Hs 30000 partnership interest is terminated through a capita

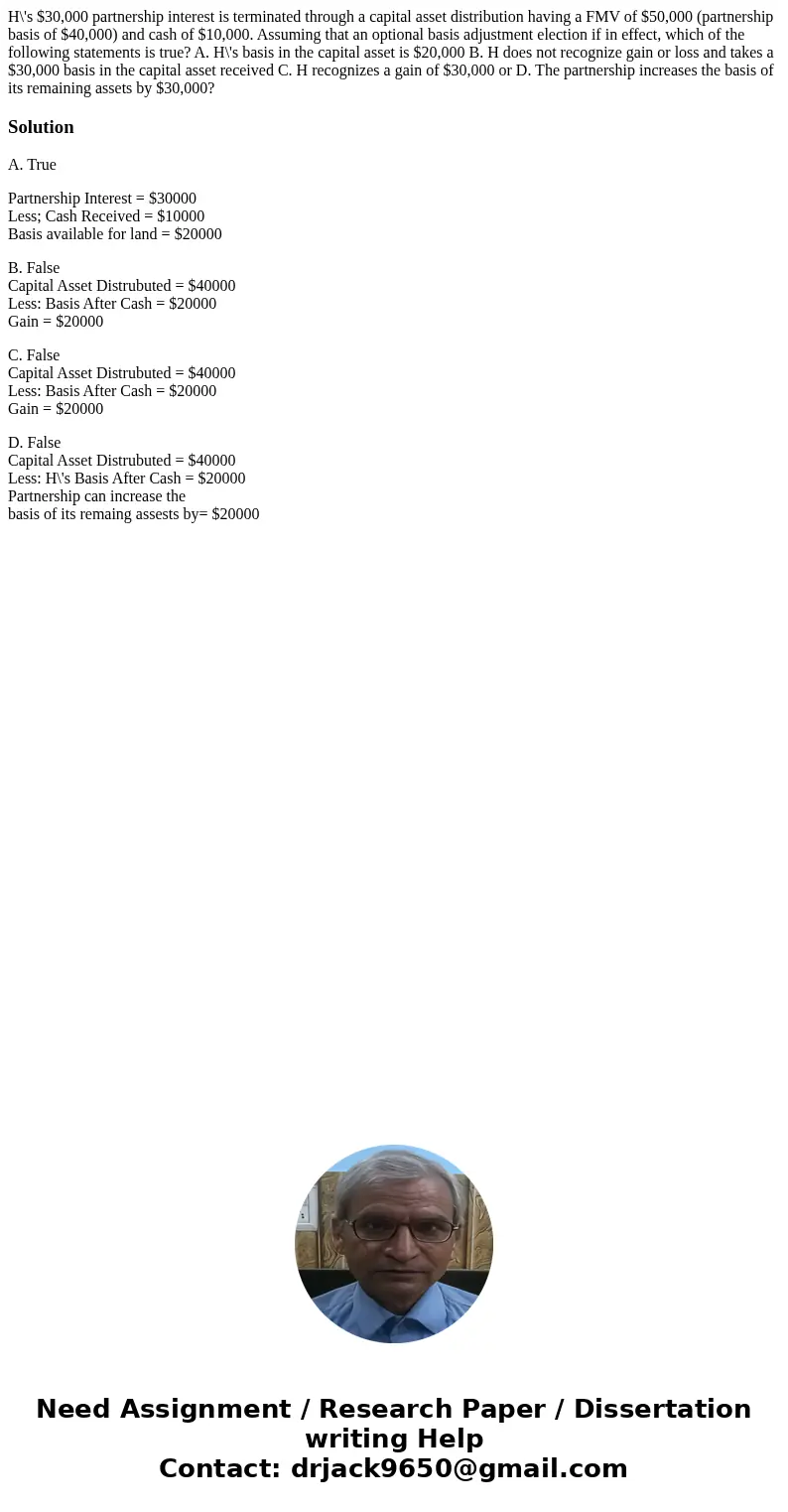

H\'s $30,000 partnership interest is terminated through a capital asset distribution having a FMV of $50,000 (partnership basis of $40,000) and cash of $10,000. Assuming that an optional basis adjustment election if in effect, which of the following statements is true? A. H\'s basis in the capital asset is $20,000 B. H does not recognize gain or loss and takes a $30,000 basis in the capital asset received C. H recognizes a gain of $30,000 or D. The partnership increases the basis of its remaining assets by $30,000?

Solution

A. True

Partnership Interest = $30000

Less; Cash Received = $10000

Basis available for land = $20000

B. False

Capital Asset Distrubuted = $40000

Less: Basis After Cash = $20000

Gain = $20000

C. False

Capital Asset Distrubuted = $40000

Less: Basis After Cash = $20000

Gain = $20000

D. False

Capital Asset Distrubuted = $40000

Less: H\'s Basis After Cash = $20000

Partnership can increase the

basis of its remaing assests by= $20000

Homework Sourse

Homework Sourse