Modern Electronics Company purchases merchandise inventory f

Modern Electronics Company purchases merchandise inventory from several suppliers. On April 1, 2017, Modern Electronics purchased from Speedy Supplies $80,000 of inventory on account. On May 15, 2017, Modern Electronics sold inventory to a Jones Apartment Complex for $60,000 cash, which included $50,000 COGS for the inventory. On June 15, 2017 Modern Electronics remitted the applicable PST and GST or HST. Use the PST, GST and HST rates in Exhibit 10.6.

Required:

Journalize Modern Electronics Company transactions on April 1, 2017, May 15, 2017 and June 15, 2017, including applicable PST and GST or HST assuming it is located in: (Round the final answer to 2 decimal places.)

a. Ontario

b. British Columbia

c. Alberta

Part a. Modern Electronics is located in Ontario

1.Record the purchase of inventory on credit plus applicable ITC.

2.Record the cash sales plus applicable Sales tax.

3.Record the cost of sales.

4.Record the refund of applicable Sales tax from Receiver General for Canada.

Part b. Modern Electronics is located in British Columbia

1.Record the purchase of inventory on credit plus applicable ITC.

2.Record the cash sales plus applicable Sales tax.

3.Record the cost of sales.

4.Record the refund of applicable Sales tax from Receiver General for Canada.

5.Record the remittance of PST to provincial authority—BC Ministry of Finance.

Part c. Modern Electronics is located in Alberta

1.Record the purchase of inventory on credit plus applicable ITC.

2.Record the cash sales plus applicable Sales tax.

3.Record the cost of sales.

4.Record the refund of applicable Sales tax from Receiver General for Canada.

Ex. 10

PST Rate GST Rate HST Rate Regions with GST Only Alberta 5% 5% 5% 5% Nunavut Yukon Regions with GST and PST British Columbia 7% 8% q.q75% 5% 5% 5% 5% 5% Quebec Regions with HST New Brunswick 13% 15% 15% 13% 14% Nova Scotia Prince Edward Island *A Harmonized Sales Tax (HST) is applied in place of PST and GST. HST is the combination of the PST with the GST for a total sales tax. For example, for both New Brunswick and Ontario the PST rate of 8% is combined with the GST of 5%, resulting in an overall HST of 13% **The Newfoundland 2015 budget announced that the rate increases from 13% to 15%, effective January 1, 2016Solution

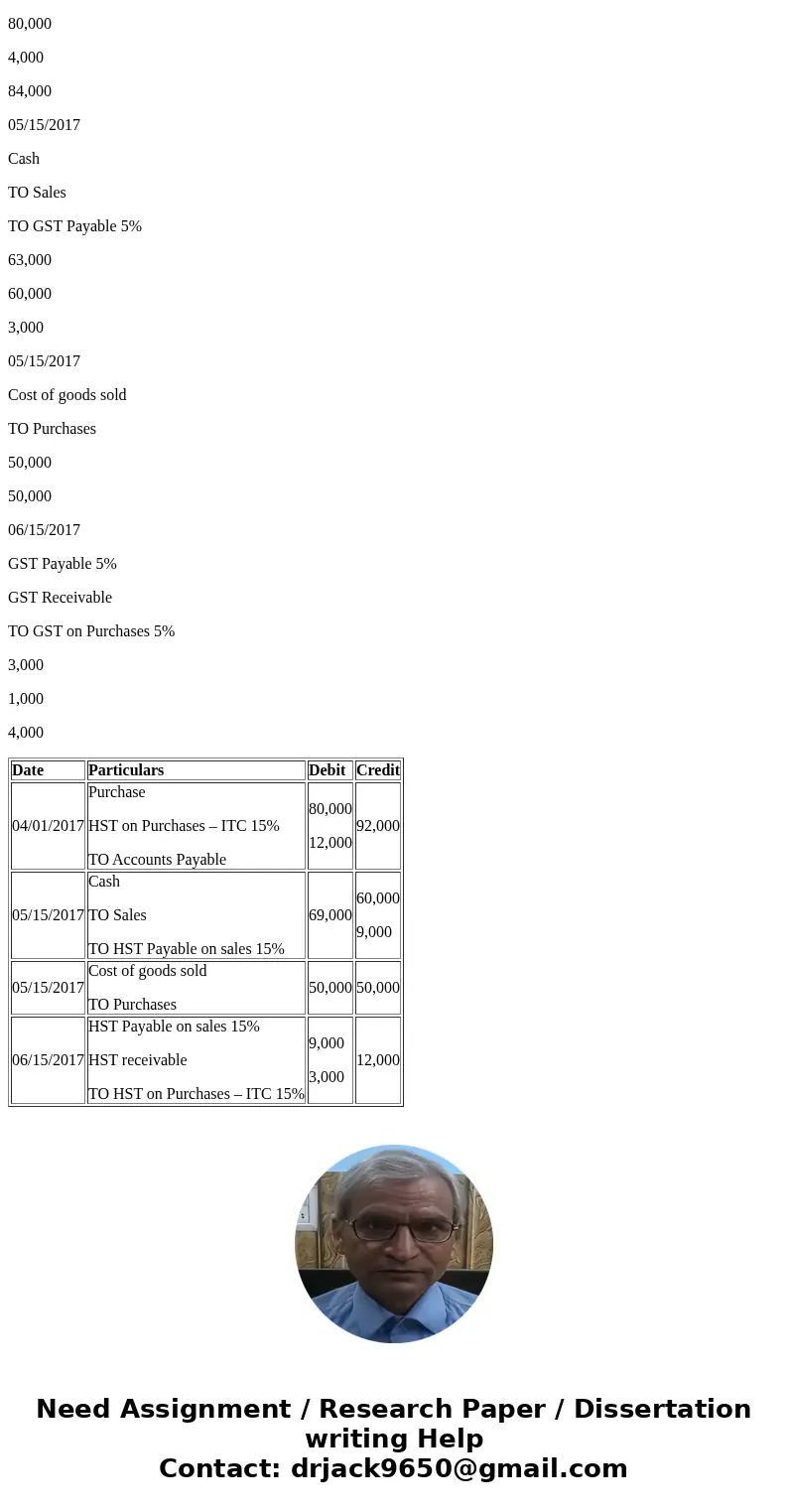

Part A. Ontario

Journal Entries

Date

Particulars

Debit

Credit

04/01/2017

Purchase

HST on Purchases – ITC 15%

TO Accounts Payable

80,000

12,000

92,000

05/15/2017

Cash

TO Sales

TO HST Payable on sales 15%

69,000

60,000

9,000

05/15/2017

Cost of goods sold

TO Purchases

50,000

50,000

06/15/2017

HST Payable on sales 15%

HST receivable

TO HST on Purchases – ITC 15%

9,000

3,000

12,000

NOTE: 15% Rate effective from 1st Jan 2016.

PART B: British Columbia

Journal Entry

Date

Particulars

Debit

Credit

04/01/2017

Purchase

GST on Purchases 5%

TO Accounts Payable

(ITC on PST not available)

85,600

4,000

89,600

05/15/2017

Cash

TO Sales

TO GST Payable 5%

TO PST Payable 7%

67,200

60,000

3,000

4,200

05/15/2017

Cost of goods sold

TO Purchases

(5000 x 107%)

53,500

53,500

06/15/2017

GST Payable 5%

GST Receivable

TO GST on Purchases 5%

3,000

1,000

4,000

06/15/2017

PST Payable 7%

TO Cash

4,200

4,200

PART C: Alberta

Journal Entry

Date

Particulars

Debit

Credit

04/01/2017

Purchase

GST on Purchases 5%

TO Accounts Payable

80,000

4,000

84,000

05/15/2017

Cash

TO Sales

TO GST Payable 5%

63,000

60,000

3,000

05/15/2017

Cost of goods sold

TO Purchases

50,000

50,000

06/15/2017

GST Payable 5%

GST Receivable

TO GST on Purchases 5%

3,000

1,000

4,000

| Date | Particulars | Debit | Credit |

| 04/01/2017 | Purchase HST on Purchases – ITC 15% TO Accounts Payable | 80,000 12,000 | 92,000 |

| 05/15/2017 | Cash TO Sales TO HST Payable on sales 15% | 69,000 | 60,000 9,000 |

| 05/15/2017 | Cost of goods sold TO Purchases | 50,000 | 50,000 |

| 06/15/2017 | HST Payable on sales 15% HST receivable TO HST on Purchases – ITC 15% | 9,000 3,000 | 12,000 |

Homework Sourse

Homework Sourse