Problem 1021 Payback NPV and MIRR Your division is consideri

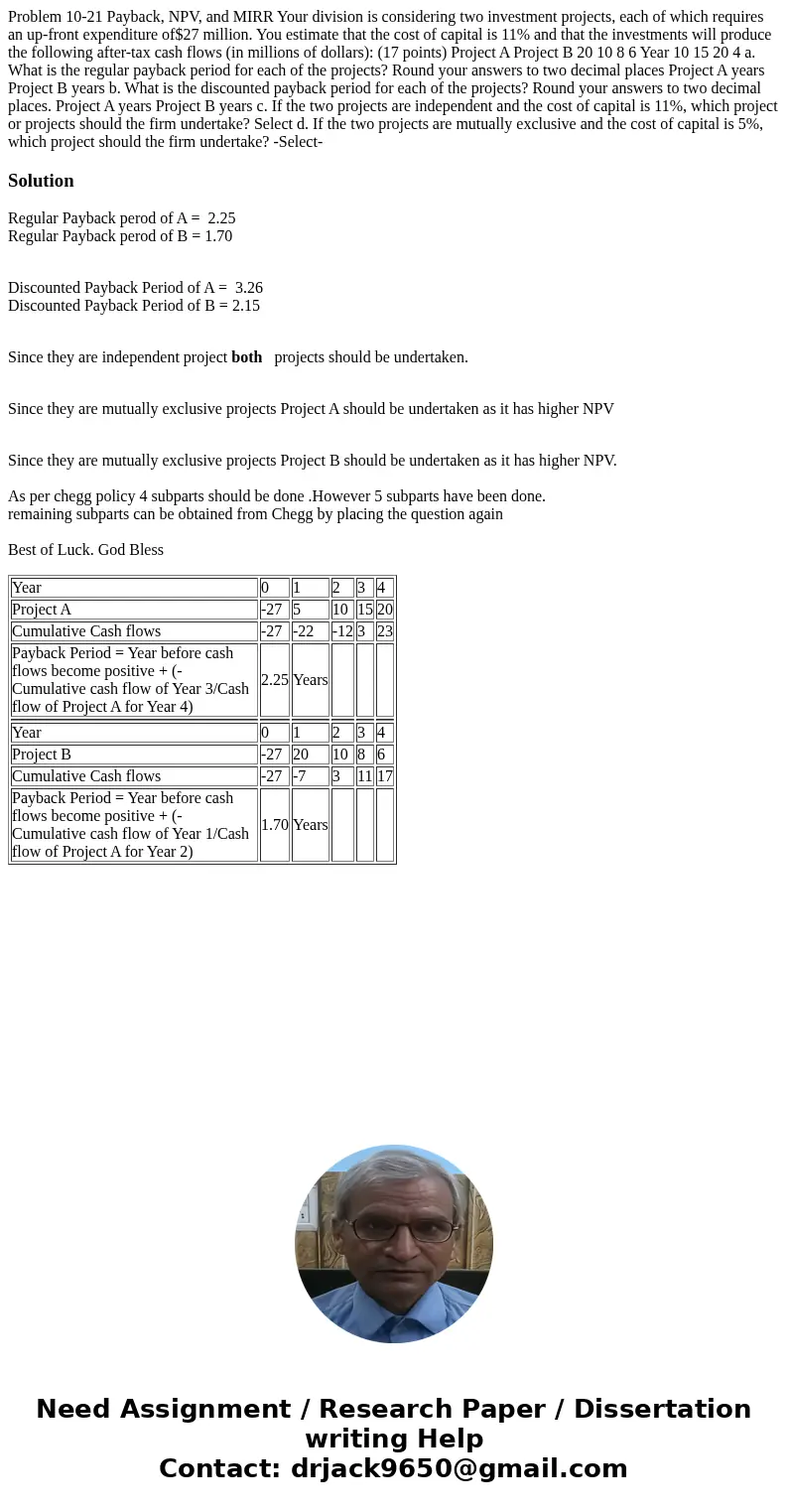

Problem 10-21 Payback, NPV, and MIRR Your division is considering two investment projects, each of which requires an up-front expenditure of$27 million. You estimate that the cost of capital is 11% and that the investments will produce the following after-tax cash flows (in millions of dollars): (17 points) Project A Project B 20 10 8 6 Year 10 15 20 4 a. What is the regular payback period for each of the projects? Round your answers to two decimal places Project A years Project B years b. What is the discounted payback period for each of the projects? Round your answers to two decimal places. Project A years Project B years c. If the two projects are independent and the cost of capital is 11%, which project or projects should the firm undertake? Select d. If the two projects are mutually exclusive and the cost of capital is 5%, which project should the firm undertake? -Select-

Solution

Regular Payback perod of A = 2.25

Regular Payback perod of B = 1.70

Discounted Payback Period of A = 3.26

Discounted Payback Period of B = 2.15

Since they are independent project both projects should be undertaken.

Since they are mutually exclusive projects Project A should be undertaken as it has higher NPV

Since they are mutually exclusive projects Project B should be undertaken as it has higher NPV.

As per chegg policy 4 subparts should be done .However 5 subparts have been done.

remaining subparts can be obtained from Chegg by placing the question again

Best of Luck. God Bless

| Year | 0 | 1 | 2 | 3 | 4 |

| Project A | -27 | 5 | 10 | 15 | 20 |

| Cumulative Cash flows | -27 | -22 | -12 | 3 | 23 |

| Payback Period = Year before cash flows become positive + (- Cumulative cash flow of Year 3/Cash flow of Project A for Year 4) | 2.25 | Years | |||

| Year | 0 | 1 | 2 | 3 | 4 |

| Project B | -27 | 20 | 10 | 8 | 6 |

| Cumulative Cash flows | -27 | -7 | 3 | 11 | 17 |

| Payback Period = Year before cash flows become positive + (- Cumulative cash flow of Year 1/Cash flow of Project A for Year 2) | 1.70 | Years |

Homework Sourse

Homework Sourse