Show the steps please 39 Bat Company began the year with 400

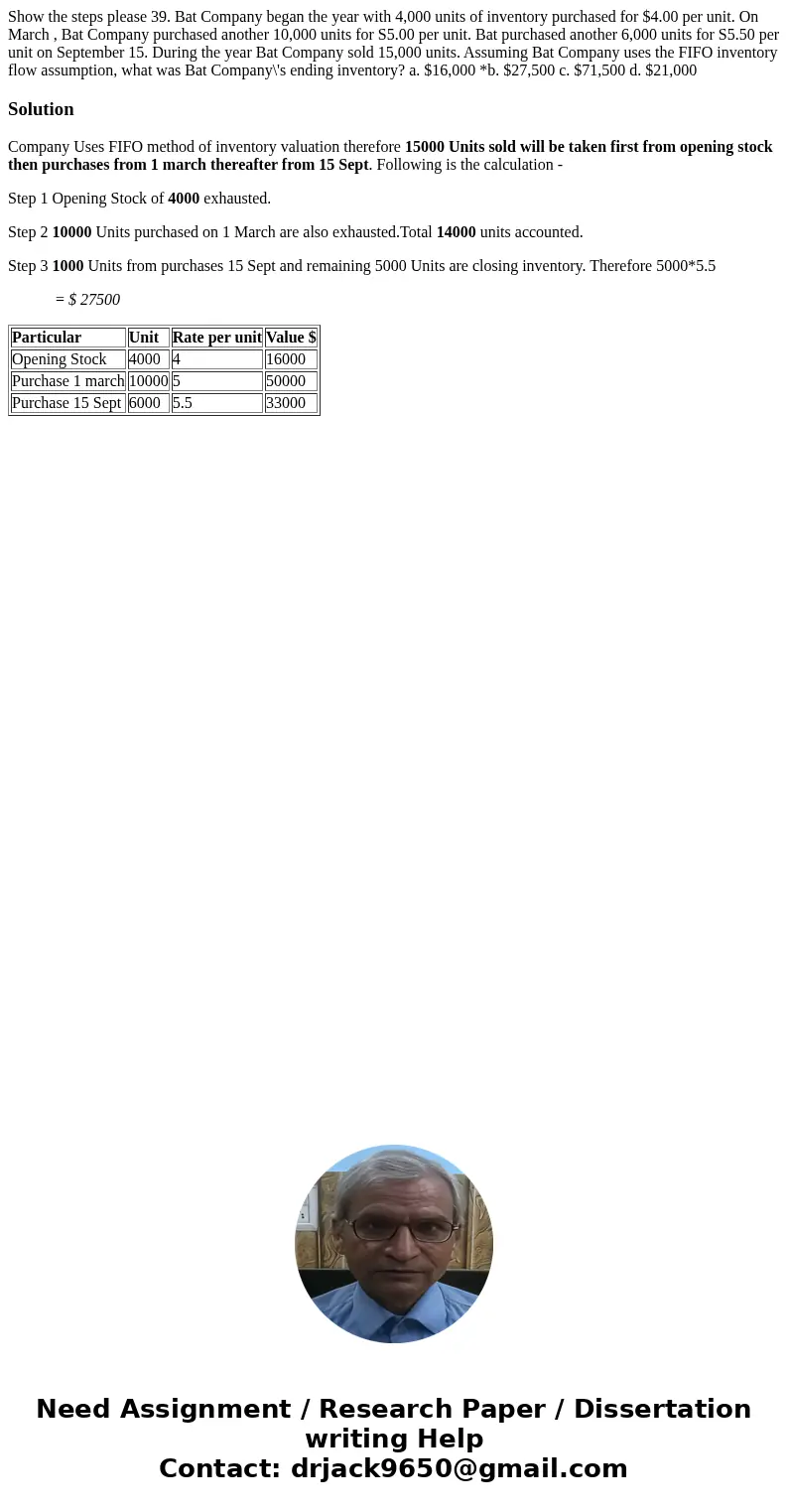

Show the steps please 39. Bat Company began the year with 4,000 units of inventory purchased for $4.00 per unit. On March , Bat Company purchased another 10,000 units for S5.00 per unit. Bat purchased another 6,000 units for S5.50 per unit on September 15. During the year Bat Company sold 15,000 units. Assuming Bat Company uses the FIFO inventory flow assumption, what was Bat Company\'s ending inventory? a. $16,000 *b. $27,500 c. $71,500 d. $21,000

Solution

Company Uses FIFO method of inventory valuation therefore 15000 Units sold will be taken first from opening stock then purchases from 1 march thereafter from 15 Sept. Following is the calculation -

Step 1 Opening Stock of 4000 exhausted.

Step 2 10000 Units purchased on 1 March are also exhausted.Total 14000 units accounted.

Step 3 1000 Units from purchases 15 Sept and remaining 5000 Units are closing inventory. Therefore 5000*5.5

= $ 27500

| Particular | Unit | Rate per unit | Value $ |

| Opening Stock | 4000 | 4 | 16000 |

| Purchase 1 march | 10000 | 5 | 50000 |

| Purchase 15 Sept | 6000 | 5.5 | 33000 |

Homework Sourse

Homework Sourse