narks Tools Window Help 63 Sat a Search Analysis General Jo

narks Tools Window Help 63% Sat | a Search Analysis General Journal Eqipment was acquired the beginning of the year at a cost of $76,020. The quipment ws depeciuned using the straigne ine method based on an estimaned usetul ite of an esimaned residual value of $7 800 years and a) What was the deprecason expense for the ear? Assuming the errere was idda!the endofthe second year tr $57,542. detem nethe gain or loss on sanofthe eaoment MacBook Air 20 3 0

Solution

SolutionA:-

Depreciation=cost-residualvalue/useful life

76020-7800/6=11370

SolutionB:-depreciation of year 2 shall be same as year 1

Book value after year 2 shall be :- 76020-11370-11370=53280

Sale value=57542

Gain=57542-53280=4262

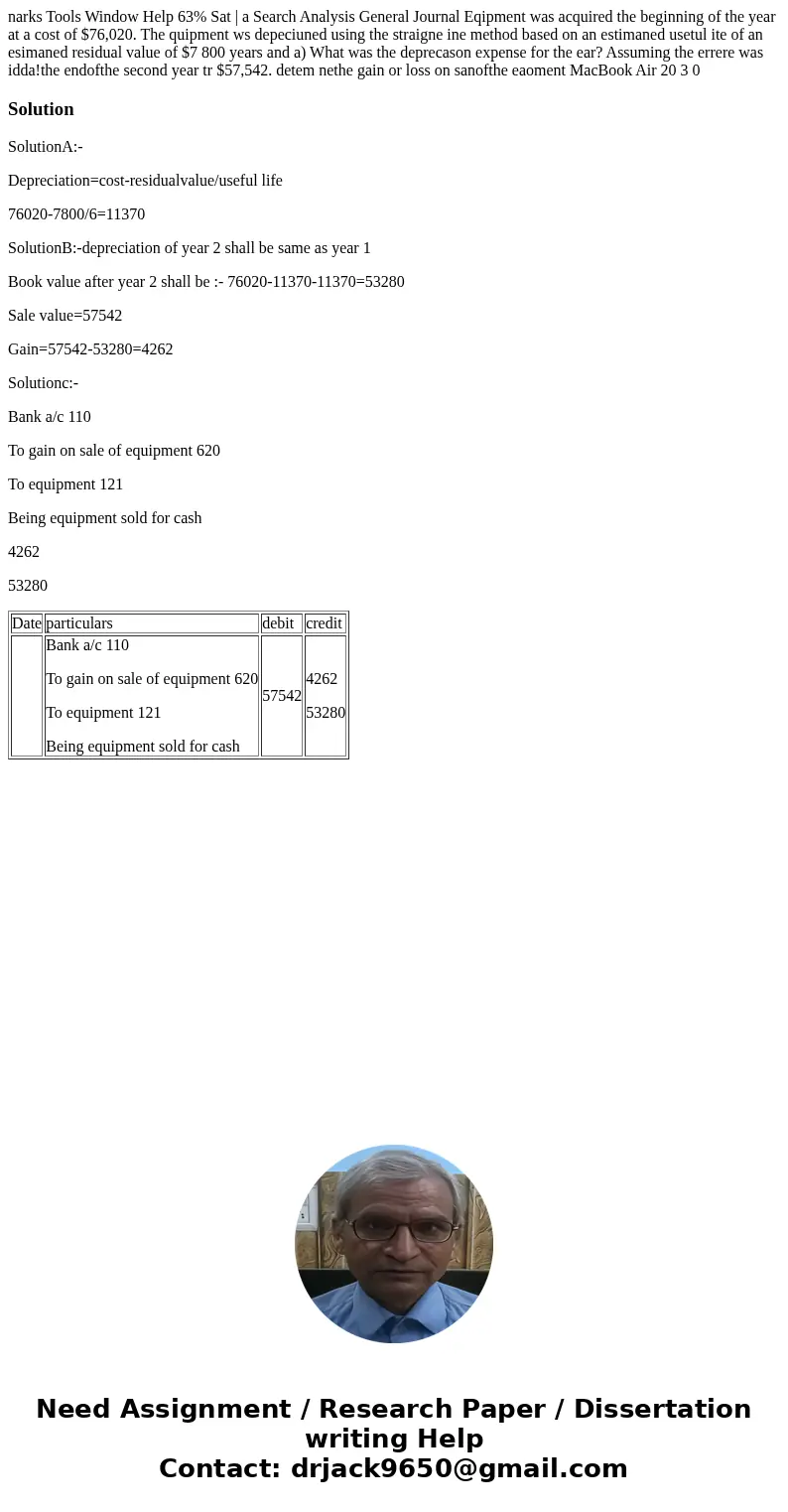

Solutionc:-

Bank a/c 110

To gain on sale of equipment 620

To equipment 121

Being equipment sold for cash

4262

53280

| Date | particulars | debit | credit |

| Bank a/c 110 To gain on sale of equipment 620 To equipment 121 Being equipment sold for cash | 57542 | 4262 53280 |

Homework Sourse

Homework Sourse