A company is considering adding a new piece of equipment tha

A company is considering adding a new piece of equipment that will speed up their processes. The cost of the piece of equipment is $42000. It is expected that the new piece of equipment will lead to cash flows of $17000, $29000, and $40000 over the next 3 years. If the appropriate discount rate is 12%, what is the NPV of this investment? Please take your time and explain each calculation....thanks.

Solution

Net Present Value [NPV] = Present Value of cash Inflows – Present Value of Outflows

Year

Annual Cash Inflows

(a)

Present Value factor at 12% Formula

Present Value factor at 12%

(b)

Present Value of Annual Cash inflows

1

$17,000

1/ (1+0.12)1

0.8928571

$15,178.57

2

$29,000

1 / (1+0.12)2

0.7971939

$23,118.62

3

$40,000

1 / (1+0.12)3

0.7117802

$28,471.21

$66,768.40

Net Present Value [NPV] = Present Value of cash Inflows – Present Value of Outflows

= $66,768.40 – 42,000

= $24,768.40

“ Therefore, Net Present value [NPV] of the Investment = $24,768.40 “

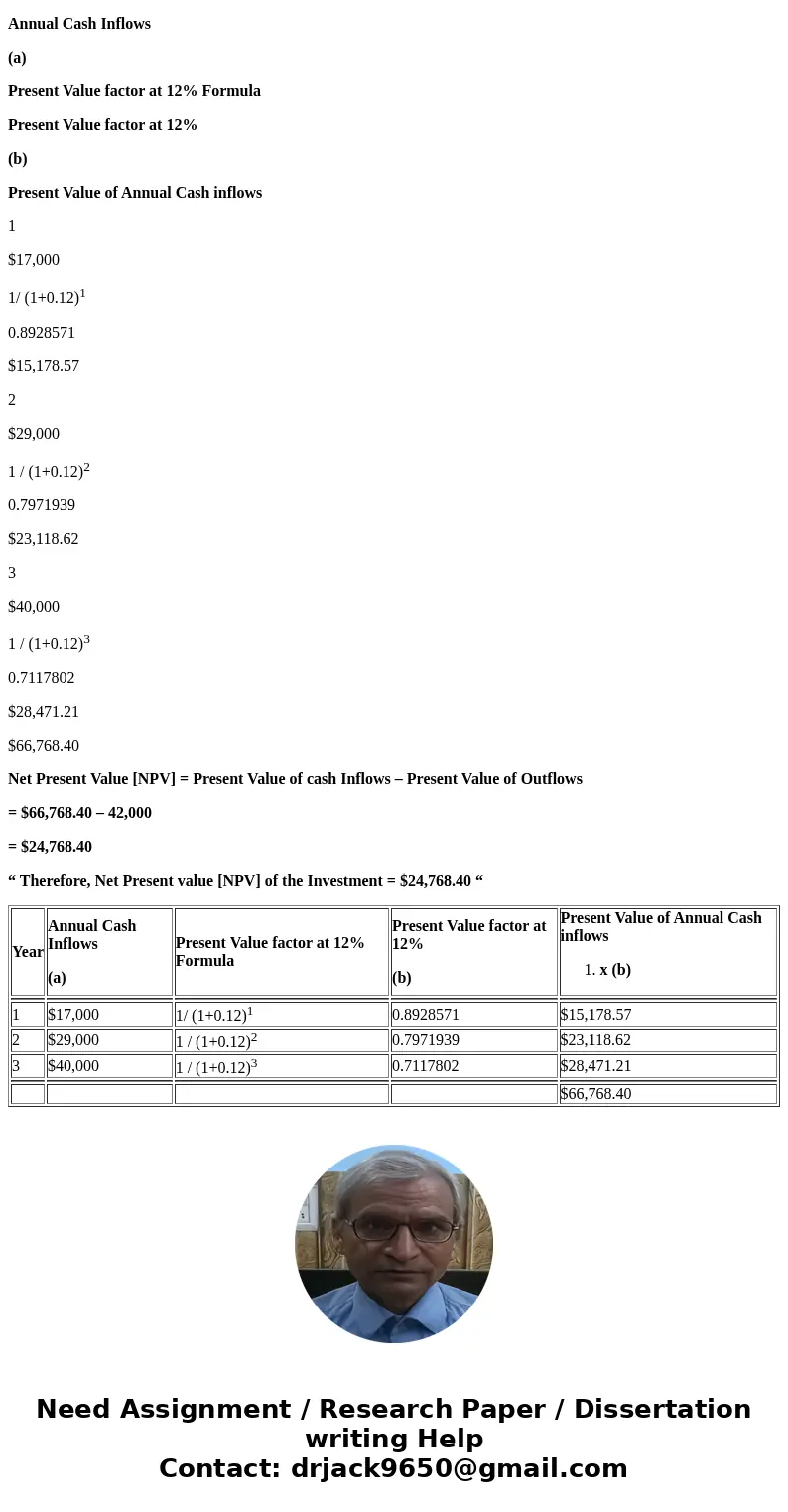

| Year | Annual Cash Inflows (a) | Present Value factor at 12% Formula | Present Value factor at 12% (b) | Present Value of Annual Cash inflows

|

| 1 | $17,000 | 1/ (1+0.12)1 | 0.8928571 | $15,178.57 |

| 2 | $29,000 | 1 / (1+0.12)2 | 0.7971939 | $23,118.62 |

| 3 | $40,000 | 1 / (1+0.12)3 | 0.7117802 | $28,471.21 |

| $66,768.40 |

Homework Sourse

Homework Sourse