Consider the following investment project Suppose the compan

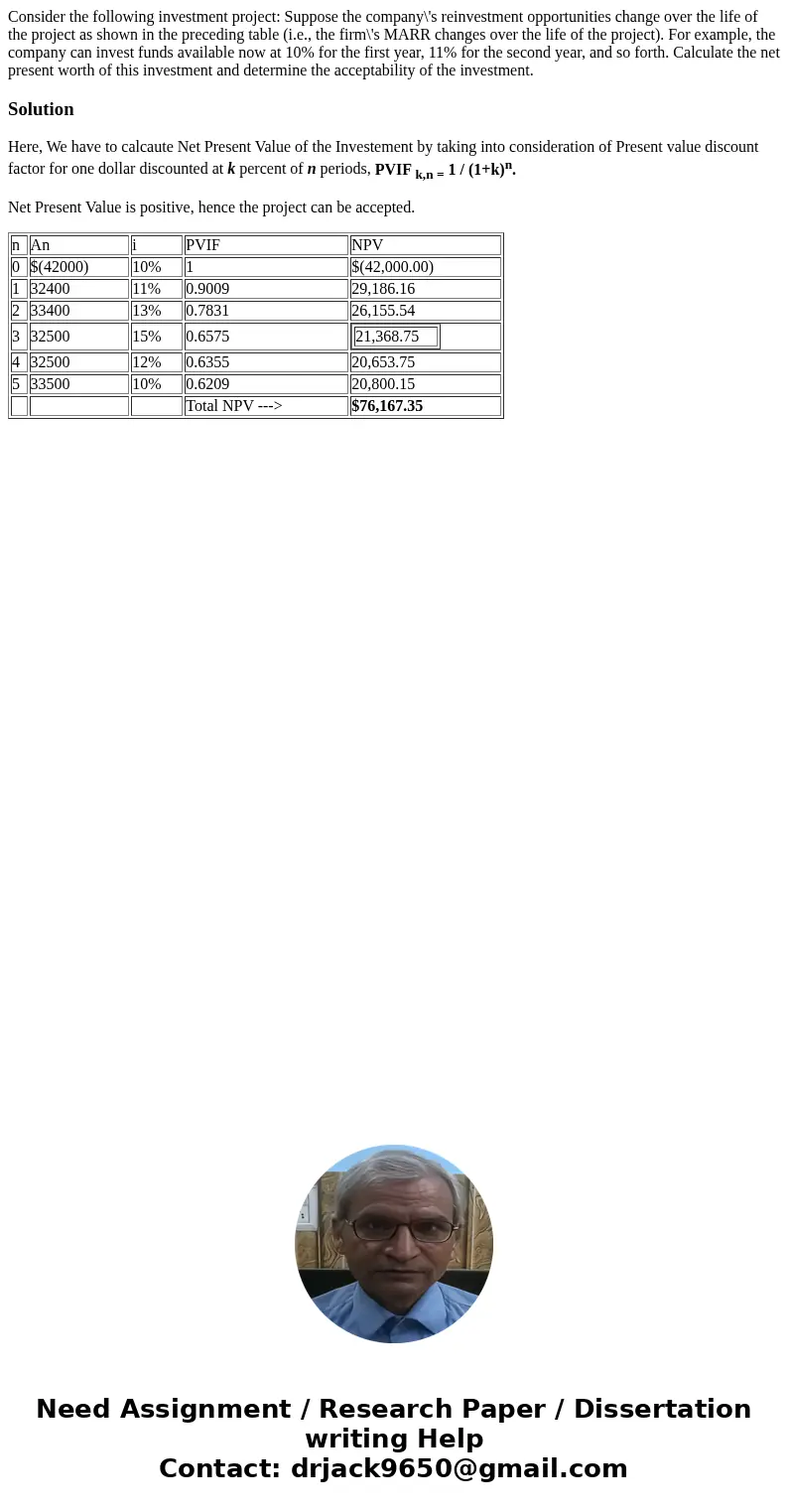

Consider the following investment project: Suppose the company\'s reinvestment opportunities change over the life of the project as shown in the preceding table (i.e., the firm\'s MARR changes over the life of the project). For example, the company can invest funds available now at 10% for the first year, 11% for the second year, and so forth. Calculate the net present worth of this investment and determine the acceptability of the investment.

Solution

Here, We have to calcaute Net Present Value of the Investement by taking into consideration of Present value discount factor for one dollar discounted at k percent of n periods, PVIF k,n = 1 / (1+k)n.

Net Present Value is positive, hence the project can be accepted.

| n | An | i | PVIF | NPV | |

| 0 | $(42000) | 10% | 1 | $(42,000.00) | |

| 1 | 32400 | 11% | 0.9009 | 29,186.16 | |

| 2 | 33400 | 13% | 0.7831 | 26,155.54 | |

| 3 | 32500 | 15% | 0.6575 |

| |

| 4 | 32500 | 12% | 0.6355 | 20,653.75 | |

| 5 | 33500 | 10% | 0.6209 | 20,800.15 | |

| Total NPV ---> | $76,167.35 |

Homework Sourse

Homework Sourse