consider a bond with a 62 percent coupon rate paid semiannua

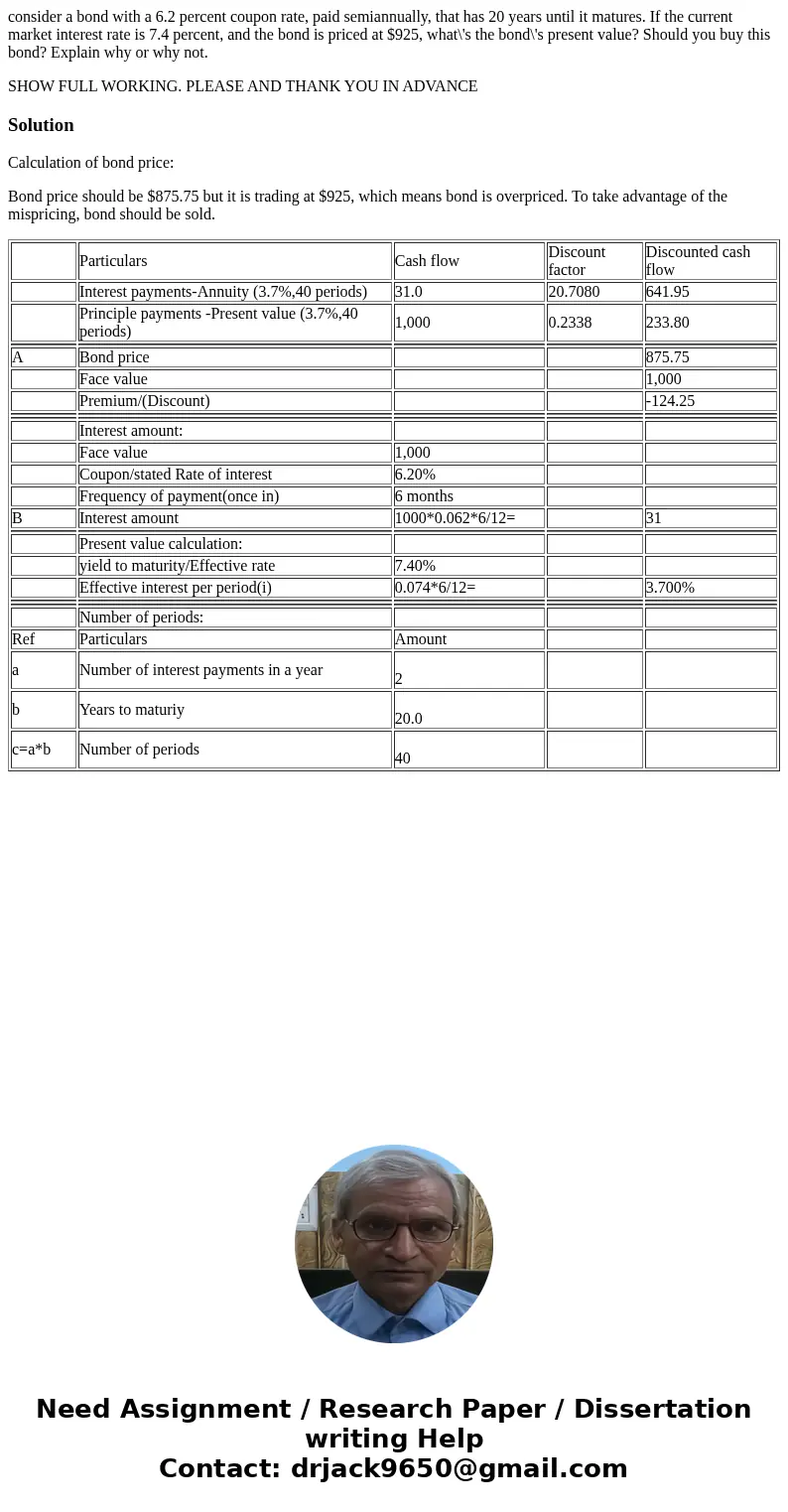

consider a bond with a 6.2 percent coupon rate, paid semiannually, that has 20 years until it matures. If the current market interest rate is 7.4 percent, and the bond is priced at $925, what\'s the bond\'s present value? Should you buy this bond? Explain why or why not.

SHOW FULL WORKING. PLEASE AND THANK YOU IN ADVANCE

Solution

Calculation of bond price:

Bond price should be $875.75 but it is trading at $925, which means bond is overpriced. To take advantage of the mispricing, bond should be sold.

| Particulars | Cash flow | Discount factor | Discounted cash flow | |

| Interest payments-Annuity (3.7%,40 periods) | 31.0 | 20.7080 | 641.95 | |

| Principle payments -Present value (3.7%,40 periods) | 1,000 | 0.2338 | 233.80 | |

| A | Bond price | 875.75 | ||

| Face value | 1,000 | |||

| Premium/(Discount) | -124.25 | |||

| Interest amount: | ||||

| Face value | 1,000 | |||

| Coupon/stated Rate of interest | 6.20% | |||

| Frequency of payment(once in) | 6 months | |||

| B | Interest amount | 1000*0.062*6/12= | 31 | |

| Present value calculation: | ||||

| yield to maturity/Effective rate | 7.40% | |||

| Effective interest per period(i) | 0.074*6/12= | 3.700% | ||

| Number of periods: | ||||

| Ref | Particulars | Amount | ||

| a | Number of interest payments in a year | 2 | ||

| b | Years to maturiy | 20.0 | ||

| c=a*b | Number of periods | 40 |

Homework Sourse

Homework Sourse