Exercise 1413 Waterway Inc had outstanding 5460000 of 11 bon

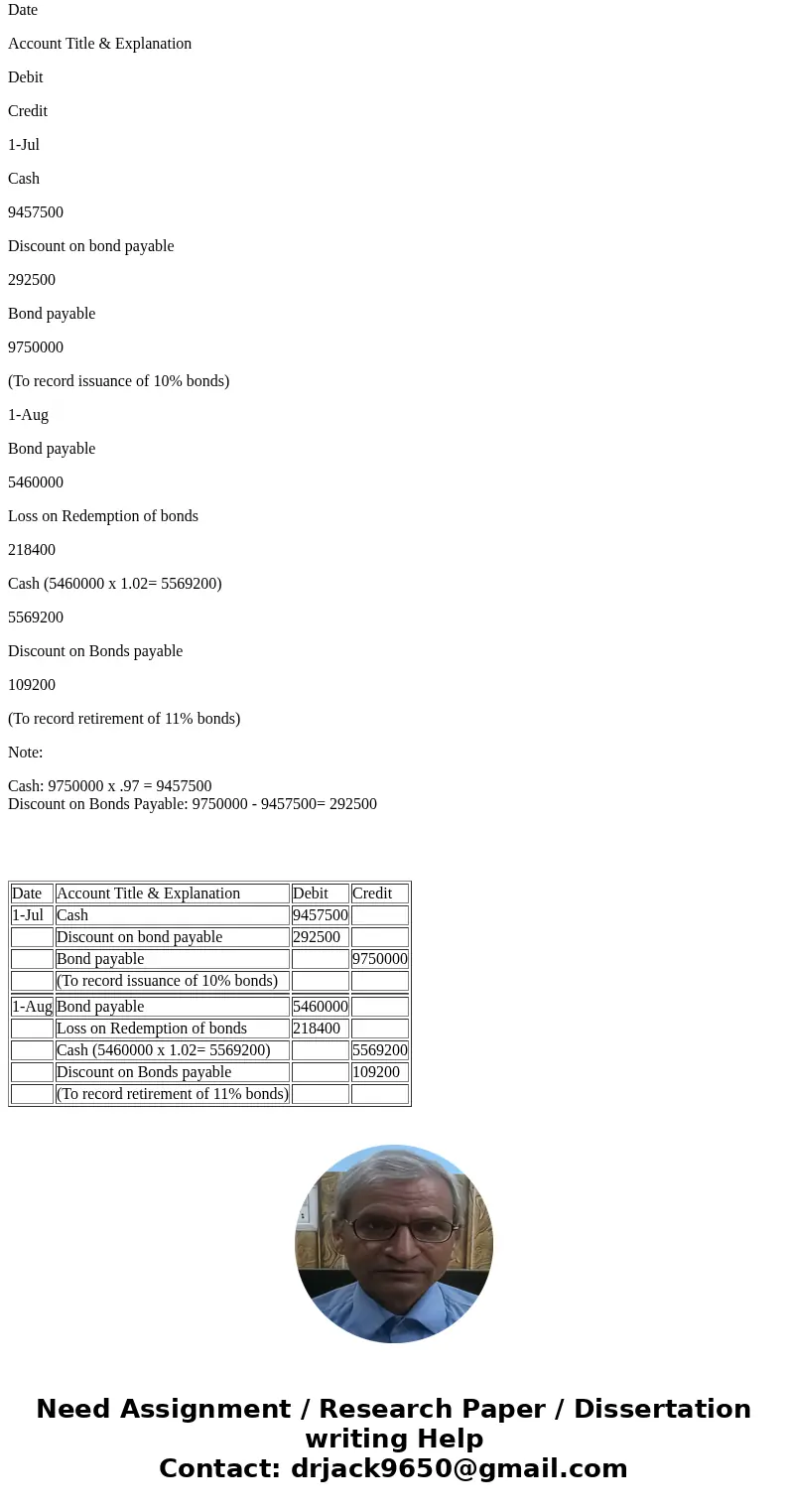

Exercise 14-13 Waterway, Inc. had outstanding $5,460,000 of 11% bonds (interest payable July 31 and January 31) due in 10 years. On July 1, it issued $9,750,000 of 10%, 15-year bonds (interest payable July 1 and January 1) at 97. A portion of the proceeds was used to call the 11% bonds (with unamortized discount of $109,200) at 102 on August 1. Prepare the journal entries necessary to record issue of the new bonds and the refunding of the bonds. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 1 (To record issuance of 10% bonds) August 1 (To record retirement of 11% bonds)

Solution

Date

Account Title & Explanation

Debit

Credit

1-Jul

Cash

9457500

Discount on bond payable

292500

Bond payable

9750000

(To record issuance of 10% bonds)

1-Aug

Bond payable

5460000

Loss on Redemption of bonds

218400

Cash (5460000 x 1.02= 5569200)

5569200

Discount on Bonds payable

109200

(To record retirement of 11% bonds)

Note:

Cash: 9750000 x .97 = 9457500

Discount on Bonds Payable: 9750000 - 9457500= 292500

| Date | Account Title & Explanation | Debit | Credit |

| 1-Jul | Cash | 9457500 | |

| Discount on bond payable | 292500 | ||

| Bond payable | 9750000 | ||

| (To record issuance of 10% bonds) | |||

| 1-Aug | Bond payable | 5460000 | |

| Loss on Redemption of bonds | 218400 | ||

| Cash (5460000 x 1.02= 5569200) | 5569200 | ||

| Discount on Bonds payable | 109200 | ||

| (To record retirement of 11% bonds) |

Homework Sourse

Homework Sourse