Can anyone help me with this onePlease include the solutionT

Can anyone help me with this one?Please include the solution.Thank you in advanve

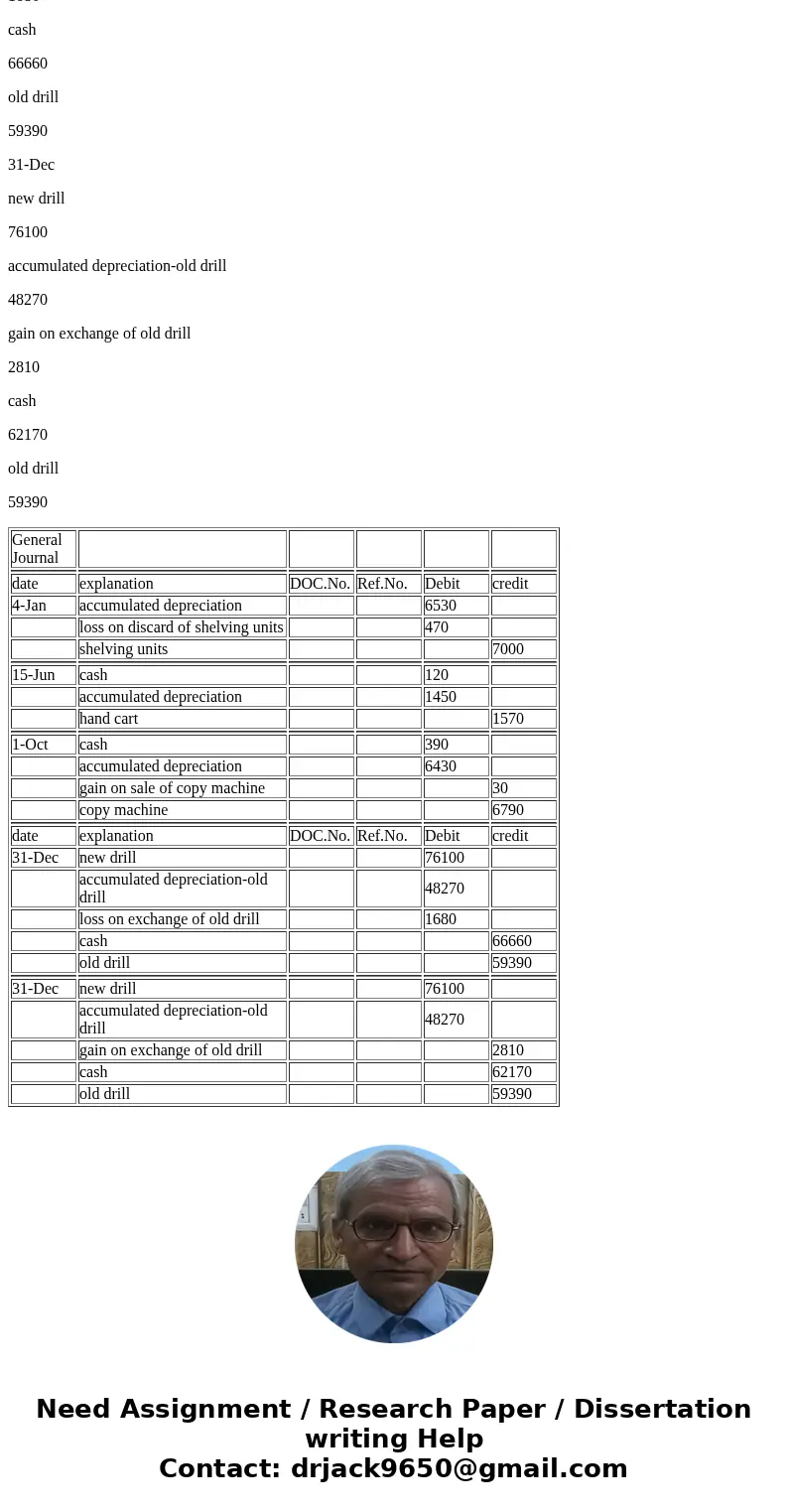

Solution

General Journal

date

explanation

DOC.No.

Ref.No.

Debit

credit

4-Jan

accumulated depreciation

6530

loss on discard of shelving units

470

shelving units

7000

15-Jun

cash

120

accumulated depreciation

1450

hand cart

1570

1-Oct

cash

390

accumulated depreciation

6430

gain on sale of copy machine

30

copy machine

6790

date

explanation

DOC.No.

Ref.No.

Debit

credit

31-Dec

new drill

76100

accumulated depreciation-old drill

48270

loss on exchange of old drill

1680

cash

66660

old drill

59390

31-Dec

new drill

76100

accumulated depreciation-old drill

48270

gain on exchange of old drill

2810

cash

62170

old drill

59390

| General Journal | |||||

| date | explanation | DOC.No. | Ref.No. | Debit | credit |

| 4-Jan | accumulated depreciation | 6530 | |||

| loss on discard of shelving units | 470 | ||||

| shelving units | 7000 | ||||

| 15-Jun | cash | 120 | |||

| accumulated depreciation | 1450 | ||||

| hand cart | 1570 | ||||

| 1-Oct | cash | 390 | |||

| accumulated depreciation | 6430 | ||||

| gain on sale of copy machine | 30 | ||||

| copy machine | 6790 | ||||

| date | explanation | DOC.No. | Ref.No. | Debit | credit |

| 31-Dec | new drill | 76100 | |||

| accumulated depreciation-old drill | 48270 | ||||

| loss on exchange of old drill | 1680 | ||||

| cash | 66660 | ||||

| old drill | 59390 | ||||

| 31-Dec | new drill | 76100 | |||

| accumulated depreciation-old drill | 48270 | ||||

| gain on exchange of old drill | 2810 | ||||

| cash | 62170 | ||||

| old drill | 59390 |

Homework Sourse

Homework Sourse