Summary information from the financial statements of two com

Solution

current ratio

current assets

/

current liabilities

current ratio

Barco

155440

/

61340

2.534072

1

Kyan

238050

/

93300

2.551447

1

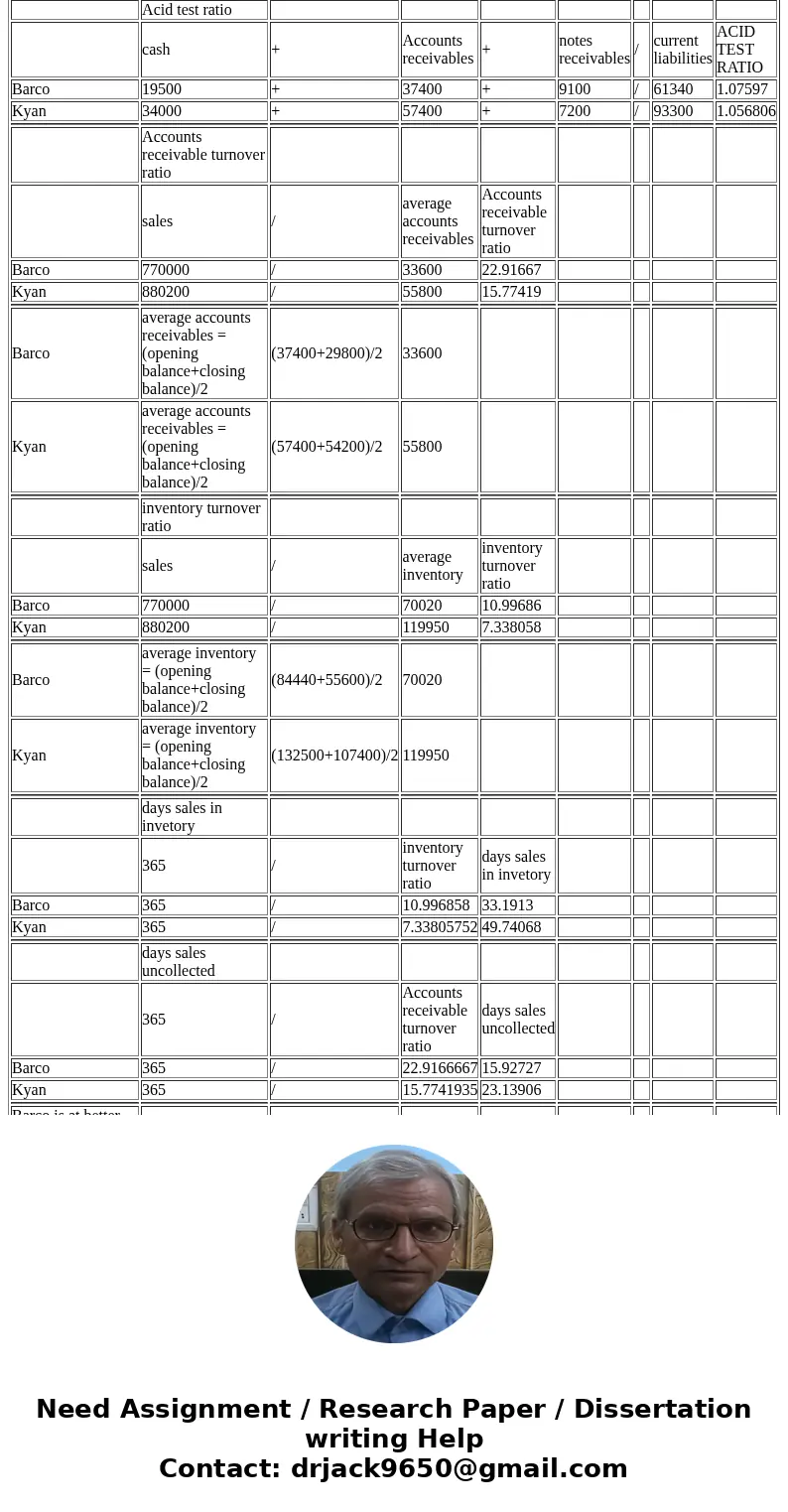

Acid test ratio

cash

+

Accounts receivables

+

notes receivables

/

current liabilities

ACID TEST RATIO

Barco

19500

+

37400

+

9100

/

61340

1.07597

Kyan

34000

+

57400

+

7200

/

93300

1.056806

Accounts receivable turnover ratio

sales

/

average accounts receivables

Accounts receivable turnover ratio

Barco

770000

/

33600

22.91667

Kyan

880200

/

55800

15.77419

Barco

average accounts receivables = (opening balance+closing balance)/2

(37400+29800)/2

33600

Kyan

average accounts receivables = (opening balance+closing balance)/2

(57400+54200)/2

55800

inventory turnover ratio

sales

/

average inventory

inventory turnover ratio

Barco

770000

/

70020

10.99686

Kyan

880200

/

119950

7.338058

Barco

average inventory = (opening balance+closing balance)/2

(84440+55600)/2

70020

Kyan

average inventory = (opening balance+closing balance)/2

(132500+107400)/2

119950

days sales in invetory

365

/

inventory turnover ratio

days sales in invetory

Barco

365

/

10.996858

33.1913

Kyan

365

/

7.33805752

49.74068

days sales uncollected

365

/

Accounts receivable turnover ratio

days sales uncollected

Barco

365

/

22.9166667

15.92727

Kyan

365

/

15.7741935

23.13906

Barco is at better short term credit risk as its day sales uncollected is 15.92 days

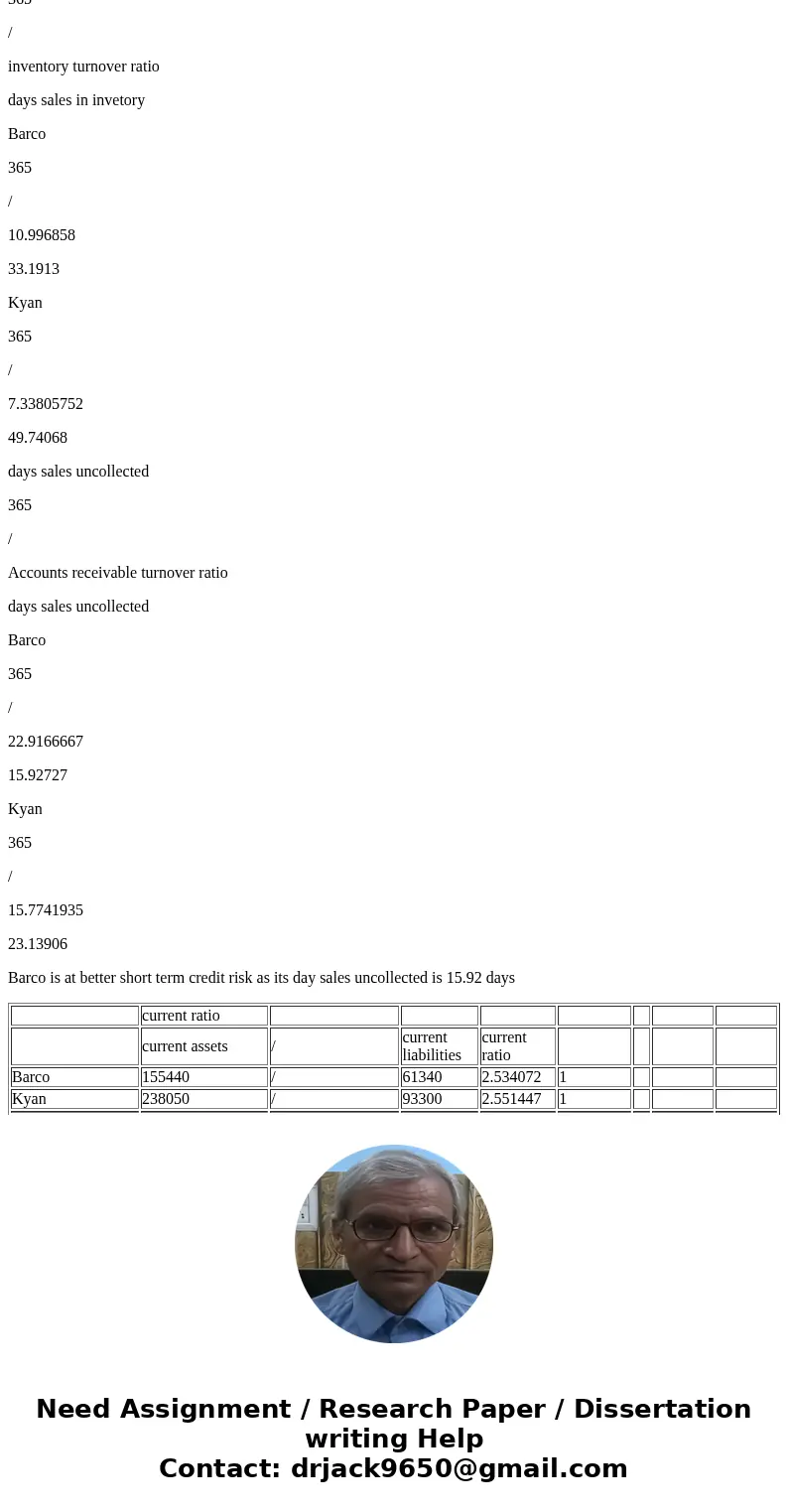

| current ratio | ||||||||

| current assets | / | current liabilities | current ratio | |||||

| Barco | 155440 | / | 61340 | 2.534072 | 1 | |||

| Kyan | 238050 | / | 93300 | 2.551447 | 1 | |||

| Acid test ratio | ||||||||

| cash | + | Accounts receivables | + | notes receivables | / | current liabilities | ACID TEST RATIO | |

| Barco | 19500 | + | 37400 | + | 9100 | / | 61340 | 1.07597 |

| Kyan | 34000 | + | 57400 | + | 7200 | / | 93300 | 1.056806 |

| Accounts receivable turnover ratio | ||||||||

| sales | / | average accounts receivables | Accounts receivable turnover ratio | |||||

| Barco | 770000 | / | 33600 | 22.91667 | ||||

| Kyan | 880200 | / | 55800 | 15.77419 | ||||

| Barco | average accounts receivables = (opening balance+closing balance)/2 | (37400+29800)/2 | 33600 | |||||

| Kyan | average accounts receivables = (opening balance+closing balance)/2 | (57400+54200)/2 | 55800 | |||||

| inventory turnover ratio | ||||||||

| sales | / | average inventory | inventory turnover ratio | |||||

| Barco | 770000 | / | 70020 | 10.99686 | ||||

| Kyan | 880200 | / | 119950 | 7.338058 | ||||

| Barco | average inventory = (opening balance+closing balance)/2 | (84440+55600)/2 | 70020 | |||||

| Kyan | average inventory = (opening balance+closing balance)/2 | (132500+107400)/2 | 119950 | |||||

| days sales in invetory | ||||||||

| 365 | / | inventory turnover ratio | days sales in invetory | |||||

| Barco | 365 | / | 10.996858 | 33.1913 | ||||

| Kyan | 365 | / | 7.33805752 | 49.74068 | ||||

| days sales uncollected | ||||||||

| 365 | / | Accounts receivable turnover ratio | days sales uncollected | |||||

| Barco | 365 | / | 22.9166667 | 15.92727 | ||||

| Kyan | 365 | / | 15.7741935 | 23.13906 | ||||

| Barco is at better short term credit risk as its day sales uncollected is 15.92 days |

Homework Sourse

Homework Sourse