Sanders Enterprises Inc has been considering the purchase of

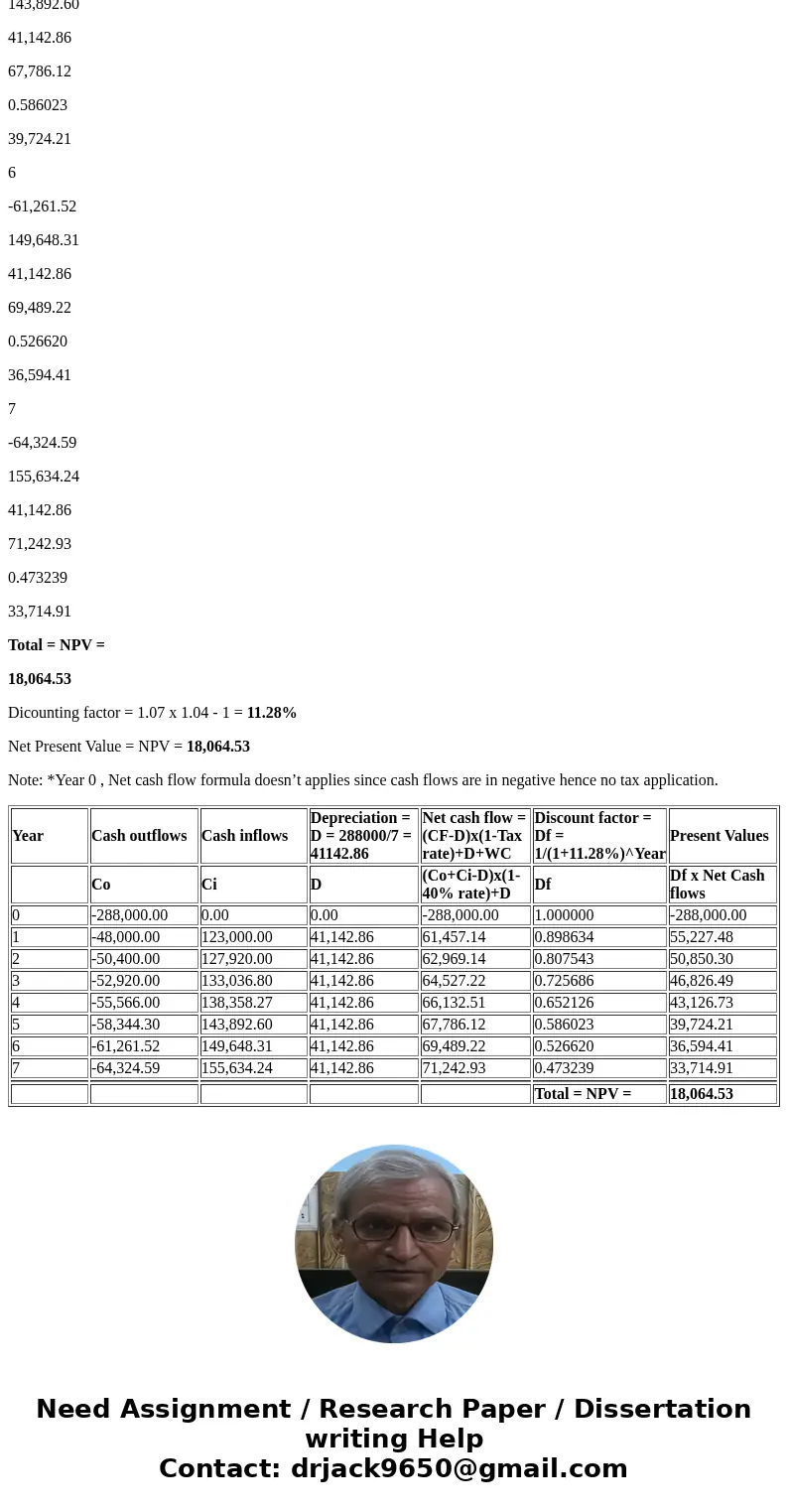

Sanders Enterprises, Inc., has been considering the purchase of a new manufacturing facility for $288,000. The facility is to be fully depreciated on a straight-line basis over seven years. It is expected to have no resale value after the seven years. Operating revenues from the facility are expected to be $123,000, in nominal terms, at the end of the first year. The revenues are expected to increase at the inflation rate of 4 percent. Production costs at the end of the first year will be $48,000, in nominal terms, and they are expected to increase at 5 percent per year. The real discount rate is 7 percent. The corporate tax rate is 40 percent. Calculate the NPV of the project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Solution

Year

Cash outflows

Cash inflows

Depreciation = D = 288000/7 = 41142.86

Net cash flow = (CF-D)x(1-Tax rate)+D+WC

Discount factor = Df = 1/(1+11.28%)^Year

Present Values

Co

Ci

D

(Co+Ci-D)x(1-40% rate)+D

Df

Df x Net Cash flows

0

-288,000.00

0.00

0.00

-288,000.00

1.000000

-288,000.00

1

-48,000.00

123,000.00

41,142.86

61,457.14

0.898634

55,227.48

2

-50,400.00

127,920.00

41,142.86

62,969.14

0.807543

50,850.30

3

-52,920.00

133,036.80

41,142.86

64,527.22

0.725686

46,826.49

4

-55,566.00

138,358.27

41,142.86

66,132.51

0.652126

43,126.73

5

-58,344.30

143,892.60

41,142.86

67,786.12

0.586023

39,724.21

6

-61,261.52

149,648.31

41,142.86

69,489.22

0.526620

36,594.41

7

-64,324.59

155,634.24

41,142.86

71,242.93

0.473239

33,714.91

Total = NPV =

18,064.53

Dicounting factor = 1.07 x 1.04 - 1 = 11.28%

Net Present Value = NPV = 18,064.53

Note: *Year 0 , Net cash flow formula doesn’t applies since cash flows are in negative hence no tax application.

| Year | Cash outflows | Cash inflows | Depreciation = D = 288000/7 = 41142.86 | Net cash flow = (CF-D)x(1-Tax rate)+D+WC | Discount factor = Df = 1/(1+11.28%)^Year | Present Values |

| Co | Ci | D | (Co+Ci-D)x(1-40% rate)+D | Df | Df x Net Cash flows | |

| 0 | -288,000.00 | 0.00 | 0.00 | -288,000.00 | 1.000000 | -288,000.00 |

| 1 | -48,000.00 | 123,000.00 | 41,142.86 | 61,457.14 | 0.898634 | 55,227.48 |

| 2 | -50,400.00 | 127,920.00 | 41,142.86 | 62,969.14 | 0.807543 | 50,850.30 |

| 3 | -52,920.00 | 133,036.80 | 41,142.86 | 64,527.22 | 0.725686 | 46,826.49 |

| 4 | -55,566.00 | 138,358.27 | 41,142.86 | 66,132.51 | 0.652126 | 43,126.73 |

| 5 | -58,344.30 | 143,892.60 | 41,142.86 | 67,786.12 | 0.586023 | 39,724.21 |

| 6 | -61,261.52 | 149,648.31 | 41,142.86 | 69,489.22 | 0.526620 | 36,594.41 |

| 7 | -64,324.59 | 155,634.24 | 41,142.86 | 71,242.93 | 0.473239 | 33,714.91 |

| Total = NPV = | 18,064.53 |

Homework Sourse

Homework Sourse