er 5HW 6 Check my Minden Company introduced a new product la

Solution

Answer

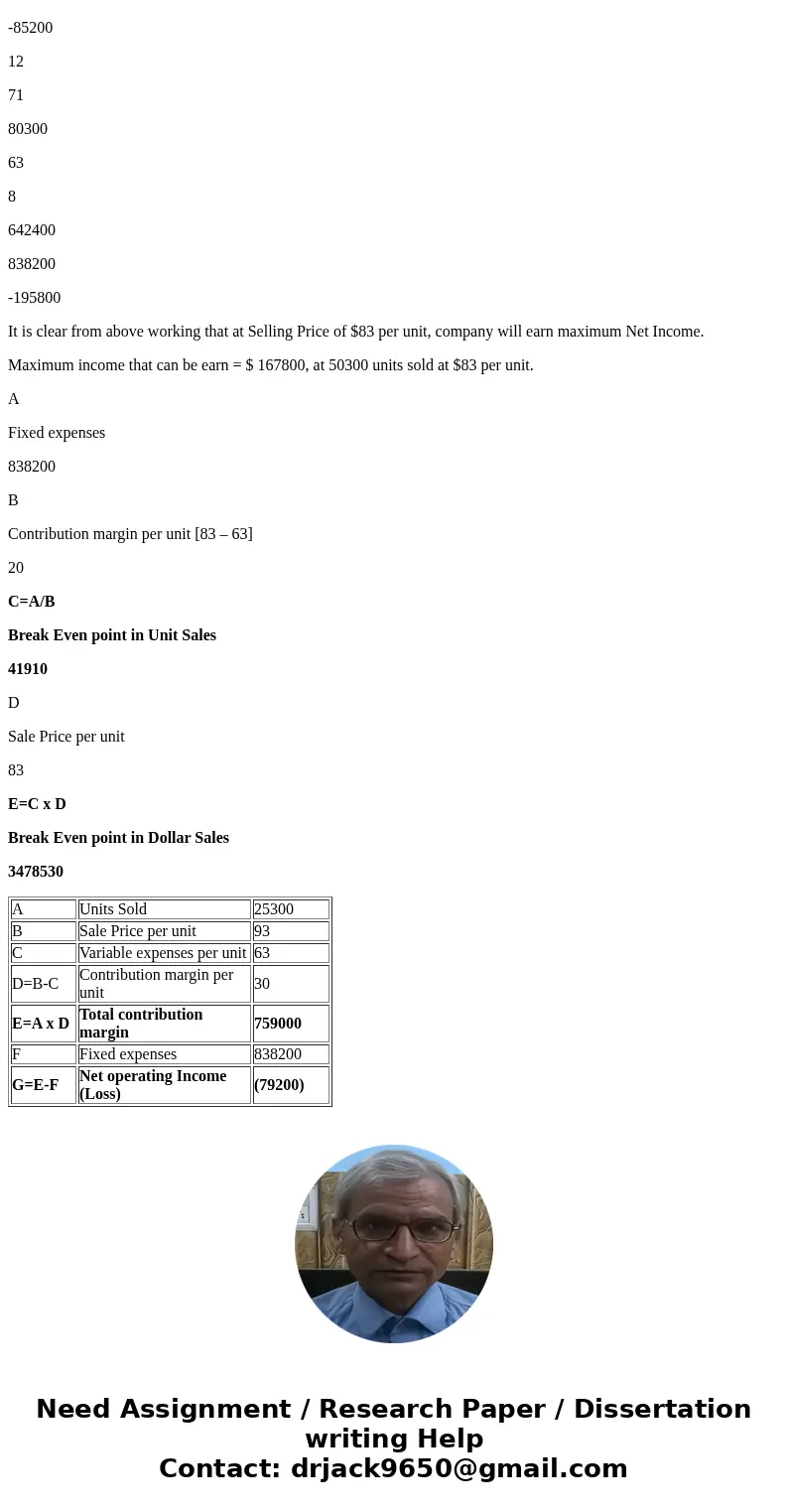

A

Units Sold

25300

B

Sale Price per unit

93

C

Variable expenses per unit

63

D=B-C

Contribution margin per unit

30

E=A x D

Total contribution margin

759000

F

Fixed expenses

838200

G=E-F

Net operating Income (Loss)

(79200)

A

Fixed expenses

838200

B

Contribution margin per unit

30

C=A/B

Break Even point in Unit Sales

27940

D

Sale Price per unit

93

E=C x D

Break Even point in Dollar Sales

$ 2598420

Sno.

Sale Price per unit (A)

Units Sold (B)

Variable Cost per unit (C )

Contribution per unit (D=A-C)

Total contribution (E=B x D)

Fixed Expenses (F)

Net Operating Income/(loss) [G=E-F]

1

93

25300

63

30

759000

838200

-79200

2

91

30300

63

28

848400

838200

10200

3

89

35300

63

26

917800

838200

79600

4

87

40300

63

24

967200

838200

129000

5

85

45300

63

22

996600

838200

158400

6

83

50300

63

20

1006000

838200

167800

7

81

55300

63

18

995400

838200

157200

8

79

60300

63

16

964800

838200

126600

9

77

65300

63

14

914200

838200

76000

10

75

70300

63

12

843600

838200

5400

11

73

75300

63

10

753000

838200

-85200

12

71

80300

63

8

642400

838200

-195800

It is clear from above working that at Selling Price of $83 per unit, company will earn maximum Net Income.

Maximum income that can be earn = $ 167800, at 50300 units sold at $83 per unit.

A

Fixed expenses

838200

B

Contribution margin per unit [83 – 63]

20

C=A/B

Break Even point in Unit Sales

41910

D

Sale Price per unit

83

E=C x D

Break Even point in Dollar Sales

3478530

| A | Units Sold | 25300 |

| B | Sale Price per unit | 93 |

| C | Variable expenses per unit | 63 |

| D=B-C | Contribution margin per unit | 30 |

| E=A x D | Total contribution margin | 759000 |

| F | Fixed expenses | 838200 |

| G=E-F | Net operating Income (Loss) | (79200) |

Homework Sourse

Homework Sourse