22 Howard Plc has produced the following account balances at

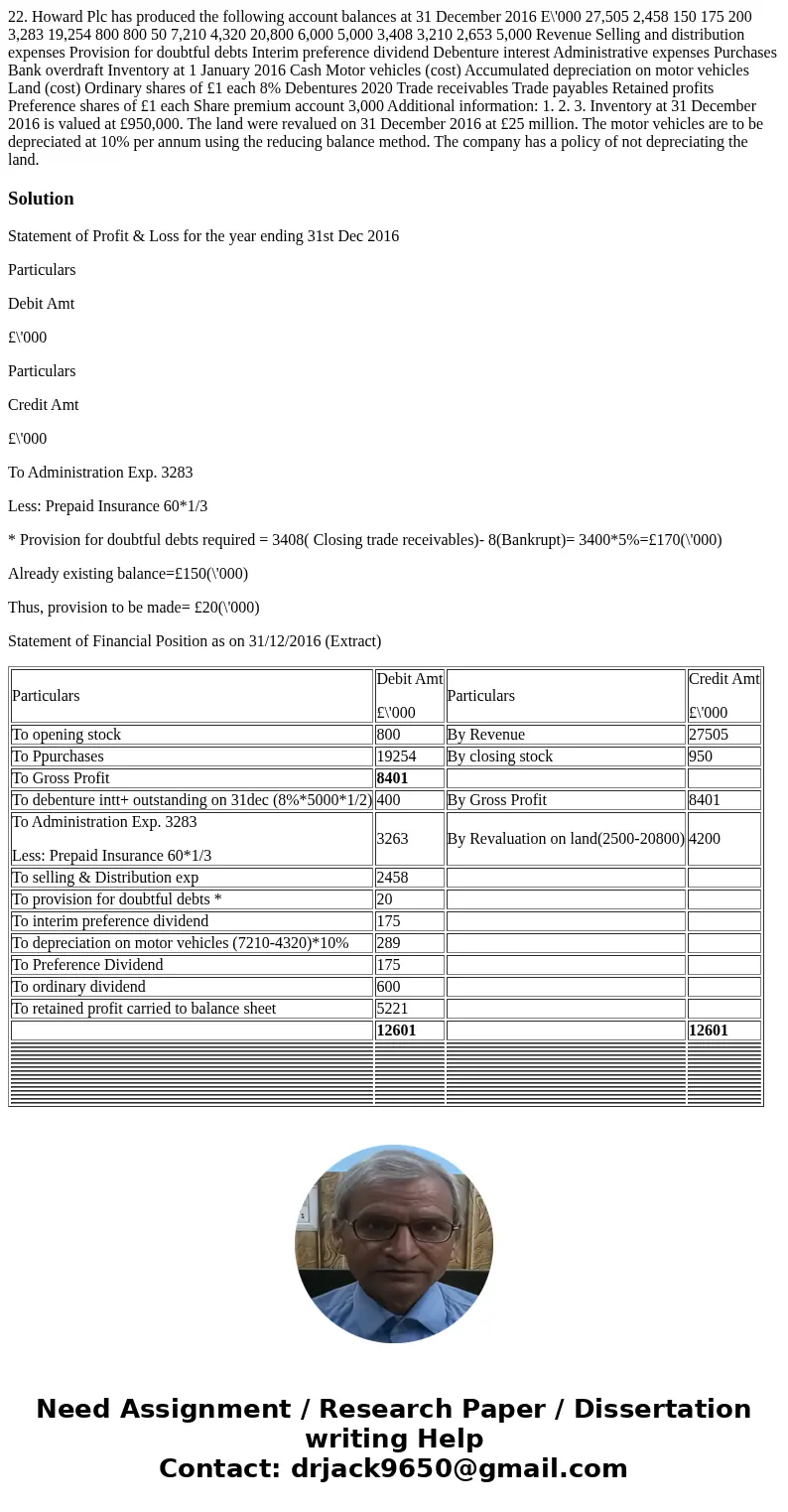

22. Howard Plc has produced the following account balances at 31 December 2016 E\'000 27,505 2,458 150 175 200 3,283 19,254 800 800 50 7,210 4,320 20,800 6,000 5,000 3,408 3,210 2,653 5,000 Revenue Selling and distribution expenses Provision for doubtful debts Interim preference dividend Debenture interest Administrative expenses Purchases Bank overdraft Inventory at 1 January 2016 Cash Motor vehicles (cost) Accumulated depreciation on motor vehicles Land (cost) Ordinary shares of £1 each 8% Debentures 2020 Trade receivables Trade payables Retained profits Preference shares of £1 each Share premium account 3,000 Additional information: 1. 2. 3. Inventory at 31 December 2016 is valued at £950,000. The land were revalued on 31 December 2016 at £25 million. The motor vehicles are to be depreciated at 10% per annum using the reducing balance method. The company has a policy of not depreciating the land.

Solution

Statement of Profit & Loss for the year ending 31st Dec 2016

Particulars

Debit Amt

£\'000

Particulars

Credit Amt

£\'000

To Administration Exp. 3283

Less: Prepaid Insurance 60*1/3

* Provision for doubtful debts required = 3408( Closing trade receivables)- 8(Bankrupt)= 3400*5%=£170(\'000)

Already existing balance=£150(\'000)

Thus, provision to be made= £20(\'000)

Statement of Financial Position as on 31/12/2016 (Extract)

| Particulars | Debit Amt £\'000 | Particulars | Credit Amt £\'000 |

| To opening stock | 800 | By Revenue | 27505 |

| To Ppurchases | 19254 | By closing stock | 950 |

| To Gross Profit | 8401 | ||

| To debenture intt+ outstanding on 31dec (8%*5000*1/2) | 400 | By Gross Profit | 8401 |

| To Administration Exp. 3283 Less: Prepaid Insurance 60*1/3 | 3263 | By Revaluation on land(2500-20800) | 4200 |

| To selling & Distribution exp | 2458 | ||

| To provision for doubtful debts * | 20 | ||

| To interim preference dividend | 175 | ||

| To depreciation on motor vehicles (7210-4320)*10% | 289 | ||

| To Preference Dividend | 175 | ||

| To ordinary dividend | 600 | ||

| To retained profit carried to balance sheet | 5221 | ||

| 12601 | 12601 | ||

Homework Sourse

Homework Sourse