20 Calculating NPV PI and IRR Fjisawa Inc is considering a m

20. (Calculating NPV, PI, and IRR) Fjisawa, Inc. is considering a major expansion of its product line and has estimated the following cash flows associated with such an expansion. The initial outlay would be $10.800.000, and the project would generate cash flows of $1,250,000 per year for 20 years. The appropriate discount rate is 9.0 percent. a. Calculate the NPV. b. Calculate the PI. c. Calculate the IRR.. d. Should this project be accepted? Why or whyaot? a. The NPV of the expansion is (Round to the nearest dollac) Should the project be accepted based on the require rate of return? Is this project acceptable to take on based on looking at all the values NPV, PI and IRR?

Solution

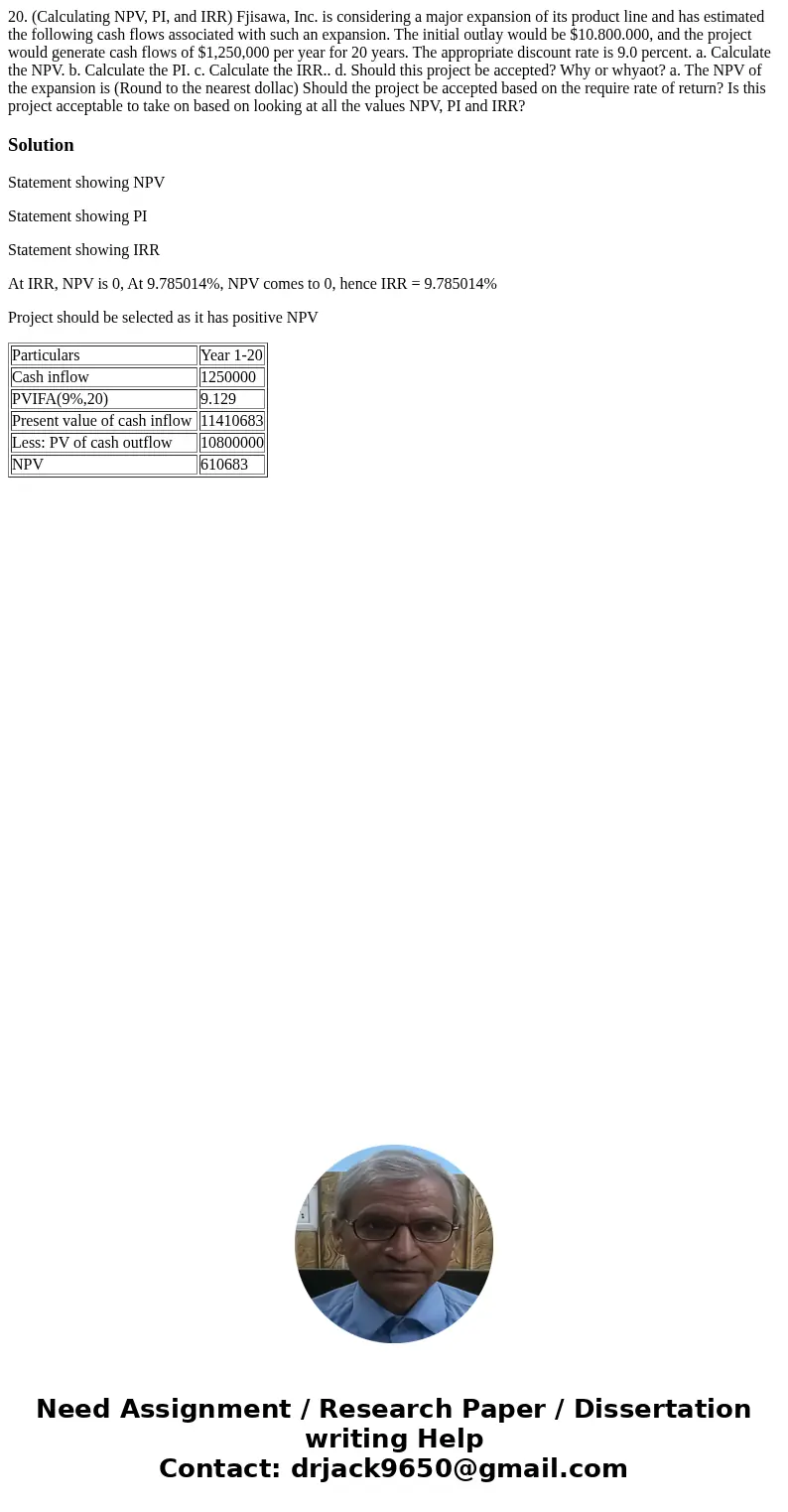

Statement showing NPV

Statement showing PI

Statement showing IRR

At IRR, NPV is 0, At 9.785014%, NPV comes to 0, hence IRR = 9.785014%

Project should be selected as it has positive NPV

| Particulars | Year 1-20 |

| Cash inflow | 1250000 |

| PVIFA(9%,20) | 9.129 |

| Present value of cash inflow | 11410683 |

| Less: PV of cash outflow | 10800000 |

| NPV | 610683 |

Homework Sourse

Homework Sourse