Suppose that a share of preferred stock pays annual dividend

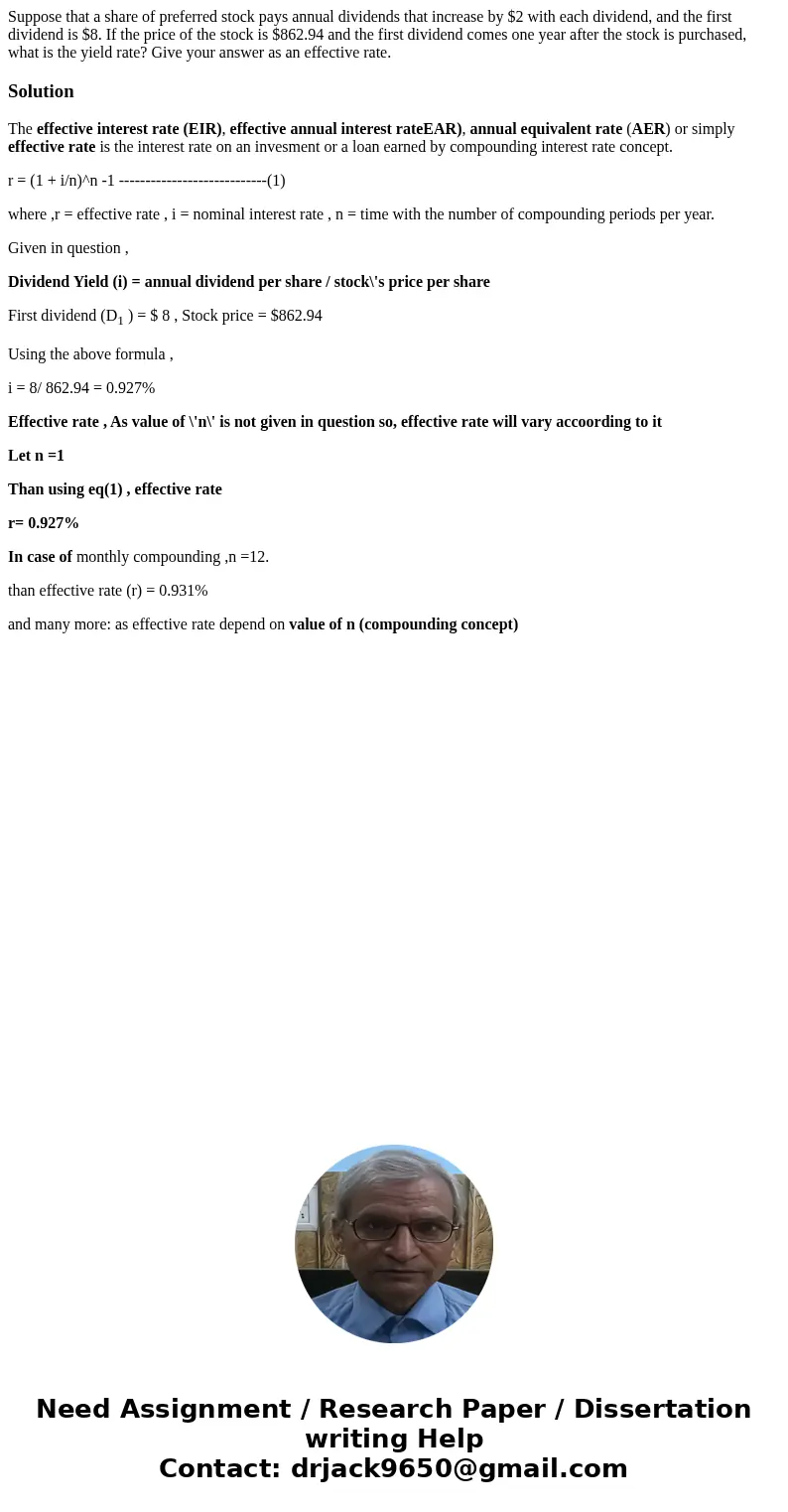

Suppose that a share of preferred stock pays annual dividends that increase by $2 with each dividend, and the first dividend is $8. If the price of the stock is $862.94 and the first dividend comes one year after the stock is purchased, what is the yield rate? Give your answer as an effective rate.

Solution

The effective interest rate (EIR), effective annual interest rateEAR), annual equivalent rate (AER) or simply effective rate is the interest rate on an invesment or a loan earned by compounding interest rate concept.

r = (1 + i/n)^n -1 ----------------------------(1)

where ,r = effective rate , i = nominal interest rate , n = time with the number of compounding periods per year.

Given in question ,

Dividend Yield (i) = annual dividend per share / stock\'s price per share

First dividend (D1 ) = $ 8 , Stock price = $862.94

Using the above formula ,

i = 8/ 862.94 = 0.927%

Effective rate , As value of \'n\' is not given in question so, effective rate will vary accoording to it

Let n =1

Than using eq(1) , effective rate

r= 0.927%

In case of monthly compounding ,n =12.

than effective rate (r) = 0.931%

and many more: as effective rate depend on value of n (compounding concept)

Homework Sourse

Homework Sourse