Two accountants for the firm of Elwes and Wright are arguing

Two accountants for the firm of Elwes and Wright are arguing about the merits of presenting an income statement in a multiple-step versus a single-step format. The discussion involves the following 2017 information related to Wildhorse Company ($000 omitted).

Administrative Expense

Officers\' salaries. $ 4,990

Depreciation of office furniture and equipment $4,050

Cost of goods sold. 60,660

Rent Revenue. 17,320

Selling expense.

Delivery expense. 2,780

Sales Commissions. 8070

Depreciation of sales equipment. 6,570

Sales Revenue. 96,590

Income tax. 9,160

Interest expense. 1,950

Common shares outstanding for 2017 total 40,550 (000 omitted).

a. Prepare an incomestatement for the year 2017 using the multiple-step form

Solution

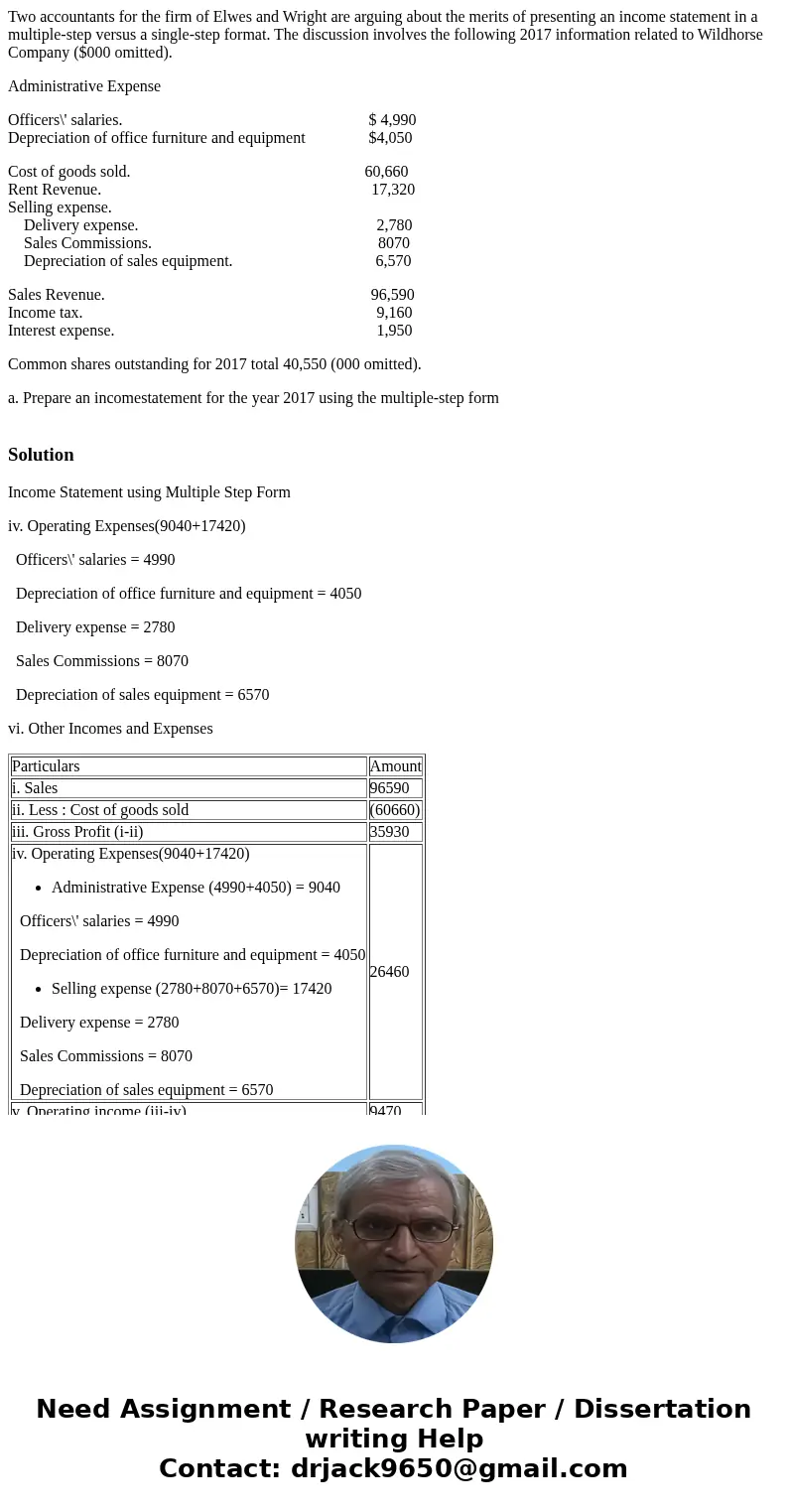

Income Statement using Multiple Step Form

iv. Operating Expenses(9040+17420)

Officers\' salaries = 4990

Depreciation of office furniture and equipment = 4050

Delivery expense = 2780

Sales Commissions = 8070

Depreciation of sales equipment = 6570

vi. Other Incomes and Expenses

| Particulars | Amount |

| i. Sales | 96590 |

| ii. Less : Cost of goods sold | (60660) |

| iii. Gross Profit (i-ii) | 35930 |

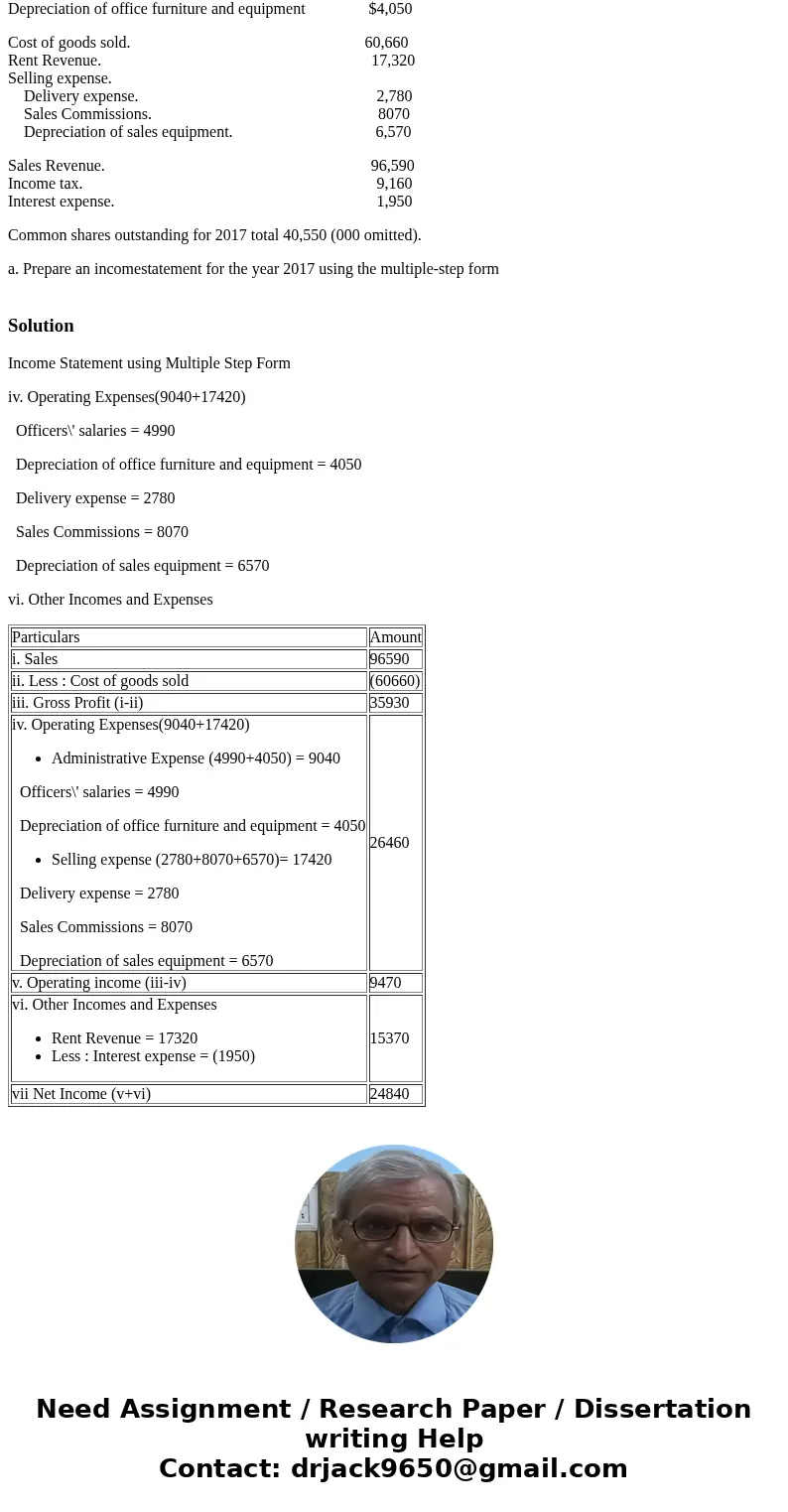

| iv. Operating Expenses(9040+17420)

Officers\' salaries = 4990 Depreciation of office furniture and equipment = 4050

Delivery expense = 2780 Sales Commissions = 8070 Depreciation of sales equipment = 6570 | 26460 |

| v. Operating income (iii-iv) | 9470 |

| vi. Other Incomes and Expenses

| 15370 |

| vii Net Income (v+vi) | 24840 |

Homework Sourse

Homework Sourse