ent18SpACCT Correct Help Save Exit S omework Set Check my w

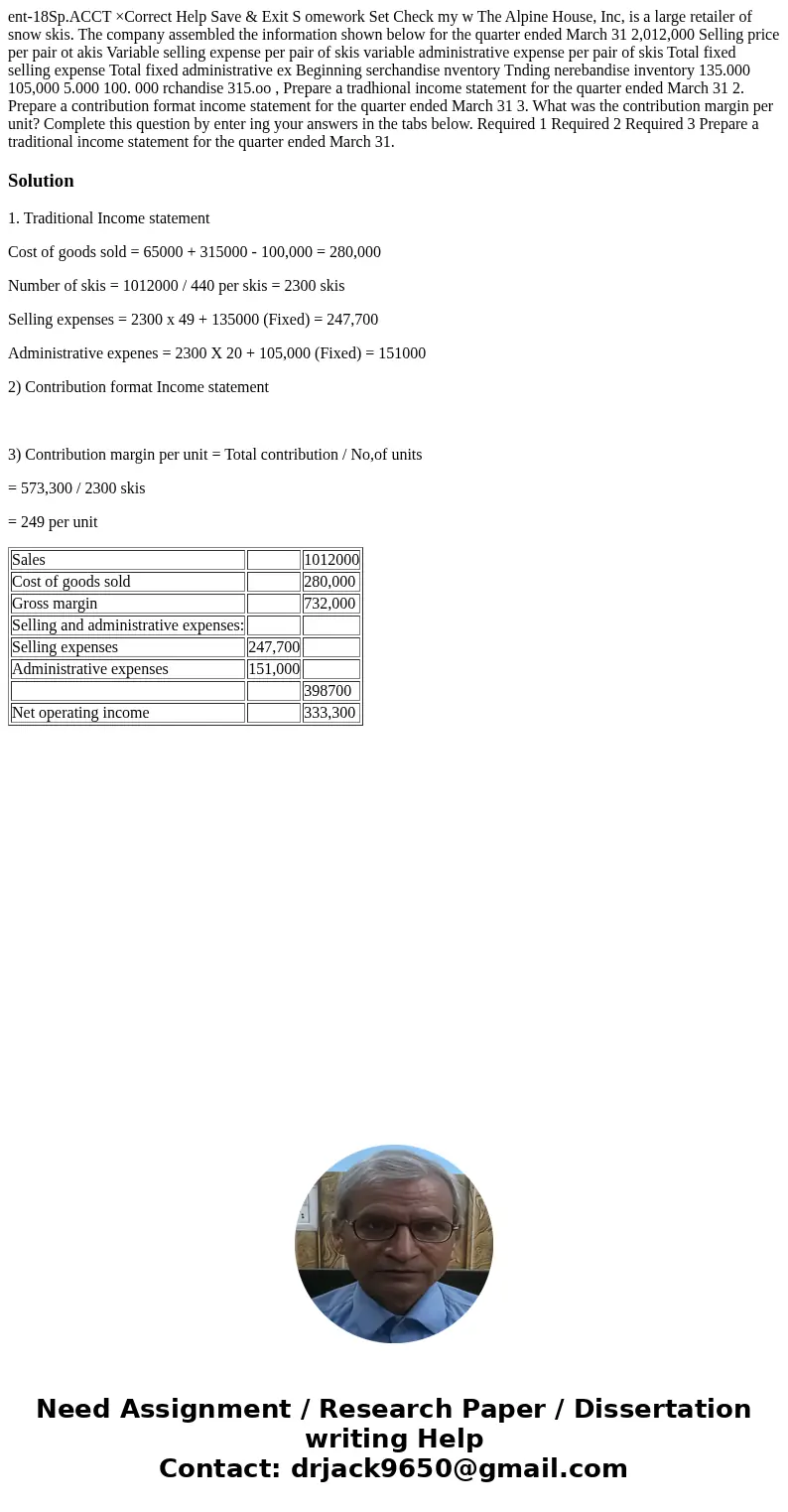

ent-18Sp.ACCT ×Correct Help Save & Exit S omework Set Check my w The Alpine House, Inc, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31 2,012,000 Selling price per pair ot akis Variable selling expense per pair of skis variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative ex Beginning serchandise nventory Tnding nerebandise inventory 135.000 105,000 5.000 100. 000 rchandise 315.oo , Prepare a tradhional income statement for the quarter ended March 31 2. Prepare a contribution format income statement for the quarter ended March 31 3. What was the contribution margin per unit? Complete this question by enter ing your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a traditional income statement for the quarter ended March 31.

Solution

1. Traditional Income statement

Cost of goods sold = 65000 + 315000 - 100,000 = 280,000

Number of skis = 1012000 / 440 per skis = 2300 skis

Selling expenses = 2300 x 49 + 135000 (Fixed) = 247,700

Administrative expenes = 2300 X 20 + 105,000 (Fixed) = 151000

2) Contribution format Income statement

3) Contribution margin per unit = Total contribution / No,of units

= 573,300 / 2300 skis

= 249 per unit

| Sales | 1012000 | |

| Cost of goods sold | 280,000 | |

| Gross margin | 732,000 | |

| Selling and administrative expenses: | ||

| Selling expenses | 247,700 | |

| Administrative expenses | 151,000 | |

| 398700 | ||

| Net operating income | 333,300 |

Homework Sourse

Homework Sourse