Consumer Research Inc is an independent agency that conducts

Consumer Research, Inc. is an independent agency that conducts research on consumer attitudes and behaviors for a variety of firms. In one study, a client asked for an investigation of consumer characteristics that can be used to predict the amount charged by credit card users. Data were collected on annual income, household size, and annual credit card charges for a sample of 50 customers.

1. Use methods of descriptive statistics to summarize the data. Comment on the findings.

2. Develop estimated regression equations, first using annual income as the independent variable, and then using the household size as the independent variable. Which variable is the better predictor of annual credit card charges? Discuss your findings.

3. Develop an estimated regression equation with annual income and household size as the independent variables. Discuss your findings.

4. What is the predicted annual credit card charge for a three-person household with an annual income of $40,000?

5. Discuss the need for other independent variables that could be added to the model. What additional variables might be helpful?

| Income ($1000s) | Household Size | Amount Charged ($) |

| 54 | 3 | 4,016 |

| 30 | 2 | 3,159 |

| 32 | 4 | 5,100 |

| 50 | 5 | 4,742 |

| 31 | 2 | 1,864 |

| 55 | 2 | 4,070 |

| 37 | 1 | 2,731 |

| 40 | 2 | 3,348 |

| 66 | 4 | 4,764 |

| 51 | 3 | 4,110 |

| 25 | 3 | 4,208 |

| 48 | 4 | 4,219 |

| 27 | 1 | 2,477 |

| 33 | 2 | 2,514 |

| 65 | 3 | 4,214 |

| 63 | 4 | 4,965 |

| 42 | 6 | 4,412 |

| 21 | 2 | 2,448 |

| 44 | 1 | 2,995 |

| 37 | 5 | 4,171 |

| 62 | 6 | 5,678 |

| 21 | 3 | 3,623 |

| 55 | 7 | 5,301 |

| 42 | 2 | 3,020 |

| 41 | 7 | 4,828 |

| 54 | 6 | 5,573 |

| 30 | 1 | 2,583 |

| 48 | 2 | 3,866 |

| 34 | 5 | 3,586 |

| 67 | 4 | 5,037 |

| 50 | 2 | 3,605 |

| 67 | 5 | 5,345 |

| 55 | 6 | 5,370 |

| 52 | 2 | 3,890 |

| 62 | 3 | 4,705 |

| 64 | 2 | 4,157 |

| 22 | 3 | 3,579 |

| 29 | 4 | 3,890 |

| 39 | 2 | 2,972 |

| 35 | 1 | 3,121 |

| 39 | 4 | 4,183 |

| 54 | 3 | 3,730 |

| 23 | 6 | 4,127 |

| 27 | 2 | 2,921 |

| 26 | 7 | 4,603 |

| 61 | 2 | 4,273 |

| 30 | 2 | 3,067 |

| 22 | 4 | 3,074 |

| 46 | 5 | 4,820 |

| 66 | 4 | 5,149 |

Solution

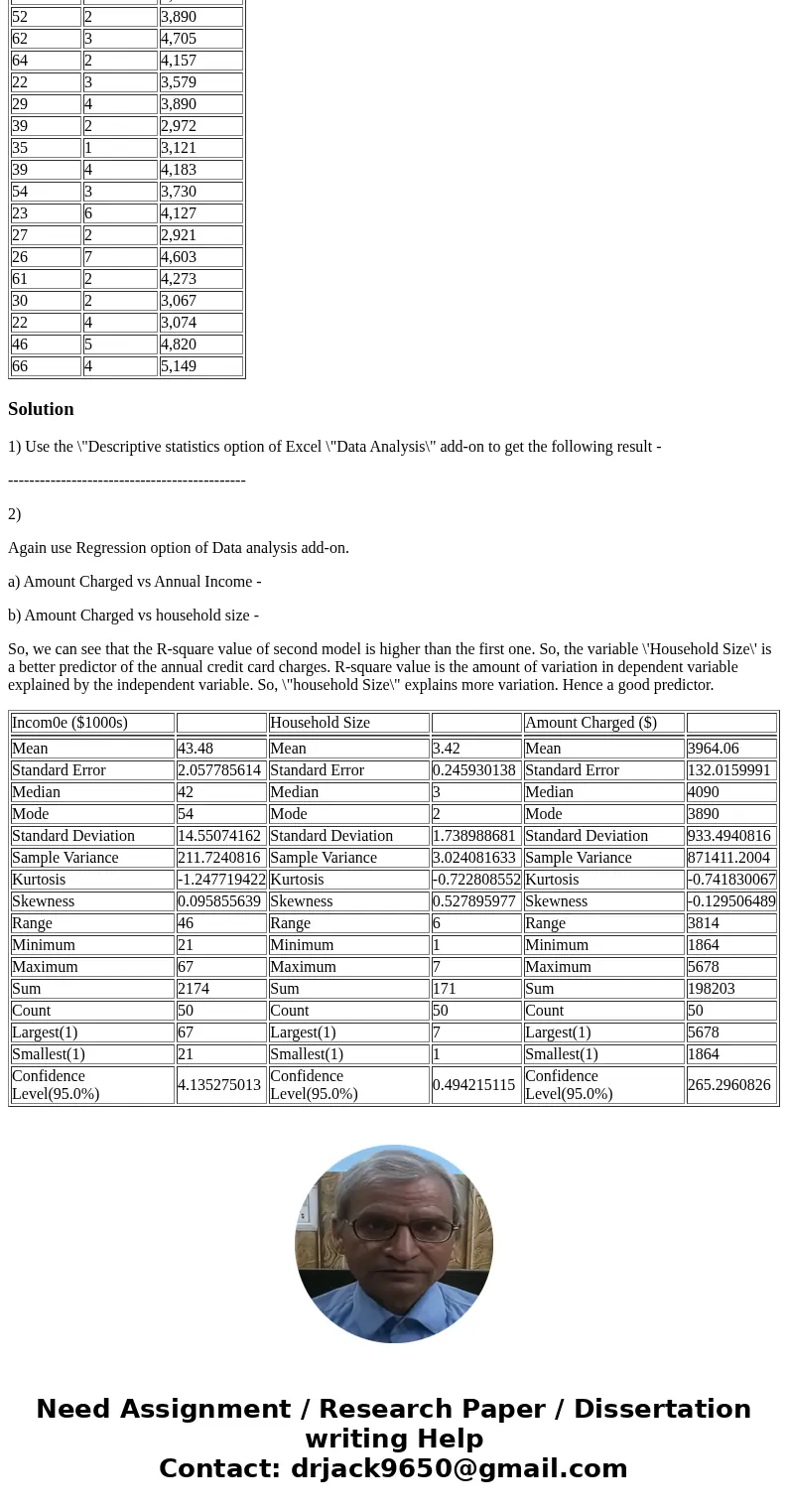

1) Use the \"Descriptive statistics option of Excel \"Data Analysis\" add-on to get the following result -

---------------------------------------------

2)

Again use Regression option of Data analysis add-on.

a) Amount Charged vs Annual Income -

b) Amount Charged vs household size -

So, we can see that the R-square value of second model is higher than the first one. So, the variable \'Household Size\' is a better predictor of the annual credit card charges. R-square value is the amount of variation in dependent variable explained by the independent variable. So, \"household Size\" explains more variation. Hence a good predictor.

| Incom0e ($1000s) | Household Size | Amount Charged ($) | |||

| Mean | 43.48 | Mean | 3.42 | Mean | 3964.06 |

| Standard Error | 2.057785614 | Standard Error | 0.245930138 | Standard Error | 132.0159991 |

| Median | 42 | Median | 3 | Median | 4090 |

| Mode | 54 | Mode | 2 | Mode | 3890 |

| Standard Deviation | 14.55074162 | Standard Deviation | 1.738988681 | Standard Deviation | 933.4940816 |

| Sample Variance | 211.7240816 | Sample Variance | 3.024081633 | Sample Variance | 871411.2004 |

| Kurtosis | -1.247719422 | Kurtosis | -0.722808552 | Kurtosis | -0.741830067 |

| Skewness | 0.095855639 | Skewness | 0.527895977 | Skewness | -0.129506489 |

| Range | 46 | Range | 6 | Range | 3814 |

| Minimum | 21 | Minimum | 1 | Minimum | 1864 |

| Maximum | 67 | Maximum | 7 | Maximum | 5678 |

| Sum | 2174 | Sum | 171 | Sum | 198203 |

| Count | 50 | Count | 50 | Count | 50 |

| Largest(1) | 67 | Largest(1) | 7 | Largest(1) | 5678 |

| Smallest(1) | 21 | Smallest(1) | 1 | Smallest(1) | 1864 |

| Confidence Level(95.0%) | 4.135275013 | Confidence Level(95.0%) | 0.494215115 | Confidence Level(95.0%) | 265.2960826 |

Homework Sourse

Homework Sourse