NONCONSTANT GROWTH Computech Corporation is expanding rapidl

NONCONSTANT GROWTH Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $0.50 coming 3 years from today. The dividend should grow rapidly-at a rate of 24% per year-during Years 4 and 5; but after Year 5, growth should be a constant 6% per year. If the required return on Computech 1496, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations.

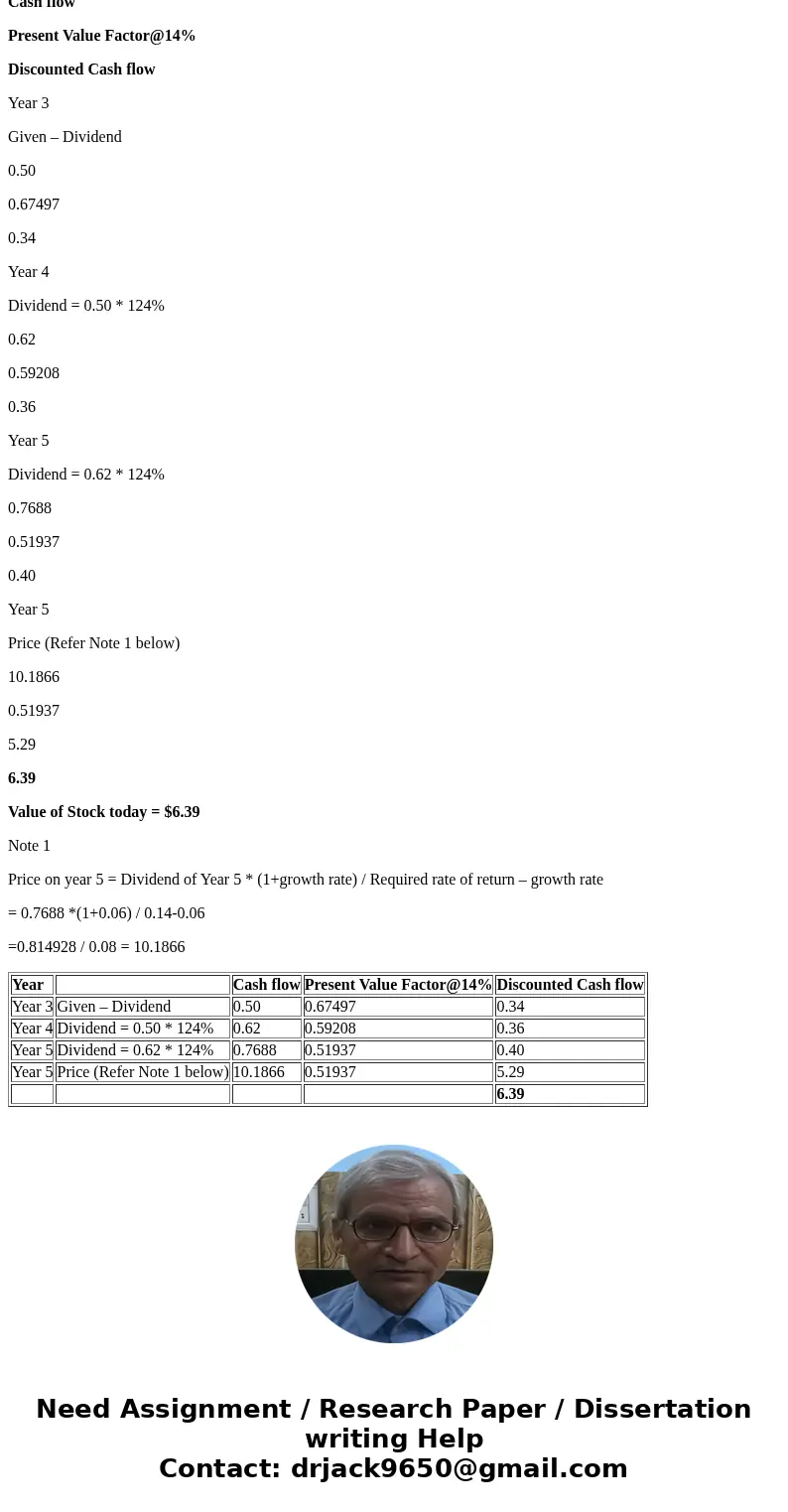

Solution

Year

Cash flow

Present Value Factor@14%

Discounted Cash flow

Year 3

Given – Dividend

0.50

0.67497

0.34

Year 4

Dividend = 0.50 * 124%

0.62

0.59208

0.36

Year 5

Dividend = 0.62 * 124%

0.7688

0.51937

0.40

Year 5

Price (Refer Note 1 below)

10.1866

0.51937

5.29

6.39

Value of Stock today = $6.39

Note 1

Price on year 5 = Dividend of Year 5 * (1+growth rate) / Required rate of return – growth rate

= 0.7688 *(1+0.06) / 0.14-0.06

=0.814928 / 0.08 = 10.1866

| Year | Cash flow | Present Value Factor@14% | Discounted Cash flow | |

| Year 3 | Given – Dividend | 0.50 | 0.67497 | 0.34 |

| Year 4 | Dividend = 0.50 * 124% | 0.62 | 0.59208 | 0.36 |

| Year 5 | Dividend = 0.62 * 124% | 0.7688 | 0.51937 | 0.40 |

| Year 5 | Price (Refer Note 1 below) | 10.1866 | 0.51937 | 5.29 |

| 6.39 |

Homework Sourse

Homework Sourse