9400 84 percent coupon bonds outstanding 1000 par value 21 y

9,400 8.4 percent coupon bonds outstanding, $1,000 par value, 21 years to maturity, selling for 100.5 percent of par; the bonds make semiannual payments.

12,900 shares of 5.95 percent preferred stock outstanding, currently selling for $97.10 per share.

What is the company\'s cost of each form of financing? (Do not round intermediate calculations. Enter your answers as a percentage rounded to 2 decimal places (e.g., 32.16).)

Calculate the company\'s WACC. (Do not round intermediate calculations. Enter your answer as a percentage rounded to 2 decimal places (e.g., 32.16).)

| Information on Janicek Power Co., is shown below. Assume the company’s tax rate is 40 percent. |

Solution

Cost of debt:

Using financial calculator BA II Plus - Input details:

#

FV = Future Value =

$1,000.00

PV = Present Value =

-$1,005.00

N = Total number of periods = Years x frequency of coupon =

42

PMT = Payment = Coupon / frequency of coupon =

$47.00

CPT > I/Y = Rate or YTM =

4.6726

Convert Yield in annual and percentage form = Yield / 100*2 =

9.35%

After-tax cost of debt = YTM x (1-Tax) = Yield x (1-40%) =

5.61%

.

Cost of equity as per CAPM:

Cost of equity = Risk free rate + Beta x Market risk premium

Cost of equity = 5% + 1.24 x 7.2%

Cost of equity = 13.93%

.

Cost of preferred share = Face value x Dividend in % / Selling price of preferred

Cost of preferred share = 100 x 5.95% / 97.1

Cost of preferred share = 6.13%

------------

Each cost of financing:

Particulars

Cost

Cost of equity

13.93%

After tax cost of debt

5.61%

Cost of preferred

6.13%

WACC = Cost of equity x Weight of equity + Cost of preferred x Weight of preferred x After tax cost of debt x Weight of debt

WACC = 13.93% x 63.20% + 6.13%*4.31% + 5.61%*32.49%

WACC = 10.89%

The following table does the detail working:

Particulars

Price

Quantity

Total value

Weights

Cost

Weight x Cost

Equity

83.9

219000

18,374,100.00

63.20%

13.93%

8.802%

Debt

1005

9400

9,447,000.00

32.49%

5.61%

1.822%

Preferred

97.1

12900

1,252,590.00

4.31%

6.13%

0.264%

29,073,690.00

10.89%

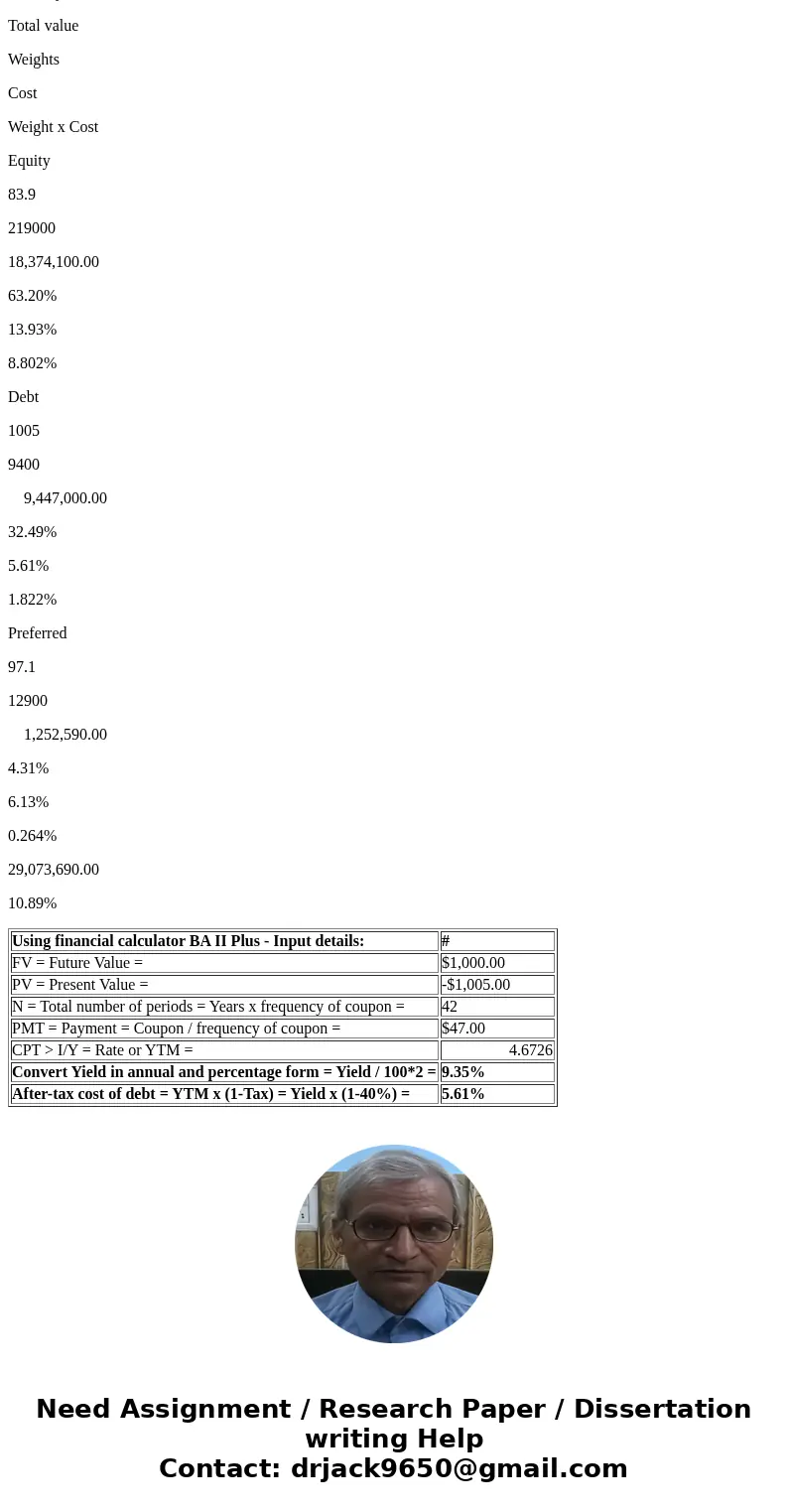

| Using financial calculator BA II Plus - Input details: | # |

| FV = Future Value = | $1,000.00 |

| PV = Present Value = | -$1,005.00 |

| N = Total number of periods = Years x frequency of coupon = | 42 |

| PMT = Payment = Coupon / frequency of coupon = | $47.00 |

| CPT > I/Y = Rate or YTM = | 4.6726 |

| Convert Yield in annual and percentage form = Yield / 100*2 = | 9.35% |

| After-tax cost of debt = YTM x (1-Tax) = Yield x (1-40%) = | 5.61% |

Homework Sourse

Homework Sourse