13 Constantgrowth dividend discount model Using the followin

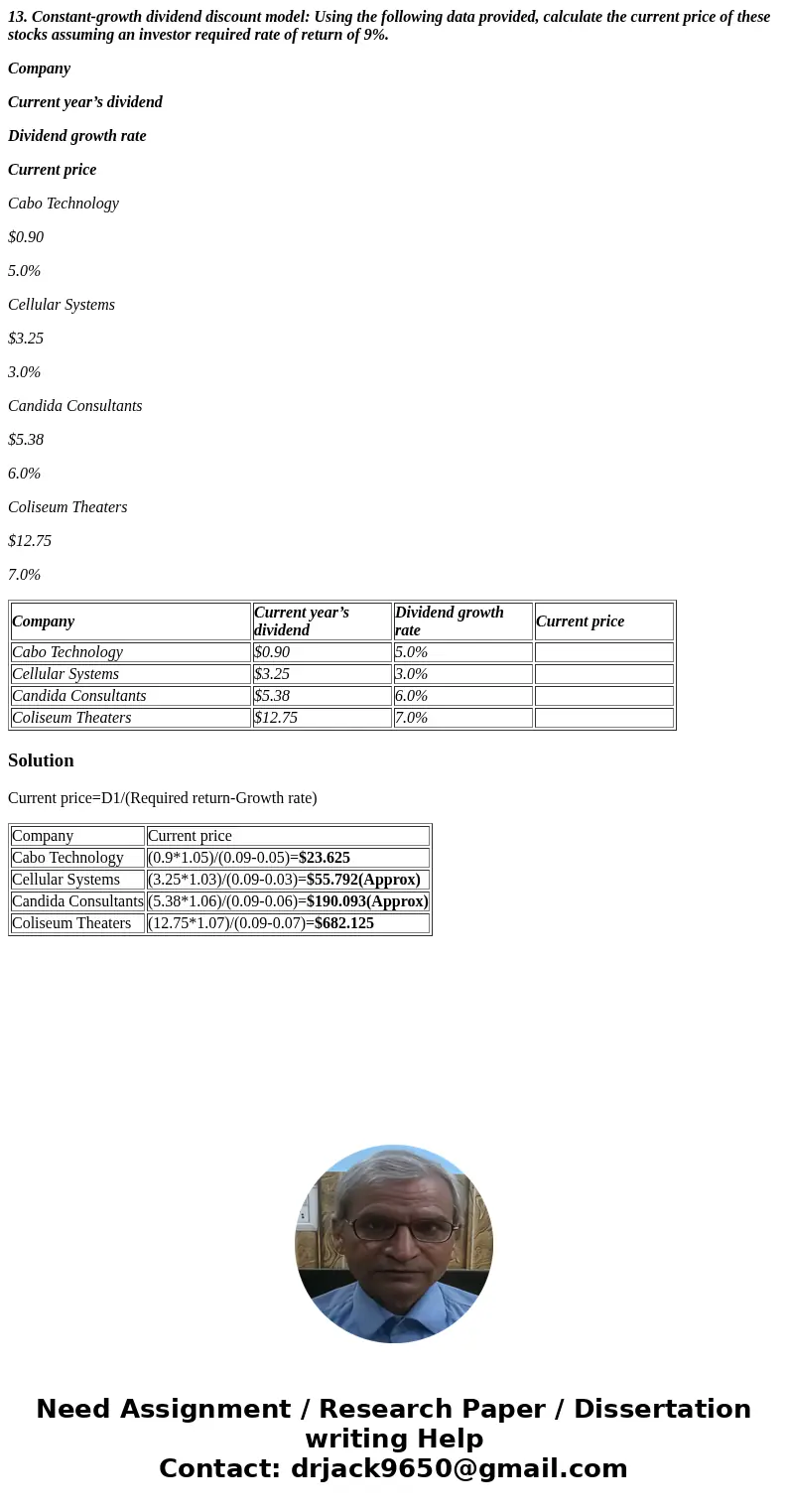

13. Constant-growth dividend discount model: Using the following data provided, calculate the current price of these stocks assuming an investor required rate of return of 9%.

Company

Current year’s dividend

Dividend growth rate

Current price

Cabo Technology

$0.90

5.0%

Cellular Systems

$3.25

3.0%

Candida Consultants

$5.38

6.0%

Coliseum Theaters

$12.75

7.0%

| Company | Current year’s dividend | Dividend growth rate | Current price |

| Cabo Technology | $0.90 | 5.0% | |

| Cellular Systems | $3.25 | 3.0% | |

| Candida Consultants | $5.38 | 6.0% | |

| Coliseum Theaters | $12.75 | 7.0% |

Solution

Current price=D1/(Required return-Growth rate)

| Company | Current price |

| Cabo Technology | (0.9*1.05)/(0.09-0.05)=$23.625 |

| Cellular Systems | (3.25*1.03)/(0.09-0.03)=$55.792(Approx) |

| Candida Consultants | (5.38*1.06)/(0.09-0.06)=$190.093(Approx) |

| Coliseum Theaters | (12.75*1.07)/(0.09-0.07)=$682.125 |

Homework Sourse

Homework Sourse