a. Determine the earnings per share for 2016 and 2015. b. Does the chang e in the earnings per share from 2015 to 2016 indicate a favorable o an unfavorable trend? EX 13-1 Dividends per share Triple Z Inc, a developer of radiology equipment, has stock outstanding as follows: 12,00 OBJ. 3 shares of cumulative preferred 2% stock, $150 par and 50,000 shares of S10 par common During its first four years of operations, the following amounts were distributed as dividends first year, $27,000; second year, $60,000; third year, $80,000 fourth year, $90,000. Calculate the dividends per share on each class of stock for each of the four years. EX 13-2 Dividends per share Lightfoot Inc., a software development firm, has stock outstanding as follows: 40,000 shares of cumulative preferred 1% stock, $125 par, and 100,000 shares of $150 par common. During OBJ. 3

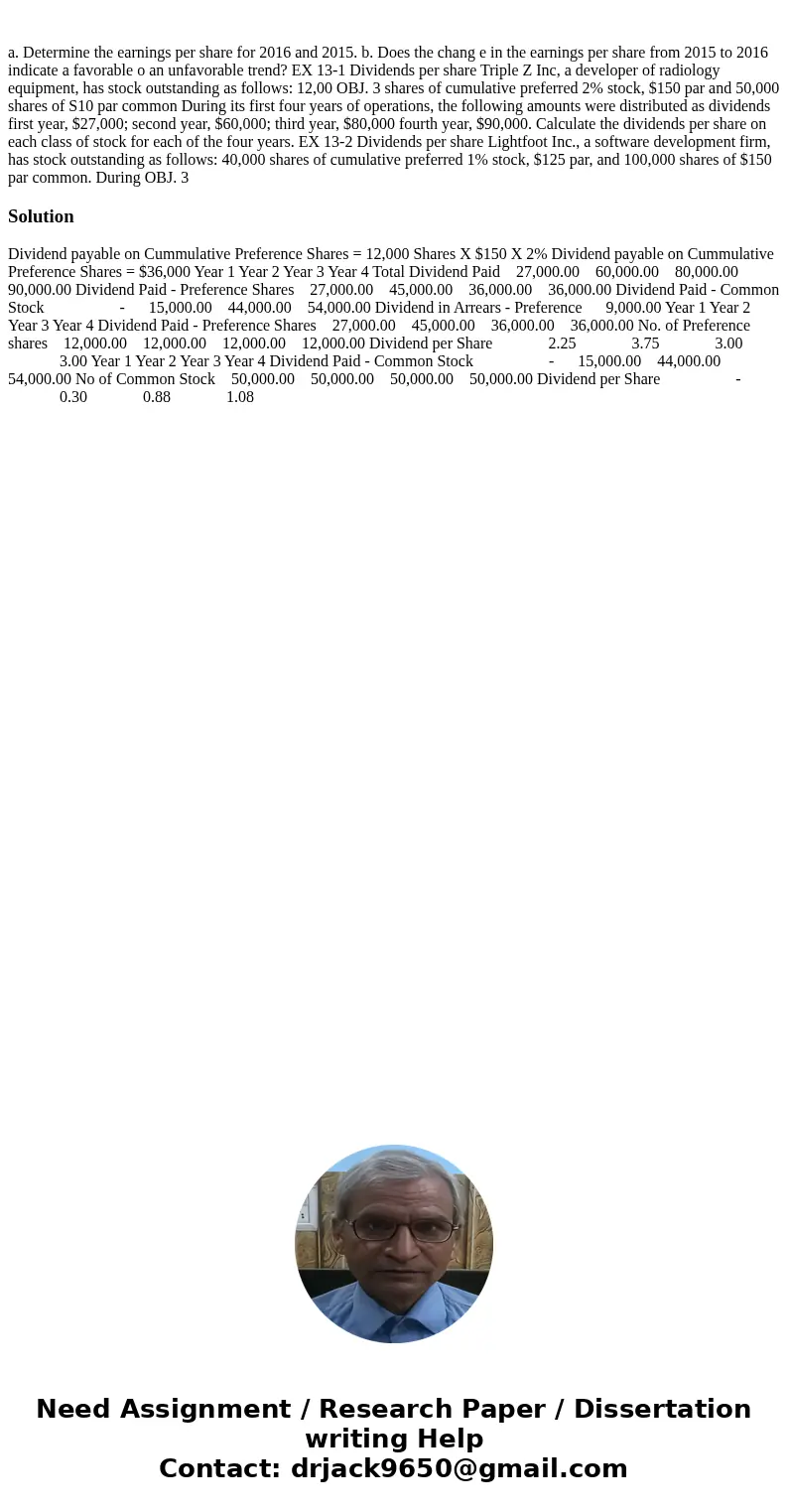

Dividend payable on Cummulative Preference Shares = 12,000 Shares X $150 X 2% Dividend payable on Cummulative Preference Shares = $36,000 Year 1 Year 2 Year 3 Year 4 Total Dividend Paid 27,000.00 60,000.00 80,000.00 90,000.00 Dividend Paid - Preference Shares 27,000.00 45,000.00 36,000.00 36,000.00 Dividend Paid - Common Stock - 15,000.00 44,000.00 54,000.00 Dividend in Arrears - Preference 9,000.00 Year 1 Year 2 Year 3 Year 4 Dividend Paid - Preference Shares 27,000.00 45,000.00 36,000.00 36,000.00 No. of Preference shares 12,000.00 12,000.00 12,000.00 12,000.00 Dividend per Share 2.25 3.75 3.00 3.00 Year 1 Year 2 Year 3 Year 4 Dividend Paid - Common Stock - 15,000.00 44,000.00 54,000.00 No of Common Stock 50,000.00 50,000.00 50,000.00 50,000.00 Dividend per Share - 0.30 0.88 1.08

Homework Sourse

Homework Sourse