EXERCISE 213 Traditional and Contribution Format Income Stat

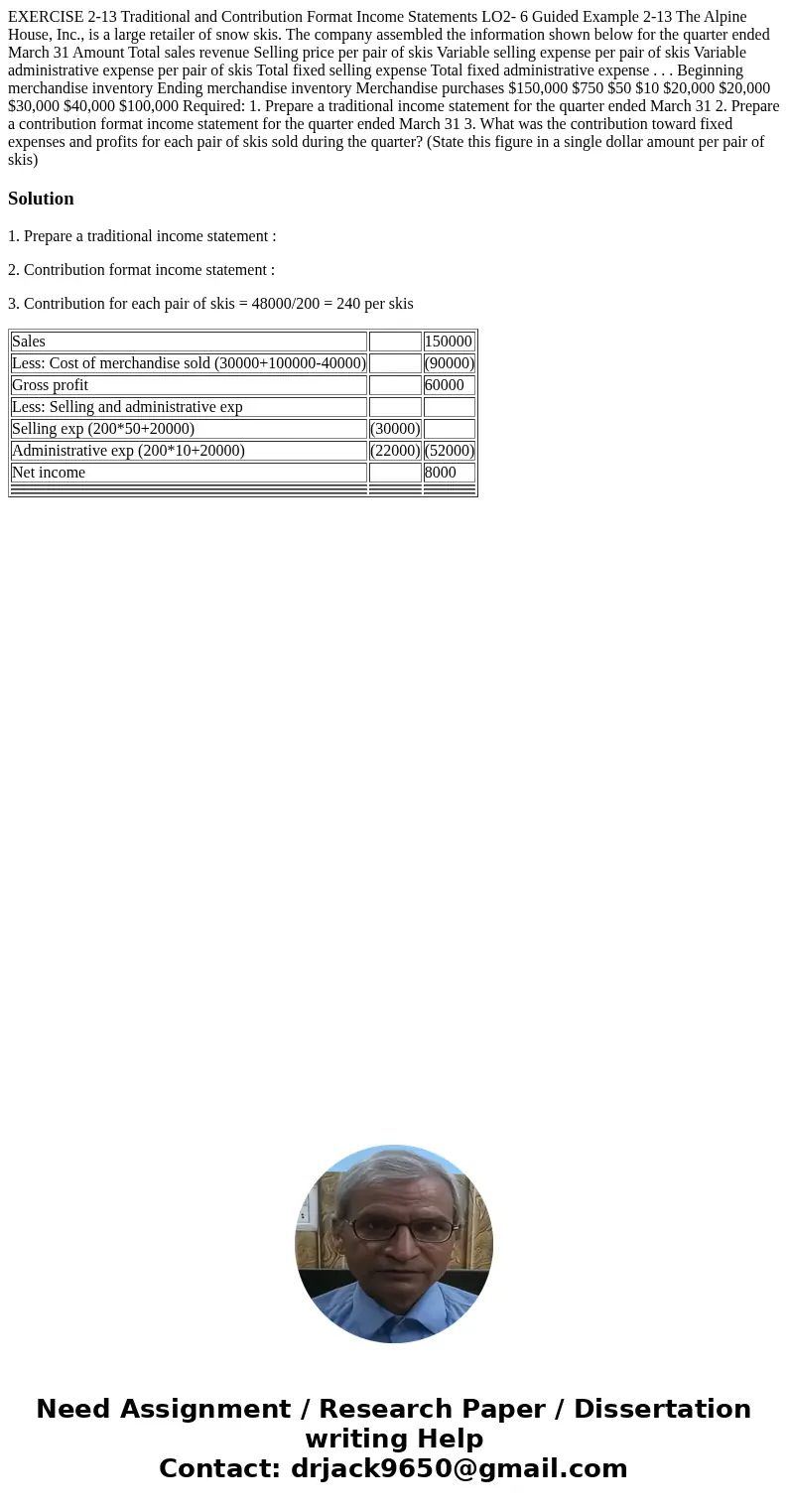

EXERCISE 2-13 Traditional and Contribution Format Income Statements LO2- 6 Guided Example 2-13 The Alpine House, Inc., is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31 Amount Total sales revenue Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense . . . Beginning merchandise inventory Ending merchandise inventory Merchandise purchases $150,000 $750 $50 $10 $20,000 $20,000 $30,000 $40,000 $100,000 Required: 1. Prepare a traditional income statement for the quarter ended March 31 2. Prepare a contribution format income statement for the quarter ended March 31 3. What was the contribution toward fixed expenses and profits for each pair of skis sold during the quarter? (State this figure in a single dollar amount per pair of skis)

Solution

1. Prepare a traditional income statement :

2. Contribution format income statement :

3. Contribution for each pair of skis = 48000/200 = 240 per skis

| Sales | 150000 | |

| Less: Cost of merchandise sold (30000+100000-40000) | (90000) | |

| Gross profit | 60000 | |

| Less: Selling and administrative exp | ||

| Selling exp (200*50+20000) | (30000) | |

| Administrative exp (200*10+20000) | (22000) | (52000) |

| Net income | 8000 | |

Homework Sourse

Homework Sourse