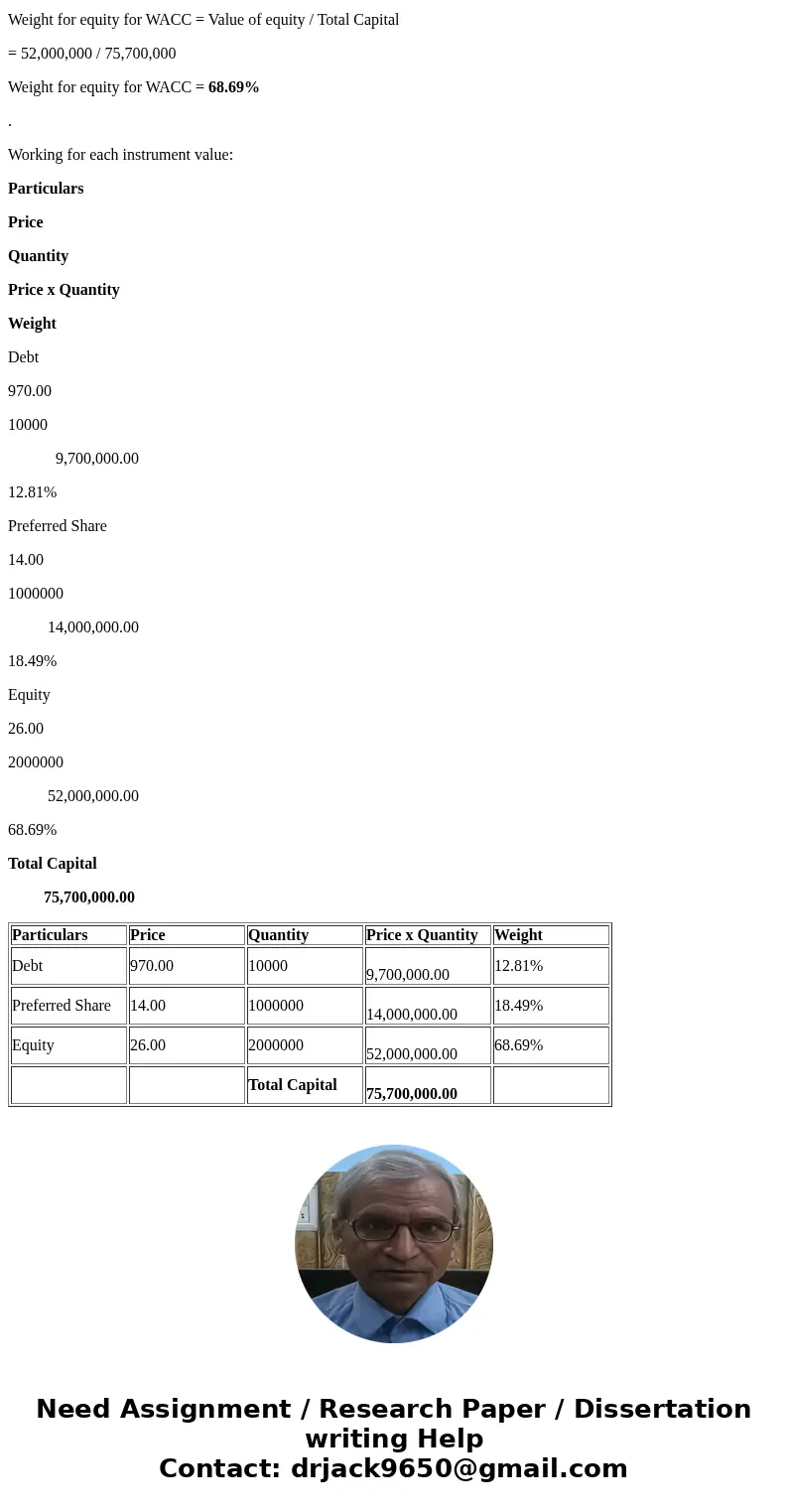

Working for each instrument value:

Particulars

Price

Quantity

Price x Quantity

Weight

Debt

970.00

10000

9,700,000.00

12.81%

Preferred Share

14.00

1000000

14,000,000.00

18.49%

Equity

26.00

2000000

52,000,000.00

68.69%

Total Capital

75,700,000.00

| Particulars | Price | Quantity | Price x Quantity | Weight |

| Debt | 970.00 | 10000 | 9,700,000.00 | 12.81% |

| Preferred Share | 14.00 | 1000000 | 14,000,000.00 | 18.49% |

| Equity | 26.00 | 2000000 | 52,000,000.00 | 68.69% |

| Total Capital | 75,700,000.00 |

Homework Sourse

Homework Sourse