No SpacingHeading 1 Styles Pane Describe health insurance co

No SpacingHeading 1 Styles Pane Describe health insurance coverage and the impact of legislative changes Define disability insurance and analyze disability insurance needs. Identify the benefits of long term care insurance. . . Section I: Protect Yourself: Health Insurance 1. Your college friend, Mandy, has two health insurance offers to cover her medical expenses. She expects to have annual medical expenses of $16,000 on average. Given the information below, help her select the best plan to minimize her total cost. Blue Cross Plan A Humana Plan B Deductible Limit Coinsurance $3,500 $4,000 $7.000 Out-of-Pocket $9,000 Out-of-pocket Max 70/30 S325 Max 80/20 $400 Monthly Premium Which plan do you recommend to her? Justify your recommendation showing the correct math. a. b. Turns out for the year, Mandy visited the doctor 3 times and her bills were: $400 for first visit, $1,750 for second visit with x-rays, and S6,500 for outpatient surgery to remove two cysts and mole from her back. For both policies (Blue Cross and Humana) determine her share of the costs and the amount covered by insurance. (Show all your math) ords English (United States)

Solution

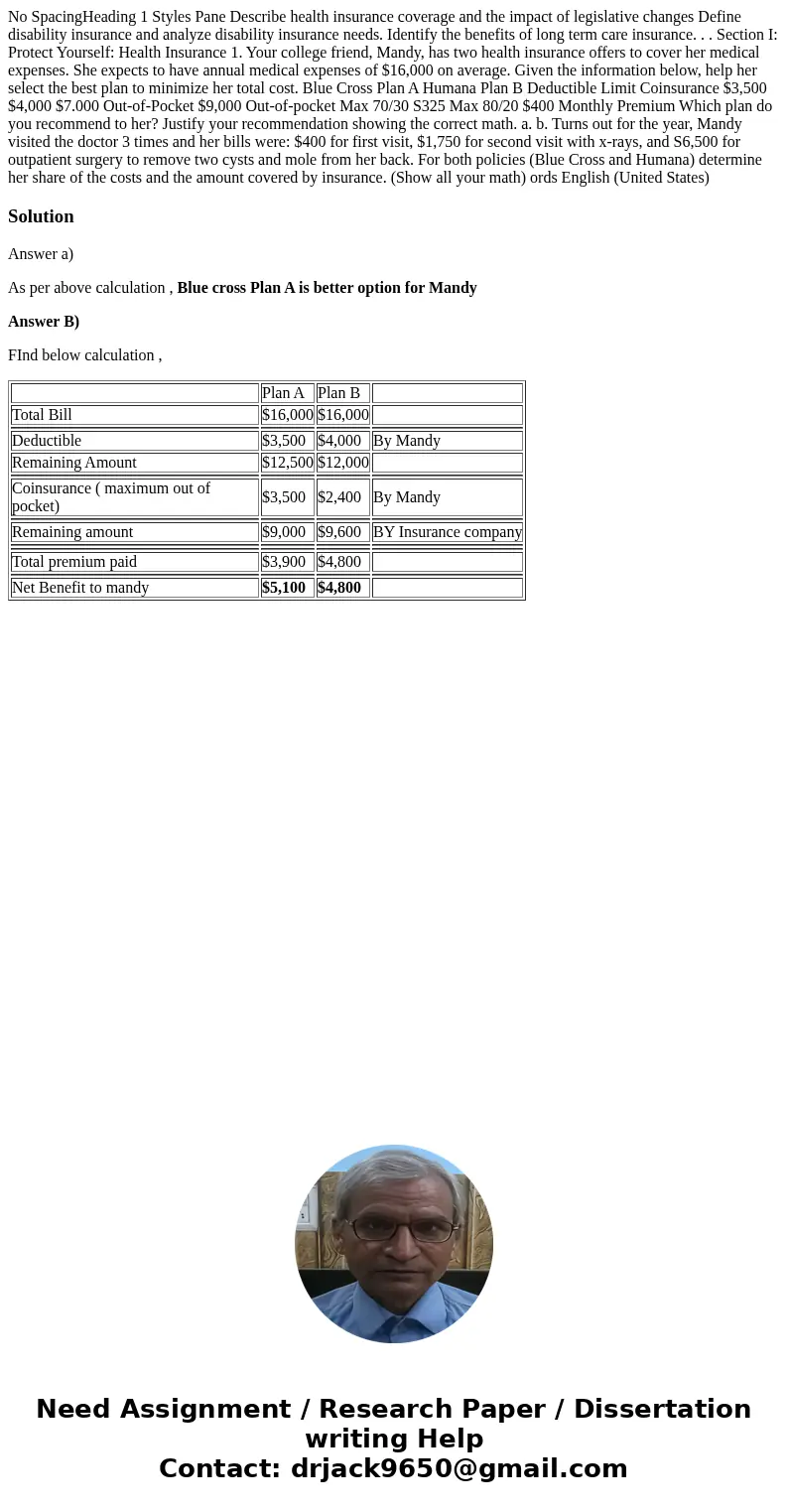

Answer a)

As per above calculation , Blue cross Plan A is better option for Mandy

Answer B)

FInd below calculation ,

| Plan A | Plan B | ||

| Total Bill | $16,000 | $16,000 | |

| Deductible | $3,500 | $4,000 | By Mandy |

| Remaining Amount | $12,500 | $12,000 | |

| Coinsurance ( maximum out of pocket) | $3,500 | $2,400 | By Mandy |

| Remaining amount | $9,000 | $9,600 | BY Insurance company |

| Total premium paid | $3,900 | $4,800 | |

| Net Benefit to mandy | $5,100 | $4,800 |

Homework Sourse

Homework Sourse