MBA 620 Week 4 Homework 1 Pleasanton Products manufactures D

Solution

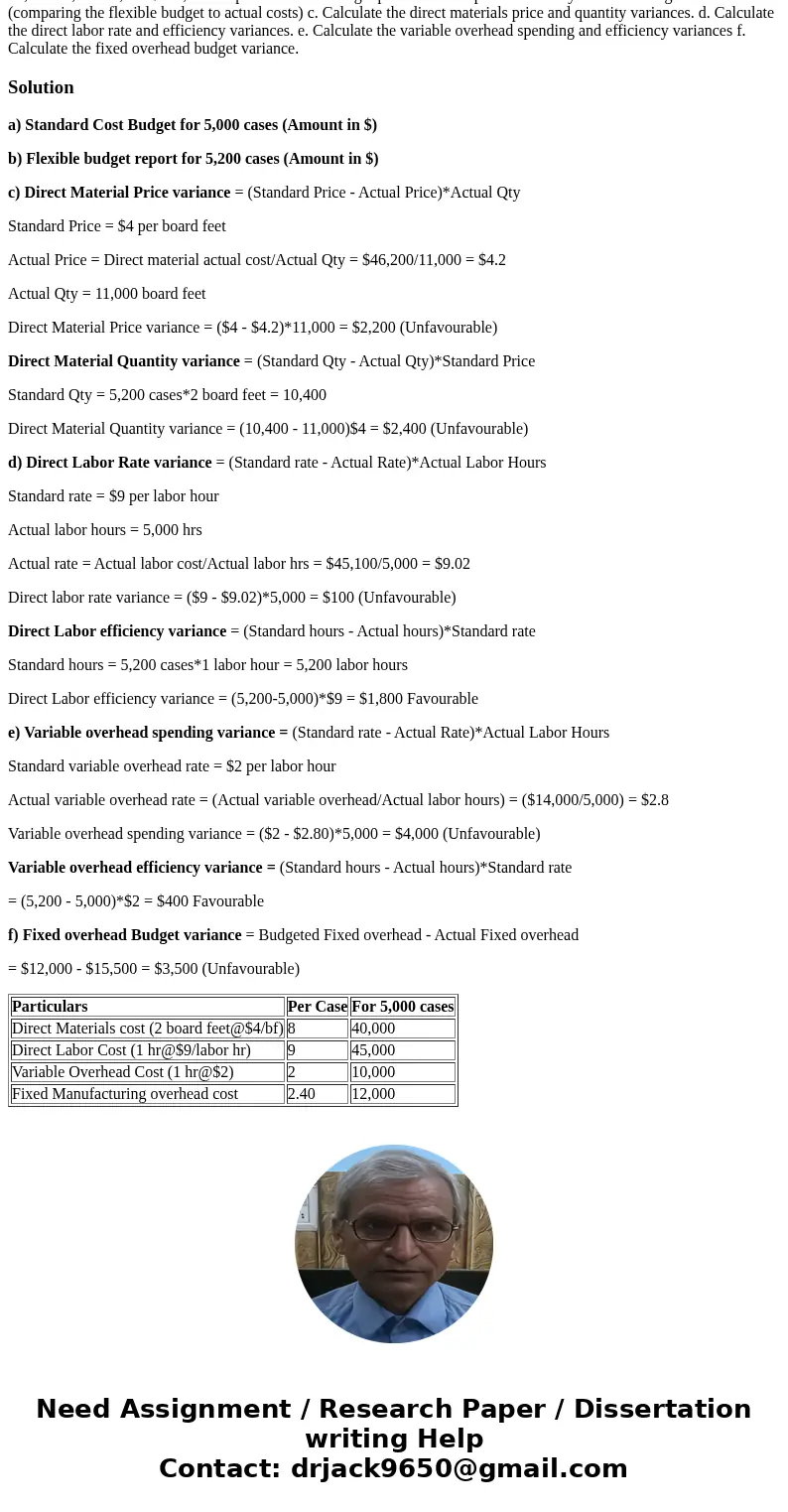

a) Standard Cost Budget for 5,000 cases (Amount in $)

b) Flexible budget report for 5,200 cases (Amount in $)

c) Direct Material Price variance = (Standard Price - Actual Price)*Actual Qty

Standard Price = $4 per board feet

Actual Price = Direct material actual cost/Actual Qty = $46,200/11,000 = $4.2

Actual Qty = 11,000 board feet

Direct Material Price variance = ($4 - $4.2)*11,000 = $2,200 (Unfavourable)

Direct Material Quantity variance = (Standard Qty - Actual Qty)*Standard Price

Standard Qty = 5,200 cases*2 board feet = 10,400

Direct Material Quantity variance = (10,400 - 11,000)$4 = $2,400 (Unfavourable)

d) Direct Labor Rate variance = (Standard rate - Actual Rate)*Actual Labor Hours

Standard rate = $9 per labor hour

Actual labor hours = 5,000 hrs

Actual rate = Actual labor cost/Actual labor hrs = $45,100/5,000 = $9.02

Direct labor rate variance = ($9 - $9.02)*5,000 = $100 (Unfavourable)

Direct Labor efficiency variance = (Standard hours - Actual hours)*Standard rate

Standard hours = 5,200 cases*1 labor hour = 5,200 labor hours

Direct Labor efficiency variance = (5,200-5,000)*$9 = $1,800 Favourable

e) Variable overhead spending variance = (Standard rate - Actual Rate)*Actual Labor Hours

Standard variable overhead rate = $2 per labor hour

Actual variable overhead rate = (Actual variable overhead/Actual labor hours) = ($14,000/5,000) = $2.8

Variable overhead spending variance = ($2 - $2.80)*5,000 = $4,000 (Unfavourable)

Variable overhead efficiency variance = (Standard hours - Actual hours)*Standard rate

= (5,200 - 5,000)*$2 = $400 Favourable

f) Fixed overhead Budget variance = Budgeted Fixed overhead - Actual Fixed overhead

= $12,000 - $15,500 = $3,500 (Unfavourable)

| Particulars | Per Case | For 5,000 cases |

| Direct Materials cost (2 board feet@$4/bf) | 8 | 40,000 |

| Direct Labor Cost (1 hr@$9/labor hr) | 9 | 45,000 |

| Variable Overhead Cost (1 hr@$2) | 2 | 10,000 |

| Fixed Manufacturing overhead cost | 2.40 | 12,000 |

Homework Sourse

Homework Sourse