On January 1 2012 Uncle Company purchased 80 percent of Neph

Solution

a. Assume that Uncle applies the equity method to account for this investment in Nephew. What is the subsidiary’s income recognized by Uncle in 2014?

Consideration transferred by Uncle

$ 660000

Noncontrolling interest fair value

165000

Nephew\'s business fair value

$ 825000

Book value

(790000)

Intangible assets

$ 35000

Life

10 years

Amortization expense (annual)

$ 3500

Net income reported by Nephew—2014

$ 55800

Amortization expense

(3500)

Accrual-based net income

52300

Uncle\'s ownership percentage

80%

Net income of subsidiary recognized by Uncle

$ 41,840

b. What is the noncontrolling interest’s share of 2014 consolidated net income?

To the outside owners, the intra-entity dividends = ($30000 × 30%) = $9000 declared by Uncle are income, because the book value of Nephew is increasing. Thus, the noncontrolling interest\'s share of consolidated net income is computed as follows:

Nephew’s accrual-based 2014 net income (above)

$ 52300

Dividends declared by Uncle to Nephew

9000

Income to outside owners

$ 61,300

Noncontrolling interest percentage

20%

Noncontrolling interest share of consolidated net income

12260

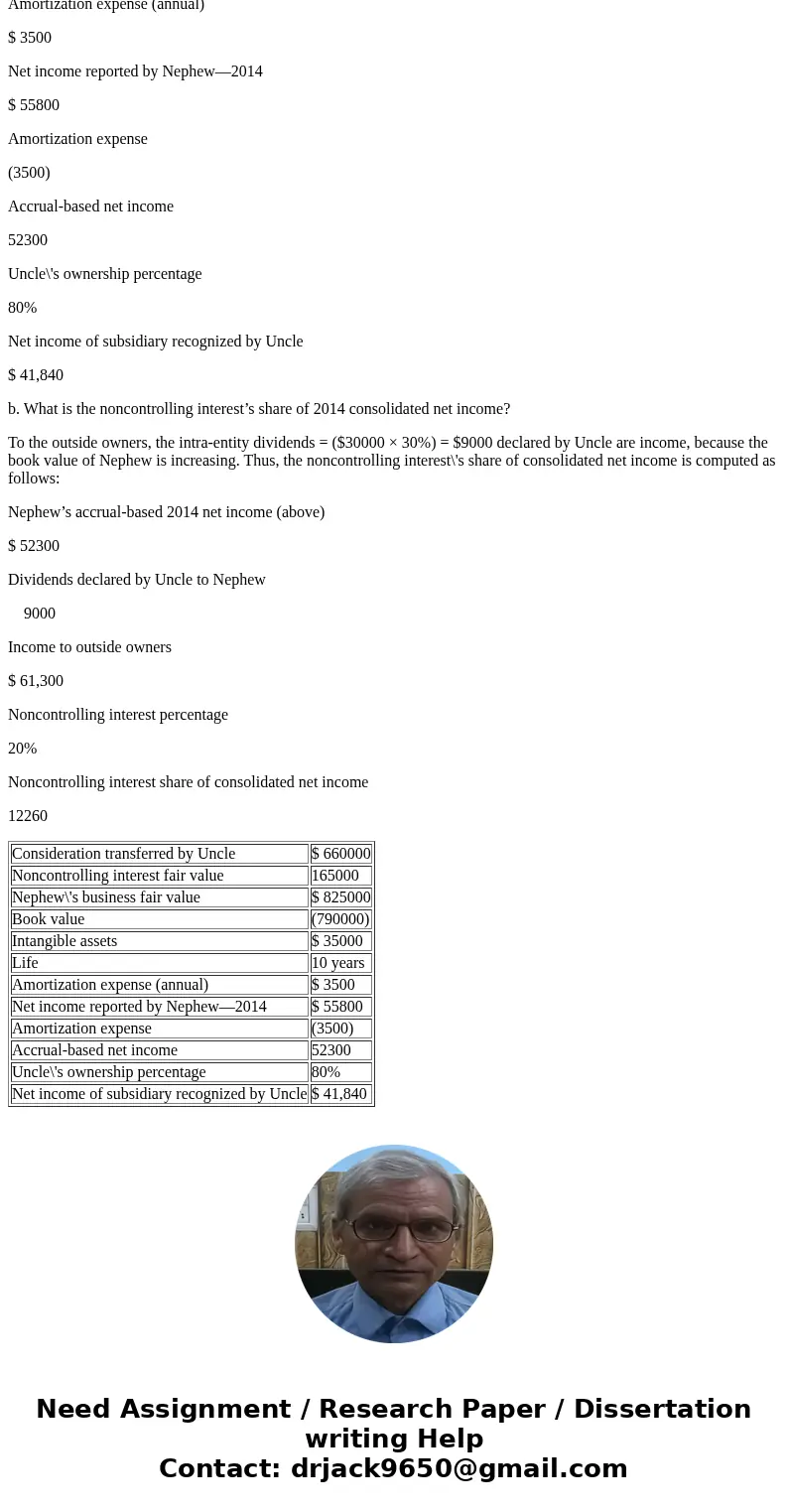

| Consideration transferred by Uncle | $ 660000 |

| Noncontrolling interest fair value | 165000 |

| Nephew\'s business fair value | $ 825000 |

| Book value | (790000) |

| Intangible assets | $ 35000 |

| Life | 10 years |

| Amortization expense (annual) | $ 3500 |

| Net income reported by Nephew—2014 | $ 55800 |

| Amortization expense | (3500) |

| Accrual-based net income | 52300 |

| Uncle\'s ownership percentage | 80% |

| Net income of subsidiary recognized by Uncle | $ 41,840 |

Homework Sourse

Homework Sourse