xercise 175 Part Level Submission On January 1 2013 Phantom

xercise 17-5 (Part Level Submission)

On January 1, 2013, Phantom Company acquires $302,500 of Spiderman Products, Inc., 8% bonds at a price of $287,455. The interest is payable each December 31, and the bonds mature December 31, 2015. The investment will provide Phantom Company a 10.00% yield. The bonds are classified as held-to-maturity.

(a)

Schedule of Interest Revenue and Bond Discount Amortization

Straight-line Method

Bond Purchased to Yield

Date

Cash

Received

Interest

Revenue

Bond Discount

Amortization

Carrying Amount

of Bonds

SHOW LIST OF ACCOUNTS

SHOW SOLUTION

SHOW ANSWER

LINK TO TEXT

(b)

Schedule of Interest Revenue and Bond Discount Amortization

Effective-Interest Method

Bond Purchased to Yield

Date

Cash

Received

Interest

Revenue

Bond Discount

Amortization

Carrying Amount

of Bonds

SHOW LIST OF ACCOUNTS

|

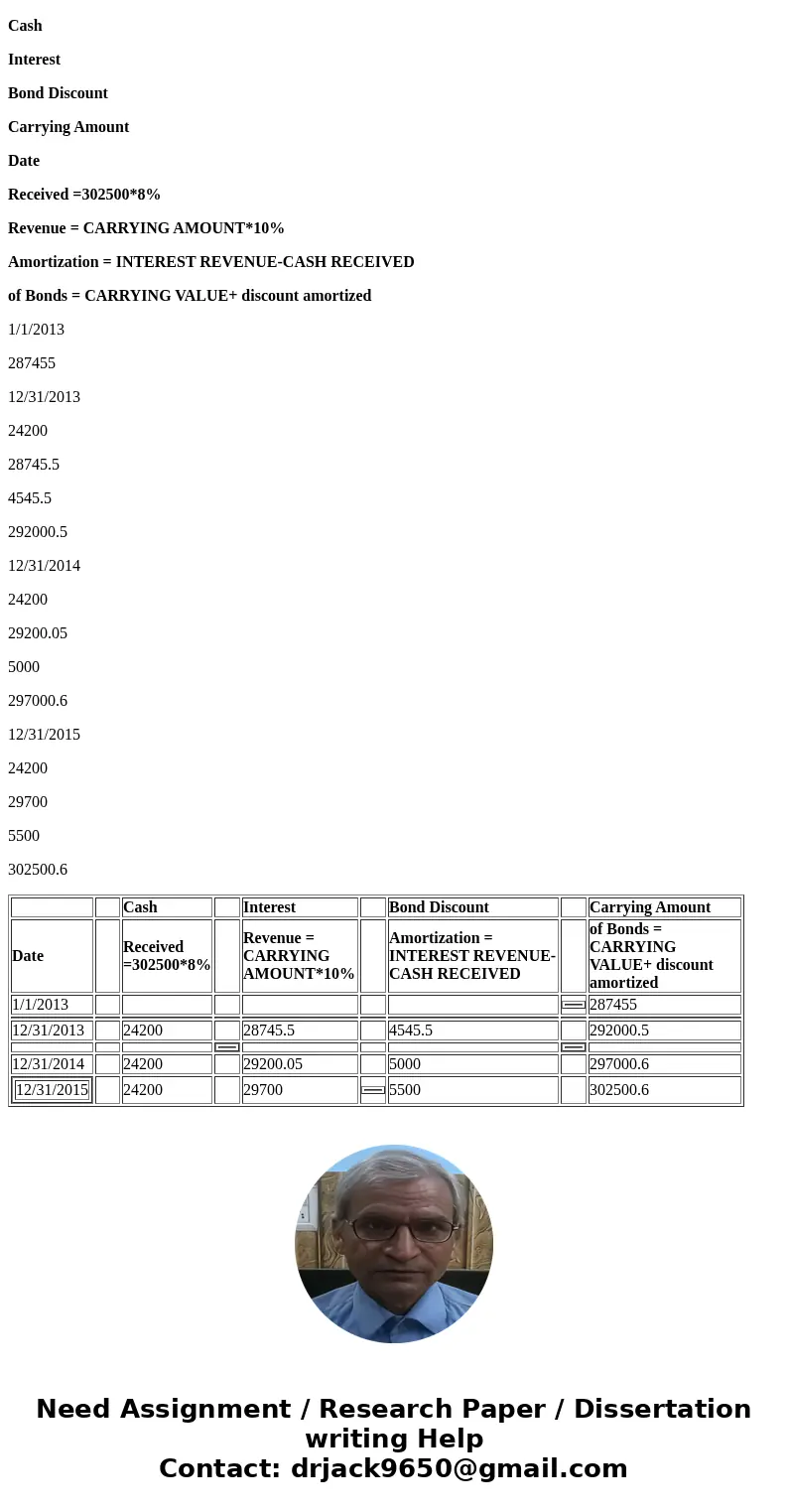

Solution

Cash

Interest

Bond Discount

Carrying Amount

Date

Received =302500*8%

Revenue = CARRYING AMOUNT*10%

Amortization = INTEREST REVENUE-CASH RECEIVED

of Bonds = CARRYING VALUE+ discount amortized

1/1/2013

287455

12/31/2013

24200

28745.5

4545.5

292000.5

12/31/2014

24200

29200.05

5000

297000.6

12/31/2015

24200

29700

5500

302500.6

| Cash | Interest | Bond Discount | Carrying Amount | |||||||

| Date | Received =302500*8% | Revenue = CARRYING AMOUNT*10% | Amortization = INTEREST REVENUE-CASH RECEIVED | of Bonds = CARRYING VALUE+ discount amortized | ||||||

| 1/1/2013 | | 287455 | ||||||||

| 12/31/2013 | 24200 | 28745.5 | 4545.5 | 292000.5 | ||||||

| | | |||||||||

| 12/31/2014 | 24200 | 29200.05 | 5000 | 297000.6 | ||||||

| 24200 | 29700 | | 5500 | 302500.6 |

Homework Sourse

Homework Sourse