759148 5 Year Project Project Constant Current Years Dollars

$759,148

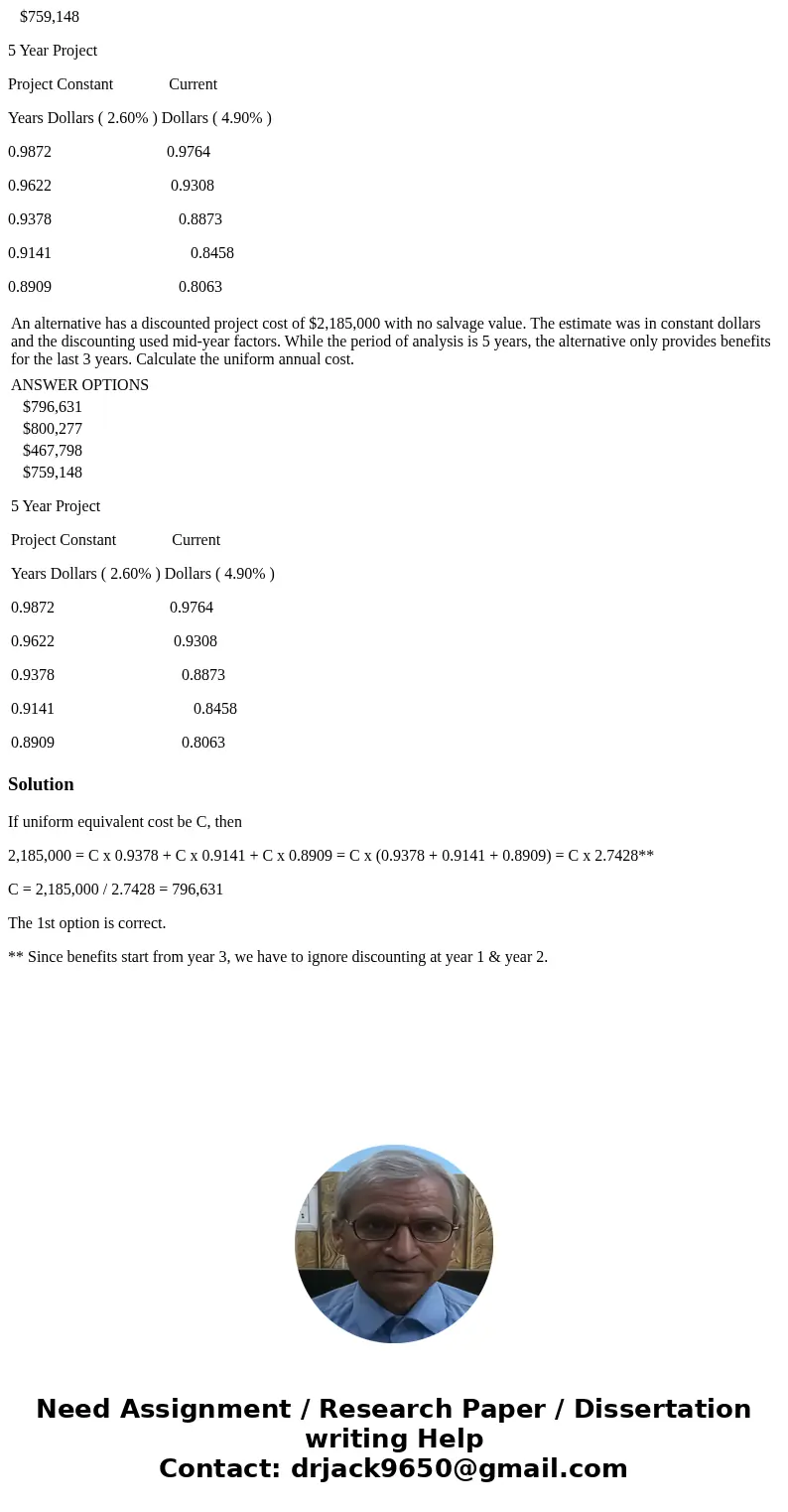

5 Year Project

Project Constant Current

Years Dollars ( 2.60% ) Dollars ( 4.90% )

0.9872 0.9764

0.9622 0.9308

0.9378 0.8873

0.9141 0.8458

0.8909 0.8063

| An alternative has a discounted project cost of $2,185,000 with no salvage value. The estimate was in constant dollars and the discounting used mid-year factors. While the period of analysis is 5 years, the alternative only provides benefits for the last 3 years. Calculate the uniform annual cost. |

| ANSWER OPTIONS |

| $796,631 |

| $800,277 |

| $467,798 |

| $759,148 5 Year Project Project Constant Current Years Dollars ( 2.60% ) Dollars ( 4.90% ) 0.9872 0.9764 0.9622 0.9308 0.9378 0.8873 0.9141 0.8458 0.8909 0.8063 |

Solution

If uniform equivalent cost be C, then

2,185,000 = C x 0.9378 + C x 0.9141 + C x 0.8909 = C x (0.9378 + 0.9141 + 0.8909) = C x 2.7428**

C = 2,185,000 / 2.7428 = 796,631

The 1st option is correct.

** Since benefits start from year 3, we have to ignore discounting at year 1 & year 2.

Homework Sourse

Homework Sourse