ABC Corporation is expected to pay a dividend next year D1

Solution

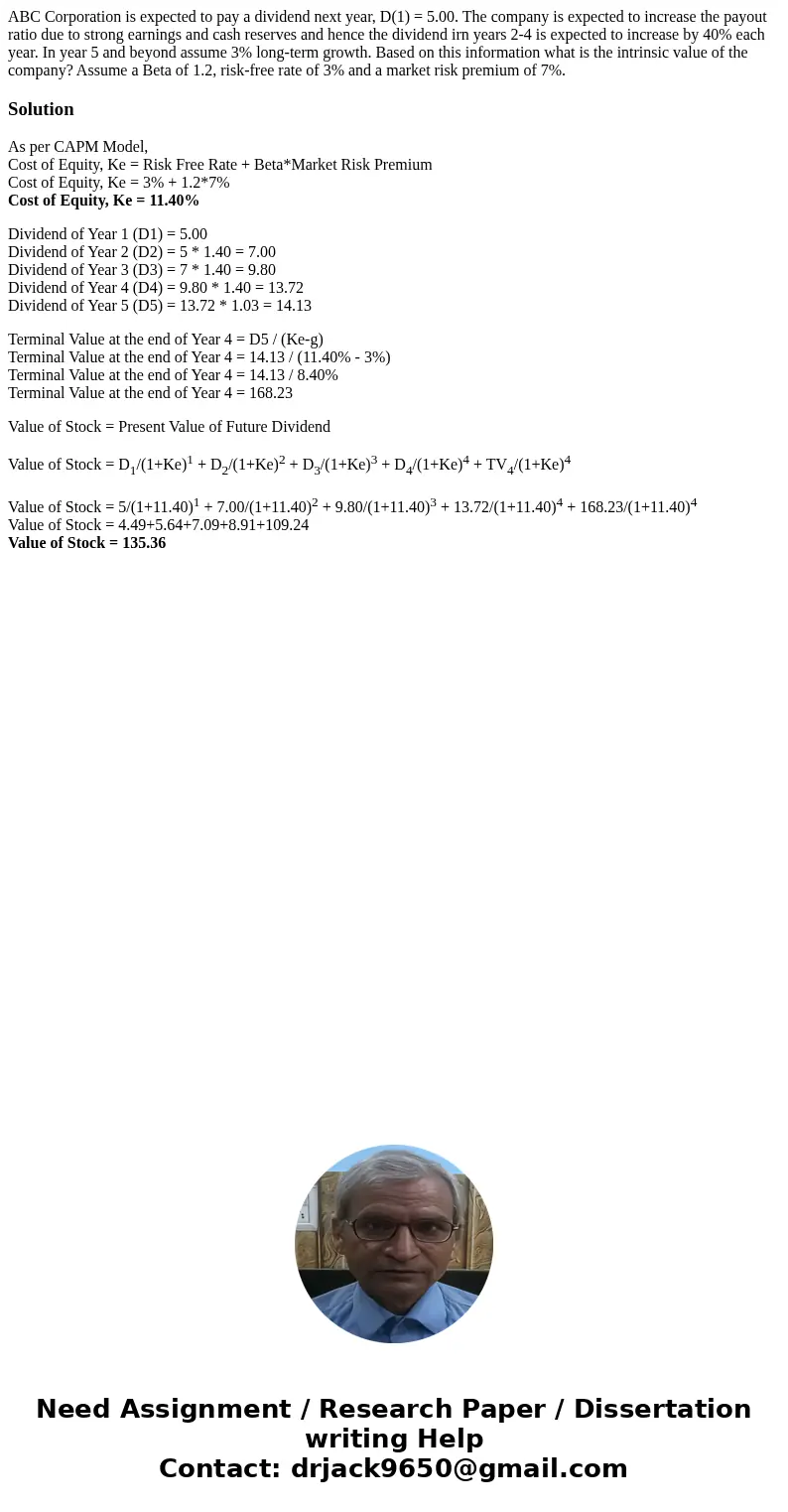

As per CAPM Model,

Cost of Equity, Ke = Risk Free Rate + Beta*Market Risk Premium

Cost of Equity, Ke = 3% + 1.2*7%

Cost of Equity, Ke = 11.40%

Dividend of Year 1 (D1) = 5.00

Dividend of Year 2 (D2) = 5 * 1.40 = 7.00

Dividend of Year 3 (D3) = 7 * 1.40 = 9.80

Dividend of Year 4 (D4) = 9.80 * 1.40 = 13.72

Dividend of Year 5 (D5) = 13.72 * 1.03 = 14.13

Terminal Value at the end of Year 4 = D5 / (Ke-g)

Terminal Value at the end of Year 4 = 14.13 / (11.40% - 3%)

Terminal Value at the end of Year 4 = 14.13 / 8.40%

Terminal Value at the end of Year 4 = 168.23

Value of Stock = Present Value of Future Dividend

Value of Stock = D1/(1+Ke)1 + D2/(1+Ke)2 + D3/(1+Ke)3 + D4/(1+Ke)4 + TV4/(1+Ke)4

Value of Stock = 5/(1+11.40)1 + 7.00/(1+11.40)2 + 9.80/(1+11.40)3 + 13.72/(1+11.40)4 + 168.23/(1+11.40)4

Value of Stock = 4.49+5.64+7.09+8.91+109.24

Value of Stock = 135.36

Homework Sourse

Homework Sourse