ook Show Me How Calculator Entries for stock dividends Chart

Solution

Answer:

1

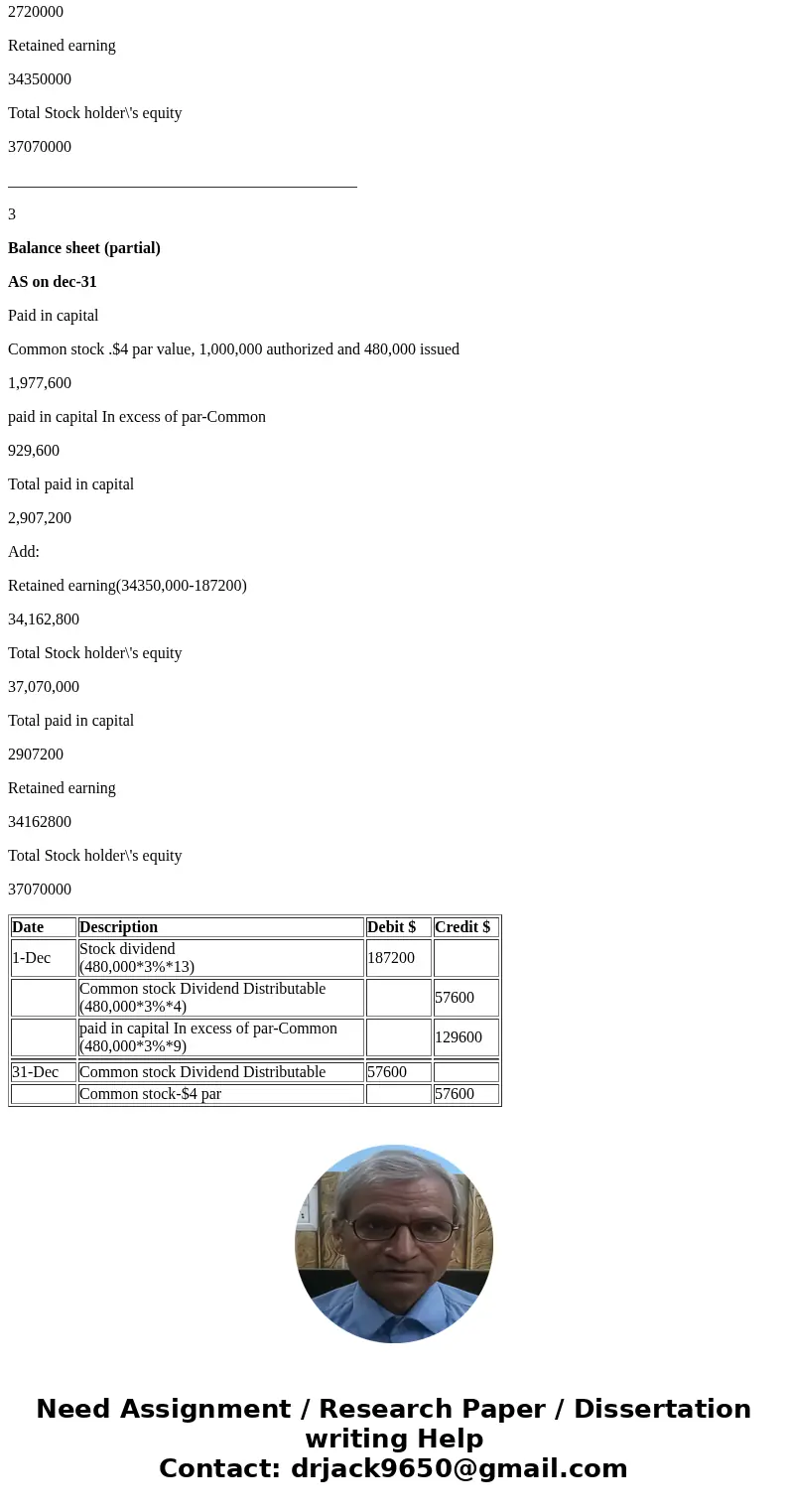

Journal Entry for the issue and payment of the dividend

Date

Description

Debit $

Credit $

1-Dec

Stock dividend

(480,000*3%*13)

187200

Common stock Dividend Distributable

(480,000*3%*4)

57600

paid in capital In excess of par-Common

(480,000*3%*9)

129600

31-Dec

Common stock Dividend Distributable

57600

Common stock-$4 par

57600

______________________________________

2

Balancesheet (partial)

AS on dec-1

Paid in capital

Common stock .$4 par value, 1,000,000 authorized and 480,000 issued

1,920,000

paid in capital In excess of par-Common

800,000

Total paid in capital

2,720,000

Add:

Retained earning

34,350,000

Total Stock holder\'s equity

37,070,000

Total paid in capital

2720000

Retained earning

34350000

Total Stock holder\'s equity

37070000

____________________________________________

3

Balance sheet (partial)

AS on dec-31

Paid in capital

Common stock .$4 par value, 1,000,000 authorized and 480,000 issued

1,977,600

paid in capital In excess of par-Common

929,600

Total paid in capital

2,907,200

Add:

Retained earning(34350,000-187200)

34,162,800

Total Stock holder\'s equity

37,070,000

Total paid in capital

2907200

Retained earning

34162800

Total Stock holder\'s equity

37070000

| Date | Description | Debit $ | Credit $ |

| 1-Dec | Stock dividend | 187200 | |

| Common stock Dividend Distributable | 57600 | ||

| paid in capital In excess of par-Common | 129600 | ||

| 31-Dec | Common stock Dividend Distributable | 57600 | |

| Common stock-$4 par | 57600 |

Homework Sourse

Homework Sourse