Please help by explaining how to get each number Will rate E

Please help by explaining how to get each number. Will rate.

E14-9 (L01) GROUPWORK (Entries and Questions for Bond Transactions) On June 30, 2017, Mischa Auer Company issued $4 000,000 face value of 13%, 20-year bonds at $4,300,920, a yield of 12% Auer uses the effective interest method to amor tize bond premium or discount. The bonds pay semiannual interest on June 30 and-December 31 (Round answers to the nearest cent.) (a) Prepare the journal entries to record the following transactions. (1) The issuance of the bonds on June 30, 2017. (2) The payment of interest and the amortization of the premium on December 31, 2017. (3) The payment of interest and the amortization of the premium on June 30, 2018. 4) The payment of interest and the amortization of the premium on December 31, 2018. Show the proper balance sheet presentation for the liability for bonds payable on the December 31, 2018, balance sheet. Provide the answers to the following questions. (1) (b) (c) s reported for 2018? What amount of interest expense i Will the bond interest expense reported in 2018 be the same as, greater than, or less than the amount that would be reported if the straight-line method of amortization were used? (2) (3) Determine the total cost of borrowing over the life of the bond. (4) Will the total bond interest expense for the life of the bond be greater than, the same as, or less than the total inter- est expense if the straight-line method of amortization were used?Solution

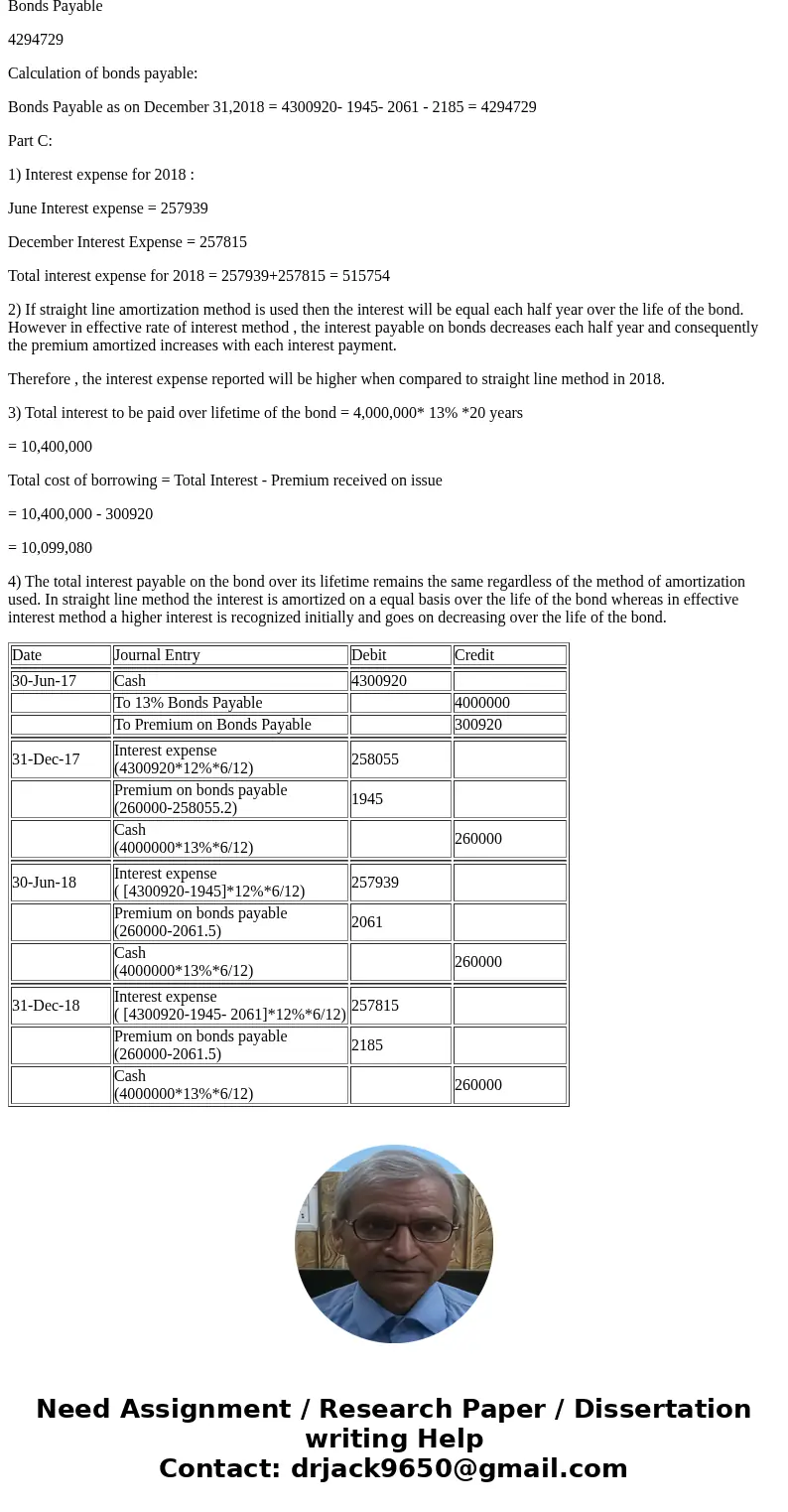

Part a

Date

Journal Entry

Debit

Credit

30-Jun-17

Cash

4300920

To 13% Bonds Payable

4000000

To Premium on Bonds Payable

300920

31-Dec-17

Interest expense

(4300920*12%*6/12)

258055

Premium on bonds payable

(260000-258055.2)

1945

Cash

(4000000*13%*6/12)

260000

30-Jun-18

Interest expense

( [4300920-1945]*12%*6/12)

257939

Premium on bonds payable

(260000-2061.5)

2061

Cash

(4000000*13%*6/12)

260000

31-Dec-18

Interest expense

( [4300920-1945- 2061]*12%*6/12)

257815

Premium on bonds payable

(260000-2061.5)

2185

Cash

(4000000*13%*6/12)

260000

Part b :

Extract of Balance of Mischa Auer Company as on December 31,2018:

Long Term Financial Liabilties

$

Bonds Payable

4294729

Calculation of bonds payable:

Bonds Payable as on December 31,2018 = 4300920- 1945- 2061 - 2185 = 4294729

Part C:

1) Interest expense for 2018 :

June Interest expense = 257939

December Interest Expense = 257815

Total interest expense for 2018 = 257939+257815 = 515754

2) If straight line amortization method is used then the interest will be equal each half year over the life of the bond. However in effective rate of interest method , the interest payable on bonds decreases each half year and consequently the premium amortized increases with each interest payment.

Therefore , the interest expense reported will be higher when compared to straight line method in 2018.

3) Total interest to be paid over lifetime of the bond = 4,000,000* 13% *20 years

= 10,400,000

Total cost of borrowing = Total Interest - Premium received on issue

= 10,400,000 - 300920

= 10,099,080

4) The total interest payable on the bond over its lifetime remains the same regardless of the method of amortization used. In straight line method the interest is amortized on a equal basis over the life of the bond whereas in effective interest method a higher interest is recognized initially and goes on decreasing over the life of the bond.

| Date | Journal Entry | Debit | Credit |

| 30-Jun-17 | Cash | 4300920 | |

| To 13% Bonds Payable | 4000000 | ||

| To Premium on Bonds Payable | 300920 | ||

| 31-Dec-17 | Interest expense | 258055 | |

| Premium on bonds payable | 1945 | ||

| Cash | 260000 | ||

| 30-Jun-18 | Interest expense | 257939 | |

| Premium on bonds payable | 2061 | ||

| Cash | 260000 | ||

| 31-Dec-18 | Interest expense | 257815 | |

| Premium on bonds payable | 2185 | ||

| Cash | 260000 |

Homework Sourse

Homework Sourse