The Rangaletta Company issues a fiveyear zerocoupon bond on

. The Rangaletta Company issues a five-year, zero-coupon bond on January 1, Year One. The bond has a face value of $200,000 and is issued to yield an effective interest rate of 9 percent. Rangaletta receives $129,986. On January 1, Year Three, Rangaletta pays off the bond early by making a payment of $155,000 to the bondholder. Make all journal entries from January 1, Year One, through January 1, Year Three assuming the effective rate method is applied. 6. Do problem 5 again but assume that the straight-line method is used.

Solution

pv of zero coupon bond = 200000/(1.09)5 = 129986

journal entry

bond were redeemed before the maturity that is in the beginning of the year 3

its liability@ 9%interest was = 129986*1.09*1.09=155437

but we paid = 155000

soextra paid = 155000-155437 = 463

pv of zero coupon bond = 200000/(1.09)5 = 129986

journal entry:- straight-line method

under straight linemethod , the difference between the face value and issue price, which is the interest earned over a period of 5 year,is to be recorded equally every year

200000-129986 = 70014 total interest yield to investor

per year interest expense = 70014/5 = 14003 approx

bond were redeemed before the maturity that is in the beginning of the year 3

its liabilityas per SLM was = 129986+14003+14003=157992

but we paid = 155000

so extra gain= 2992

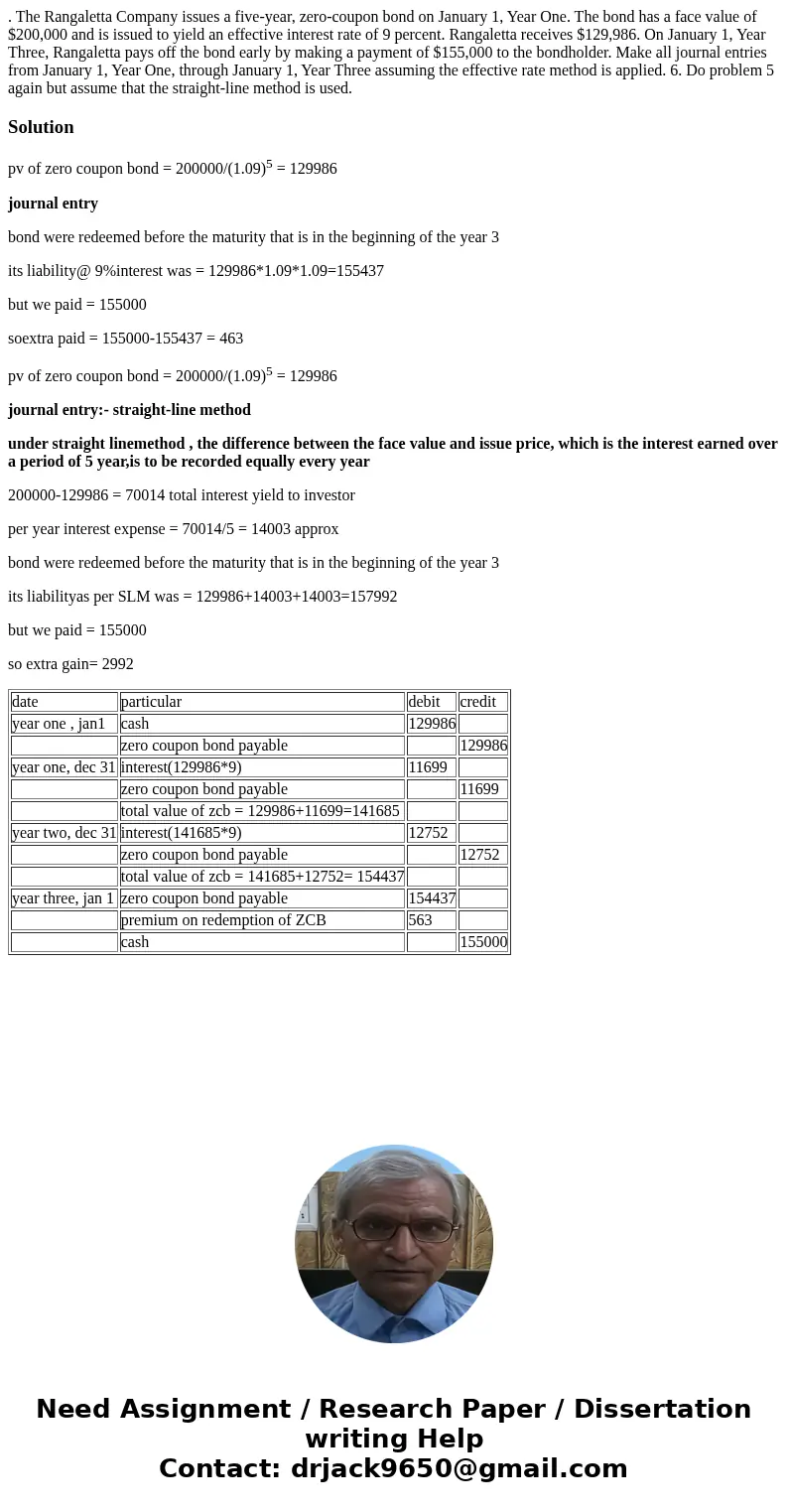

| date | particular | debit | credit |

| year one , jan1 | cash | 129986 | |

| zero coupon bond payable | 129986 | ||

| year one, dec 31 | interest(129986*9) | 11699 | |

| zero coupon bond payable | 11699 | ||

| total value of zcb = 129986+11699=141685 | |||

| year two, dec 31 | interest(141685*9) | 12752 | |

| zero coupon bond payable | 12752 | ||

| total value of zcb = 141685+12752= 154437 | |||

| year three, jan 1 | zero coupon bond payable | 154437 | |

| premium on redemption of ZCB | 563 | ||

| cash | 155000 |

Homework Sourse

Homework Sourse