Assume that above trial balance is an unadjusted and incurre

Assume that above trial balance is an unadjusted and incurred the following operations.

Expired insurance, $3,060. Inventory of unused delivery supplies, $1,430. Inventory of unused office supplies, $186. Estimated depreciation on the building, $14,400. Estimated depreciation on the trucks, $15,450. Estimated depreciation on the office equipment, $2,700. The company credits the lockbox fees of customers who pay in advance to the Unearned Lockbox Fees account. Of the amount credited to this account during the year, $5,630 had been earned by August 31. Lockbox fees earned but unrecorded and uncollected at the end of the accounting period, $816. Accrued but unpaid truck drivers’ wages at the end of the year, $1,920

Prepare adjusted trial balance and Income statement.

Trial Balance August 31, 2010 Cash Accounts Receivable Prepaid Insurance Delivery Supplies Office Supplies Land Building Accumulated Depreciation-Building Trucks Accumulated Depreciation-Trucks Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Unearned Lockbox Fees Mortgage Payable N. Reed, Capital N. Reed, Withdrawals Delivery Service Revenue Lockbox Fees Earned Truck Drivers\' Wages Expense Office Salaries Expense Gas, Oil, and Truck Repairs Expense Interest Expense 10,072 29,314 5,340 14,700 2,460 15,000 196,000 53,400 103,800 30,900 15,900 10,800 9,396 8,340 72,000 128,730 30,000 283,470 28,800 120,600 44,400 31,050 7,200 $625,836 $625,836Solution

SOLUTION:

PART-1)

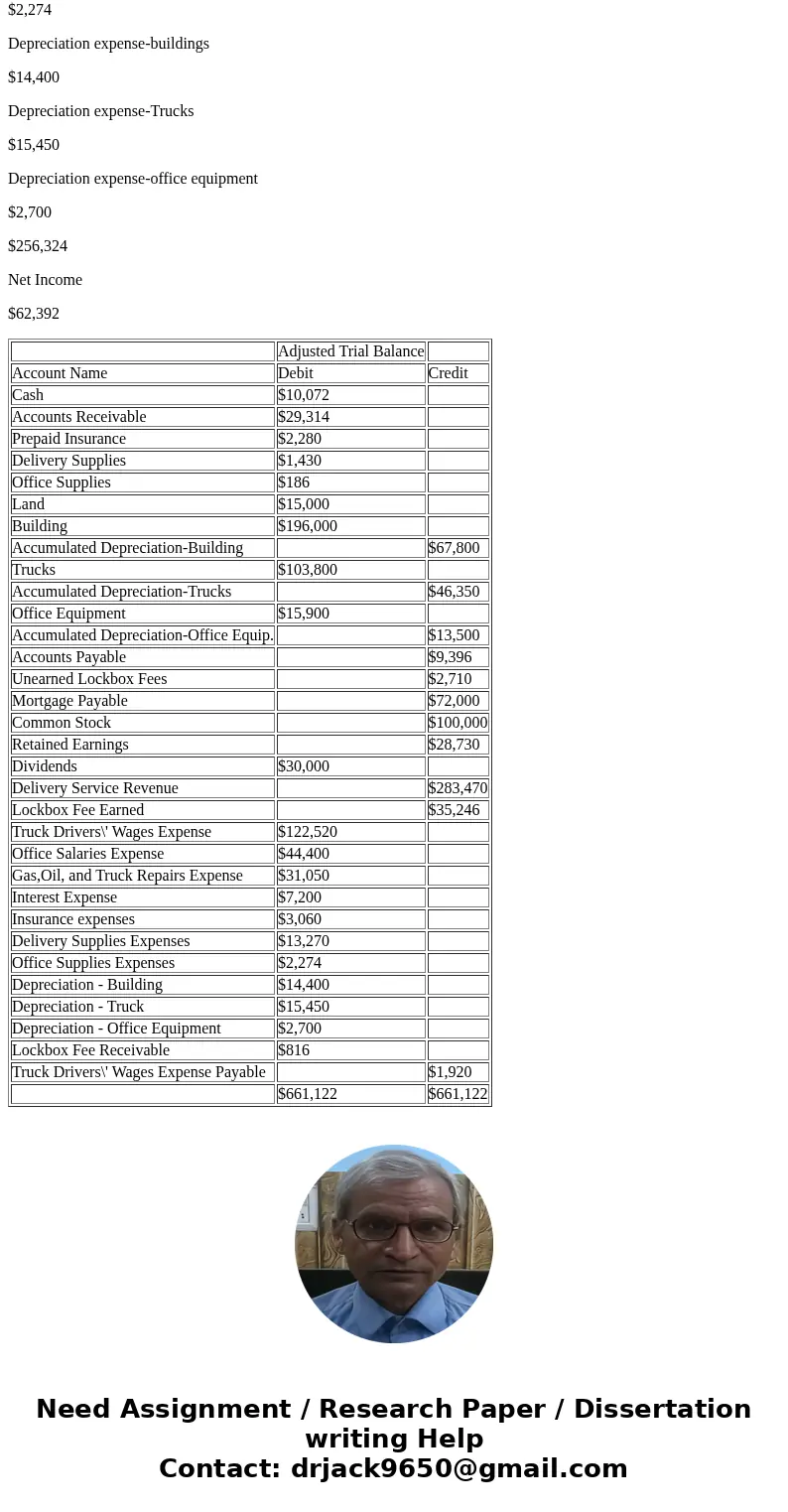

Adjusted Trial Balance

Account Name

Debit

Credit

Cash

$10,072

Accounts Receivable

$29,314

Prepaid Insurance

$2,280

Delivery Supplies

$1,430

Office Supplies

$186

Land

$15,000

Building

$196,000

Accumulated Depreciation-Building

$67,800

Trucks

$103,800

Accumulated Depreciation-Trucks

$46,350

Office Equipment

$15,900

Accumulated Depreciation-Office Equip.

$13,500

Accounts Payable

$9,396

Unearned Lockbox Fees

$2,710

Mortgage Payable

$72,000

Common Stock

$100,000

Retained Earnings

$28,730

Dividends

$30,000

Delivery Service Revenue

$283,470

Lockbox Fee Earned

$35,246

Truck Drivers\' Wages Expense

$122,520

Office Salaries Expense

$44,400

Gas,Oil, and Truck Repairs Expense

$31,050

Interest Expense

$7,200

Insurance expenses

$3,060

Delivery Supplies Expenses

$13,270

Office Supplies Expenses

$2,274

Depreciation - Building

$14,400

Depreciation - Truck

$15,450

Depreciation - Office Equipment

$2,700

Lockbox Fee Receivable

$816

Truck Drivers\' Wages Expense Payable

$1,920

$661,122

$661,122

Working:

Trial Balance

Adjustments

Adjusted Trial Balance

Account Name

Debit

Credit

debit

Credit

Debit

Credit

Cash

$10,072

$10,072

Accounts Receivable

$29,314

$29,314

Prepaid Insurance

$5,340

$3,060

$2,280

Delivery Supplies

$14,700

$13,270

$1,430

Office Supplies

$2,460

$2,274

$186

Land

$15,000

$15,000

Building

$196,000

$196,000

Accumulated Depreciation-Building

$53,400

$14,400

$67,800

Trucks

$103,800

$103,800

Accumulated Depreciation-Trucks

$30,900

$15,450

$46,350

Office Equipment

$15,900

$15,900

Accumulated Depreciation-Office Equip.

$10,800

$2,700

$13,500

Accounts Payable

$9,396

$9,396

Unearned Lockbox Fees

$8,340

$5,630

$2,710

Mortgage Payable

$72,000

$72,000

Common Stock

$100,000

$100,000

Retained Earnings

$28,730

$28,730

Dividends

$30,000

$30,000

Delivery Service Revenue

$283,470

$283,470

Lockbox Fee Earned

$28,800

$6,446

$35,246

Truck Drivers\' Wages Expense

$120,600

$1,920

$122,520

Office Salaries Expense

$44,400

$44,400

Gas,Oil, and Truck Repairs Expense

$31,050

$31,050

Interest Expense

$7,200

$7,200

Insurance expenses

$3,060

$3,060

Delivery Supplies Expenses

$13,270

$13,270

Office Supplies Expenses

$2,274

$2,274

Depreciation - Building

$14,400

$14,400

Depreciation - Truck

$15,450

$15,450

Depreciation - Office Equipment

$2,700

$2,700

Lockbox Fee Receivable

$816

$816

Truck Drivers\' Wages Expense Payable

$1,920

$1,920

$625,836

$625,836

$59,520

$59,520

$661,122

$661,122

PART-2)

INCOME STATEMENT

Revenues

Delivery Service Revenue

$283,470

Lockbox fees earned

$35,246

Total revenue

$318,716

Expenses

Truck Drivers Wages Expense

$122,520

Office Salaries expense

$44,400

Gas, Oil, and Truck repairs expense

$31,050

Interest expense

$7,200

Insurance expense

$3,060

Delivery supplies expense

$13,270

Office supplies expense

$2,274

Depreciation expense-buildings

$14,400

Depreciation expense-Trucks

$15,450

Depreciation expense-office equipment

$2,700

$256,324

Net Income

$62,392

| Adjusted Trial Balance | ||

| Account Name | Debit | Credit |

| Cash | $10,072 | |

| Accounts Receivable | $29,314 | |

| Prepaid Insurance | $2,280 | |

| Delivery Supplies | $1,430 | |

| Office Supplies | $186 | |

| Land | $15,000 | |

| Building | $196,000 | |

| Accumulated Depreciation-Building | $67,800 | |

| Trucks | $103,800 | |

| Accumulated Depreciation-Trucks | $46,350 | |

| Office Equipment | $15,900 | |

| Accumulated Depreciation-Office Equip. | $13,500 | |

| Accounts Payable | $9,396 | |

| Unearned Lockbox Fees | $2,710 | |

| Mortgage Payable | $72,000 | |

| Common Stock | $100,000 | |

| Retained Earnings | $28,730 | |

| Dividends | $30,000 | |

| Delivery Service Revenue | $283,470 | |

| Lockbox Fee Earned | $35,246 | |

| Truck Drivers\' Wages Expense | $122,520 | |

| Office Salaries Expense | $44,400 | |

| Gas,Oil, and Truck Repairs Expense | $31,050 | |

| Interest Expense | $7,200 | |

| Insurance expenses | $3,060 | |

| Delivery Supplies Expenses | $13,270 | |

| Office Supplies Expenses | $2,274 | |

| Depreciation - Building | $14,400 | |

| Depreciation - Truck | $15,450 | |

| Depreciation - Office Equipment | $2,700 | |

| Lockbox Fee Receivable | $816 | |

| Truck Drivers\' Wages Expense Payable | $1,920 | |

| $661,122 | $661,122 |

Homework Sourse

Homework Sourse